6 Common LLC Creation Mistakes

Starting a new business is exciting but also a little intimidating. There’s a lot you probably don’t know, and mistakes can end up costing you.

If you’ve decided to start a limited liability company (LLC), then you’ve already avoided the biggest mistake, which is not having a business entity at all. But you’ll also want to avoid these 6 other common mistakes people make when starting an LLC.

Mistake 1: Choosing to Become an LLC When It’s Not the Right Entity for Your Business

The first mistake people make when creating an LLC is choosing an LLC to begin with. The limited liability company is a great business structure for many business ventures, but it’s not suitable for all.

The main consideration is money. Do you plan on growing with capital from outside investors? If so, a corporation is likely a better choice for you. Investors are typically more comfortable investing in corporations than in LLCs. Corporations are also the only entities that can issue stock, so if you dream of a big IPO in the future, then the corporation is the entity for you.

Mistake 2: Incorporating Your Business in the Wrong State

Once you’ve determined that the LLC is the right entity for your business, your next step is to decide on where to incorporate it, i.e., where to register it.

Most of the time, incorporating in the state where you live and do business is the best solution. Some entrepreneurs want to incorporate in other states like Delaware, Wyoming, or Nevada for the supposed tax and legal benefits. This can make sense for larger companies, but it rarely makes sense for smaller LLCs.

Incorporating your business in a state your business isn’t based in means taking on hassles like maintaining a registered agent in both the state you live in and incorporate in, filing paperwork in both states, and paying fees to both states. After considering the time and money involved, it’s typically not a savvy move for most LLCs. It’s usually smarter to incorporate in your home state.

Mistake 3: Choosing the Wrong Type of LLC

There are actually four types of LLCs you can create in South Carolina, as we’ve covered before in a previous blog. Check out that blog for more information, but in short, know that an LLC can be either “term” or “at will” and “member managed” or “manager managed.” If you select the wrong type when setting up your LLC, it can be bad for the LLC and the members down the line.

Mistake 4: Choosing a Bad Name

What makes a “bad” name? One that’s already being used.

Before choosing a business name, do some research. You can search for existing business names in South Carolina here under “Existing Business,” which is a good start. (South Carolina does not allow a new business to register a name that’s not “grammatically distinguishable” from existing names.) You might also want to search the trademark database at the US Patent and Trademark Office here to see if the name you have in mind is being used somewhere else. Finally, a thorough Google search for your proposed name can turn up other uses of the name.

Your name matters because if you inadvertently violate someone else’s trademark, you can get in trouble. Disputes over names can end up being costly and time-consuming if someone sues you over the name and you want to defend your right to use it. But even if you decide to let go of the name, it will cost you time and money to rebrand your digital and physical presence. Worse, you will have lost the brand recognition and goodwill you’ve built up over the years in your community. So choose wisely.

Mistake 5: Not Having Corporate Governance Documents

This is probably the single biggest mistake you can make when you plan to start an LLC with business partners. Many people go into business with friends or family members, and at the start everything is copacetic. Everyone gets along and there are no major disagreements. But many an experienced business attorney will tell you that times change, and that’s when things can get ugly.

Imagine that you’re in a business with two friends and everything is going well at first. Then one friend unexpectedly dies, and you find you’re now in business with their spouse. Or the other friend starts slacking off, working fewer hours but taking the same profits as the hard-working partners. Or you become incapacitated and can no longer work. Or the three of you disagree on how to raise money for the company. What happens to you, your investment, and the business in these situations?

Corporate governance documents are intended to lay out the rules so that when a disagreement or unpleasant situation arises, what happens next is clear. These simple documents can preserve good relations between partners, protect the partners’ investments, and protect the business itself.

Two important documents that any business owner with partners should consider getting during the creation of their business:

An operating agreement. This spells out how the company should be managed, how profits and losses are handled, how much of the company each member owns, what each member’s responsibilities are, and more.

A buy-sell agreement. This document covers what happens to the business when a member dies, becomes incapacitated, stops working, etc. Read more about buy-sell agreements here.

By addressing future scenarios now, you can avoid major problems down the line. Just know that it’s vital to discuss these things before you and your partners start operating your business.

Mistake 6: Not Getting Legal Assistance When You Need It

It’s very easy to go online and get the forms to start an LLC yourself, without the help of an attorney. Is that smart?

In some cases, doing so is fine and poses no future problems, particularly with single-member LLCs that operate within one state and are wholly self-funded. These business owners would likely benefit from speaking with a business attorney, but they may feel pretty confident that they can create their LLC on their own.

But other entrepreneurs should consider speaking with an attorney before and during the creation process of their LLC. This is especially true in any of the following situations:

- You have business partners

- You plan to take on money from outside investors

- You plan to do business in multiple states

The cost is usually the main reason that people don’t want to spend the money on an attorney at this stage, and that’s understandable. Business owners want to make money before they spend it. But the money you spend up front on corporate governance documents or advice from an experienced attorney can save you money and mistakes down the road. (Plus, don’t forget this expense is a business write-off when it comes to tax time.)

Questions About Your LLC? Speak with Business Attorney Gem McDowell

Gem McDowell is a business attorney with over 25 years of experience helping people start and run their businesses. He’s a problem solver who can help you start out right and avoid the many mistakes he’s seen in the past. Contact Gem at his Mt. Pleasant office today to schedule a free consultation by calling (843) 284-1021 or filling out this contact form.

Arguing for Bigamy: When the Court Must Decide Between Competing Public Policy Issues

Should a bigamous marriage be recognized in South Carolina if doing so upholds an important legal doctrine? That was the main issue at the center of a case recently decided by the South Carolina Court of Appeals. (You can read the decision in full here: PDF.)

The Background of the Case

Blondell and Charles Gary were married (exactly when is unclear) and had two children together, one of whom is Angel Gary. They later divorced. Then, in 1982, Charles married Doretha Chisholm. They later divorced as well.

Charles then remarried Blondell in 1999 – two years before his divorce from Doretha was finalized in 2001. Charles and Blondell lived together as man and wife from 1999 until Blondell’s death in 2012 in a traffic accident. She and Charles were passengers in an ambulance operated by Lowcountry Medical Transport when the driver lost control and collided with a tree, killing Blondell.

After Blondell’s death, Angel Gary was appointed personal representative to her mother’s estate. In 2012 she filed suit against Lowcountry Medical Transport for actual and punitive damages for the accident that led to her mother’s death. They settled for $2.25 million in 2015.

Later that year, Angel filed a petition to determine heirship to her mother’s estate. She contended that Charles was already married to another woman when he attempted to marry Blondell, and that the marriage between Charles and Blondell was void. Charles argued that he was a rightful heir, but the Circuit Court disagreed, and ruled that his marriage to Blondell was void and he was not heir to Blondell’s estate.

The decision was appealed, which brings us to the case in hand.

Issues of the Case

There are two issues here at odds with each other.

- Parties being judicially bound by their pleadings.

What does this mean? It means that parties that have stated something on the record in a court proceeding are bound to those statements unless they are “withdrawn, altered or stricken by amendment or otherwise.” Essentially, a party cannot take a position contradictory to its pleadings in previous cases.

This was a key defense for Charles. He argued that based on the above doctrine, the Estate must be bound by their previous assertion in the Lowcountry Medical Transport suit that he was the “surviving spouse and beneficiary” of Blondell’s estate.

The Court of Appeals has previously stated that “parties are judicially bound by their pleadings” as a matter of course.

- Bigamous Marriage.

South Carolina, like all other states, outlaws bigamy. It also prevents a common law marriage from forming if there was an impediment at the time of marriage, such as one of the intended spouses being married to someone else. Even if the impediment is removed, the union does not automatically become a common law marriage. (Note that Charles did not attempt to argue that he and Blondell had a common law marriage.)

A similar issue occurred in the 1992 Johns v Johns case in which a woman sued her purported common law husband for divorce, child custody, and financial support. The Court found there was no common law marriage and denied her requests because her purported husband was married to another woman for the entirety of their relationship.

A Matter of Public Policy

On this blog we’ve seen the term “public policy” before, when discussing indemnification clauses and covenants not to compete and NDAs. In the context of contract law, public policy may be a reason to find a contact unenforceable, because enforcing it would be detrimental to the public good.

The Court acknowledges that it comes down to weighing competing public policies in this case. In its decision, it writes, “On one side, we have a marriage which contravened public policy […] On the other, the doctrine of binding a party to its pleadings exists to protect the integrity of the court process.”

In this instance, the Court finds that public policy is better served by not recognizing bigamous marriage: “While ordinarily the Estate may be bound to its previous assertions, we find that policy should yield to the overriding policy against bigamous marriages.” In so doing, it affirmed the Circuit Court decision that Charles was not a rightful heir to Blondell’s estate.

The Law Can Be Complex – Call Gem McDowell

We like to cover recent South Carolina cases from the Court of Appeals and Supreme Court on this blog because it’s important to understand that what happens in these cases has a very real effect on how laws are interpreted in our state and on the work we do for our clients.

The fact is, the law is complex and can change. If you’re facing legal issues having to do with estate planning, business, commercial real estate, or tax law, contact Gem and his associatess at Gem McDowell Law Group in Mt. Pleasant, SC. Gem and his associatess help individuals and families plan their estates with foresight and intelligence to avoid problems in the future. Call today to schedule an initial consultation at 843-284-1021.

The #1 Mistake People Make With Trusts

Trusts are wonderful tools for financial planning and estate planning. There are many, many kinds of trusts, each with its own purpose, pros, and cons. Trusts may be used to, among other things, avoid certain taxes, avoid probate, leave specific assets to an individual or organization, or pay for life insurance.

However, it doesn’t matter what kind of trust it is when it comes to the biggest mistake we see people make with trusts. That mistake: not putting anything into the trust.

The Basics Of Trusts

This can happen when people don’t understand what a trust fundamentally is.

A “trust” is an arrangement between three parties where the “trustor” (also called a “trustmaker,” “grantee,” or “settlor”) gives ownership of certain assets to a “trustee” for the benefit of a “beneficiary.” (Note that there may be more than one trustee and/or more than one beneficiary, according to the terms of the trust.)

The key point here is that the trustor gives up ownership of assets that go into the trust. This does not happen automatically upon signing the documents that create trust. The trustor must do it separately. Ideally, the estate planning attorney who draws up the trust will provide explicit instructions on what to do next and how to transfer assets, but that doesn’t always happen.

To transfer assets into the trust, the trustor signs over the deed of their house, title of their car, stocks and bonds, bank accounts, and any other selected assets to the trust. Which assets go in the trust depend on what the objective of the trust is. If the purpose is to avoid probate, then everything should go in the trust. If the purpose is to provide some money for the grandchildren over several years, for example, a selection of securities might be enough.

What Can Go Wrong

If someone does make this mistake, and fails to transfer ownership of assets from themselves to the trust they created, it can and likely will cause unintended consequences.

Imagine an adult child whose father said he had created a trust in order to avoid probate. Upon the father’s death, the child discovers that the trust was never funded. Everything is still owned in the father’s name at the time of his passing. Now the estate will pass through probate and, depending on the size of the estate, may be subject to estate taxes that could have been avoided. This is just one example, but there are many other ways an unfunded trust can cause unexpected problems.

Avoid This Mistake and Others With Guidance From Experienced Attorneys

Trusts are complex. For help creating trusts and understanding how they fit into your overall estate plan, call Gem McDowell Law Group. Gem is an estate planning and business attorney with over 20 years of experience helping individuals and families plan for the future. Contact Gem at the Mt. Pleasant office at (843) 284-1021 or use this contact form to get in touch and schedule a consultation today.

Would Your Contract Hold Up in Court? Indemnification Clauses and Public Policy.

If you’re in business, you know that contracts are a must to protect yourself. But don’t make the mistake of assuming that simply having a contract is enough. If it’s worded incorrectly, it can cost you.

In previous blogs we’ve discussed what can happen when covenants not to compete and nondisclosure agreements overreach or violate public policy – they become unenforceable.

The same is true with other common clauses in business contracts. Today we’re looking at the indemnification clause, which was the subject in a recent case before the South Carolina Court of Appeals. The Court determined that the clause in question was worded in such a way as to violate state public policy and was therefore unenforceable.

Let’s look at what indemnification is first, then the case, and finally, what you as a business owner can do so you don’t find yourself in the same situation.

What is Indemnification?

In an indemnification clause, the indemnifying party (the indemnifier) agrees to – in standard contract language – “indemnify, hold harmless, and defend” the indemnified party (the indemnitee) against lawsuits and losses resulting from the actions or negligence of the indemnifying party.

In practice, indemnification serves to shift the costs of defending lawsuits and paying resulting damages, if any, from one party (the indemnitee) to the other (the indemnifier). It may also shift the actual defense litigation as well.

For example, say a construction company hires a subcontractor to do some work on a house. The subcontractor indemnifies the construction company against damages arising from lawsuits due to its (the subcontractor’s) work. Let’s say the subcontractor does a shoddy job and the homeowner later sues the construction company for damages. Because it was indemnified, the construction company can expect the subcontractor to cover the fees it spends defending itself and the damages it pays to settle the claim.

A Real-Life Example

This was the general situation in the case at hand, D.R. Horton v. Builders FirstSource v. Jamie Arreguin.

The builder D.R. Horton, Inc. (Horton) entered into a contract with Builders FirstSource (BFS) for BFS to do some construction work on a home. Several years after the work was completed, Horton was sued by Patricia Clark for damages related to multiple alleged construction defects in the home. Horton was ordered to pay Clark $150,000 in general damages after arbitration.

Horton then sought to recover those damages and legal fees from BFS under their contract’s indemnification clause. The case went to a circuit court, which sided with BFS. It then went to the South Carolina Court of Appeals, which affirmed the lower court’s decision.

(For more details about this case, read the PDF of the court’s opinion here.)

What happened? BFS and Horton had an indemnification clause in their contract; why was Horton not able to recover under it?

The Indemnification Clause Violated Public Policy

The main reason the Court decided in BFS’s favor was that the contract’s indemnification clause was written in such a way as to violate South Carolina public policy.

The Court of Appeals found that it was allowable under state statute for Horton and BFS to agree that BFS would indemnify Horton for damages caused by BFS. However, the Court also found that it was not allowable for Horton to have BFS indemnify Horton for damages caused by Horton, which is how the clause was worded. That violated Section 32-2-10 of the South Carolina code and went against public policy, making it illegal and therefore unenforceable.

Here is the relevant section of the Code, abridged for clarity:

“Notwithstanding any other provision of law, a promise or agreement in connection with the […] construction […] of a building […] purporting to indemnify the promisee […] against liability for damages […] proximately caused by or resulting from the sole negligence of the promisee […] is against public policy and unenforceable.”

In addition, the circuit court and Court of Appeals found that Horton failed to provide BFS written notice of the Clark matter, as per their contract, which acted as a waiver of Horton’s right to indemnification. Also, Horton and Clark requested that the arbitration award be general, which means there was no way to know what part, if any, of the $150,000 award was related to construction work completed by BFS.

What This Means for You

Time and again, businesses get in trouble when they try to get more than they fairly and lawfully deserve. Here, Horton wanted BFS to pay damages for what may have been Horton’s own negligence, which is not reasonably fair, and is also not legal. In the end, Horton got nothing.

As a business owner, here’s what you can do to avoid a similar situation:

- Be very intentional about the wording in the contracts you create. While you want to protect your company’s interests, if you go overboard, you could end up with a clause or contract that’s unenforceable.

- Be just as careful about the contracts you sign. Do you understand what every clause means, and is it fair?

- Work closely with an attorney who understands contract law. Have your attorney draft new contracts or review existing contracts and discuss them with you to ensure they’re worded correctly and align with your business interests.

Get Help with Your Contracts From the Business Attorneys at Gem McDowell Law Group

Gem McDowell is a problem solver and a business attorney with over 25 years of experience. He can help you with your legal needs including reviewing and drafting contracts. Call them at Gem McDowell Law Group in Mt. Pleasant, South Carolina to discuss your business matter at (843) 284-1021 today.

Should Your Estate Go Through Probate? Why or Why Not?

Last time we cleared up confusion around probate in South Carolina and looked at what probate is and isn’t.

If there’s one thing people do know about probate, it’s that they want to avoid it when the time comes. But is that really the best advice for everyone? Let’s look at the common reasons why people work to avoid probate, and why it may not be worth the effort to avoid probate after all.

Avoiding The Cost Of Probate

By avoiding probate, you avoid the associated costs. In South Carolina, the cost of probate as of 2017 is:

$1,845 for the first $1,000,000

$2,500 for every $1,000,000 thereafter

For an estate worth $2 million, for example, the total cost of probate would be $4,345, while an estate worth $10 million would have a fee of $24,345. Many people choose to avoid probate to skip paying these fees.

What to consider: Keep in mind that it can be costly to set up an estate plan that keeps assets out of probate in the first place. For smaller estates, it may not be worth it.

Maintaining Privacy

When a will is filed with the probate court, it becomes a public document. In contrast, the details of an estate handled through a trust do not become public.

What to consider: Most people do not need to worry about this. Public figures facing curiosity and business owners wanting to keep company financial info private may have a valid reason for concern, but for most people this is a non-issue.

Making Disbursements To The Heirs More Quickly

Making sure heirs get their inheritances more quickly is another reason people choose to avoid probate. Theoretically, the trustee of a living trust can begin disbursements to heirs immediately upon death. In practice, trustees will ensure that the estate’s debts and taxes are paid before disbursing money to heirs. Whether this actually means beneficiaries get their money more quickly depends on the situation.

What to consider: Estates passing outside probate are subject to creditors’ claims for three years compared to just eight months given to creditors through the probate process. This increases the chance that a creditor will make a claim after disbursements have been paid out from the trust, which can lead to lawsuits against the trustee and/or beneficiaries. The shortened time creditors have to make a claim is an advantage of going through probate.

Is Your Estate Set Up To Pass Through Probate or Avoid Probate?

Estate planning is complex. Laws change and family situations change, making old estate plans obsolete or imprudent. It’s difficult to know the long-reaching consequences of estate planning unless you speak with an experienced estate planning attorney like Gem McDowell of Gem McDowell Law Group. He don’t just provide wills and trusts, but the insight and advice from years of experience on the real-world consequences of estate plans. Call Gem today at their Mount Pleasant office at (843) 284-1021 or use this contact form to set up a consultation.

Clearing Up Confusion About Probate in South Carolina

Updated 09/04/2025

For some people, “probate” is a dirty word. Much of this attitude comes from not understanding the process, so let’s clear up the confusion.

What Probate Is and What Probate Isn’t

There are some myths out there about probate, so here’s what it’s not: Probate is not a way for the government to take the estate of someone who dies without a will. Probate is not a way to avoid any applicable estate taxes. Probate does not take many years (except in rare cases).

Probate is simply a process, overseen by the court, in which a person’s estate is settled. It’s a way for ownership of assets to be transferred from the decedent to other people and for final taxes and debts to be paid.

For an estate to go through probate, no estate planning is required. A person’s estate can pass through probate whether they died without a will or with one, as long as it has assets that are subject to the process.

For an estate to avoid probate, the deceased must own no assets subject to probate at the time of death. A common way to do this is to put all those assets in a living trust (an inter vivos trust), which stays in someone’s name and control during their lifetime and immediately passes to the named successor trustee upon death. The assets owned by the trust are not subject to probate.

What’s subject to probate and what’s not?

Assets subject to probate in SC include:

- Real estate held as a tenant in common

- Property owned solely in the deceased’s name

- Interest in a partnership, corporation, or LLC

Assets not subject to probate in SC include:

- Real estate held as a joint tenancy with right of surviorship

- Retirement accounts with named beneficiary

- Insurance accounts with named beneficiary

- Pension plan distributions

- Assets held in a trust

- Assets that are payable-on-death or transfer-on-death

Now that we know what probate is and isn’t, let’s look at the process.

The Probate Process in South Carolina

The probate process consists of a series of steps:

1. Deliver the will at death. Someone in possession of the deceased’s will must deliver it within 30 days to the judge of the probate court, or to the personal representative named in the will, who will then deliver it to the judge.

2. Personal representative is appointed. This person is typically named in the will and is officially appointed by the court.

3. Notice to intestate heirs is sent. Heirs can contest if they aren’t named or are treated differently.

4. Inventory and appraisement of the estate. This must be filed within 90 days of the opening of the estate. Professional appraisers may be needed to provide the values at the date of death for assets like homes, art, and jewelry.

5. Final accounting. This involves paying applicable taxes, outstanding debts, and ongoing expenses while settling the estate, such as legal and accounting fees. If there’s not enough money in the estate to pay all debts owed, creditors will be paid in order of priority according to South Carolina code (as described in Section 62-3-805).

6. Disbursements. If there’s money left over after debts and taxes are paid, distributions may finally be made to the heirs according to the will, or, if there is no will, according to the state.

7. Close the estate. The personal representative files a number of documents with the court after the above steps have been completed, and the estate is finally closed when the court issues a Certificate of Discharge.

Probate Fees in South Carolina

An estate going through probate is subject to probate fees as laid out in South Carolina Code Section 8-21-770. Fees are based on the gross value of the decedent’s probate estate and are set/calculated as follows:

| Gross Value of Probate Estate | Fees |

| Less than $5,000 | $25.00 |

| $5,000-$20,000 | $45.00 |

| $20,000.00-$60,000 | $67.50 |

| $60,000.00-$100,000.00 | $95.00 |

| $100,000.00-$600,000.00 | $95.00 plus 0.15% of the property valuation between $100,000 and $600,000 |

| $600,000 or higher | $95.00 plus 0.15% of the property valuation between $100,000 and $600,000 plus ¼ of 1% (0.25%) of property valuation above $600,000

= $845 plus ¼ of 1% (0.25%) of property valuation above $600,000 |

Here’s a table with sample probate fees calculated based on the value of the estate:

| Gross Value of Probate Estate | Fees |

| $150,000 | $170.00

$95.00+(0.0015*($150,000-$100,000)) = $95.00+$75.00 = $170.00 |

| $300,000 | $395.00

$95.00+(0.0015*($300,000-$100,000)) = $95.00+$300.00 = $395.00 |

| $500,000 | $695.00

$95.00+(0.0015*($500,000-$100,000)) = $95.00+$600.00 = $695.00 |

| $750,000 | $1,220.00

$845+(0.0025*($750,000-$600,000)) = $845+$375 = $1,220 |

| $1,000,000 | $1,845.00

$845+(0.0025*($1,000,000-$600,000)) = $845+$1,000 = $1,845 |

| $3,000,000 | $6,845.00

$845+(0.0025*($3,000,000-$600,000)) = $845+$6,000 = $6,845 |

| $10,000,000 | $24,345.00

$845+(0.0025*($10,000,000-$600,000)) = $845+$23,500 = $24,345 |

How Long Does Probate Take in South Carolina?

How long it takes an estate to go through the probate process depends on a number of things, including:

- Whether the deceased had a valid will or not

- How large and complex the estate is

- Whether the will is contested

- Whether lawsuits are filed

- How efficient the personal representative is

Under good conditions, a relatively simple estate can take approximately a year from open to close. More complex cases will take longer.

(Note that “small estates,” which contain no real property and total less than $25,000 $45,000* in value, may qualify for a summary administrative procedure, a quicker and cheaper process than the regular probate process. A small estate can be settled in a matter of a few days or weeks.)

*The threshold for small estates in South Carolina has increased from $25,000 to $45,000 as of May 8, 2025.

Is It a Good Idea to Avoid Probate?

Now that you know more about probate in South Carolina, you may be wondering whether it’s smart to approach estate planning with the intent of avoiding probate altogether. There are many things to consider, so that’s the subject of the next blog.

For help with your estate plan, contact Gem McDowell Law Group in Mount Pleasant. Contact Gem today at (843) 284-1021 to set up a consultation.

The Statute of Elizabeth: What You Need to Know About Transferring Assets

What if you owed someone a lot of money, but you didn’t want to pay them back? You might try to put your assets somewhere they couldn’t be touched; for example, you might gift them to a person you trust, or transfer them to an LLC.

Fortunately for your creditor, and unfortunately for you, you won’t get away with this scheme if your intention is to avoid paying your debts.

Moving assets in the way described above is referred to as “fraudulent conveyance,” after the Fraudulent Conveyances Act of 1571, aka the Statute of 13 Elizabeth.

The Statute of Elizabeth

The Fraudulent Conveyances Act, as it’s properly known, was an English act of 16th Century Parliament that many U.S. states adopted early on. Most states have since adopted the Uniform Fraudulent Conveyances Act (UFCA) or, more commonly, the Uniform Fraudulent Transfer Act (UFTA).

The purpose of the Statute of Elizabeth is to provide a way for creditors to “undo” asset transfers of their debtors when the transfers were done so fraudulently. According to South Carolina Code, “every gift, grant alienation, bargain, transfer, and conveyance of lands… for any intent or purpose to delay, hinder, or defraud creditors and others of their just and lawful actions, suits, debts, accounts, damages, penalties, and forfeitures must be deemed and taken… to be clearly and utterly void…”

How does the court know whether the transfer was, indeed, done fraudulently? If the transferor denies fraud (as you’d expect), the court can look for these “badges of fraud”:

- Insolvency or indebtedness of transferor

- A lack of consideration for the conveyance

- A relationship between the transferor and transferee

- Pending litigation or threat of litigation

- Secrecy or concealment

- Departure from usual method of business

- Transfer of debtor’s entire estate

- Reservation of benefit to the transferor

- Retention by the debtor of possession of the property

The court will look for a number of badges of fraud; one alone does not create a presumption of fraud.

If the court does find that the conveyance was fraudulent, it can be “undone,” giving the creditor recourse for collecting on its debt.

A recent South Carolina case on the Statute of Elizabeth

The South Carolina Court of Appeals heard a case on this very subject and decided in the case in February. Here’s what happened.

Kenneth Clifton borrowed $3.873 million from First Citizens Bank

Kenneth Clifton was a successful real estate developer who frequently bought land as investment properties and transferred them to LLCs. He purchased one property with Linda Whiteman in 1995, a piece of land in Laurens County, SC of approximately 370 acres, which they said was for retirement.

Clifton also regularly borrowed money to finance his purchases. He took out three loans from First Citizens Bank to finance three separate investments, totaling an initial loan amount of $3.873 million, and renewed them several times.

Around the time that the housing bubble burst, Clifton requested extensions on the loans, which the bank granted after he provided a personal financial statement demonstrating his ability to pay them back. His personal financial statement put the value of the assets he held at around $50 million, including a 50% stake in the Laurens County property valued at $1.57 million.

Clifton transferred away his interest as the bank came for its money

Before receiving an extension on the third loan, Clifton didn’t tell the bank that both he and Whiteman transferred their interests in the Laurens County property to Park at Durbin Creek (PDC), an LLC that Clifton had an interest in.

When the bank asked Clifton to come current with interest payments and provide more collateral before extending the loans again, he didn’t, and the bank began foreclosing proceedings, getting a deficiency judgment of $745,317.86 plus interest.

Meanwhile, Clifton disassociated himself from PDC and transferred his membership in it to Streamline, a company that did not yet exist and was comprised of his two daughters and ex-wife.

When the bank tried to collect on the judgment, it couldn’t, as all the assets listed in Clifton’s personal financial statement had been foreclosed on, transferred away to cover other debts, or otherwise disposed of. The bank filed suit against Clifton, citing the Statute of Elizabeth.

Fraudulent or not?

After a one-day, nonjury trial, the Circuit Court issued an order to set aside the conveyance of the Laurens County property to PDC; the conveyance of his 50% interest in the property was null and void, pursuant to Statute of Elizabeth. (The Court found many other issues with the transfer of interests to Streamline, as well.)

Clifton denied having transferred the land fraudulently, but the Court found that sufficient badges of fraud existed – six out of the nine listed above, to be exact.

The Court of Appeals affirmed the Circuit Court’s findings.

Asset protection the right way

Let’s look again at the badges of fraud:

- *Insolvency or indebtedness of transferor

- A lack of consideration for the conveyance

- A relationship between the transferor and transferee

- *Pending litigation or threat of litigation

- Secrecy or concealment

- Departure from usual method of business

- Transfer of debtor’s entire estate

- Reservation of benefit to the transferor

- Retention by the debtor of possession of the property

The two marked with an * are key. If someone knows they owe money they must pay back soon but can’t, or even if they don’t owe any money but could reasonably expect a lawsuit coming their way, then transferring away assets can look suspicious.

However, asset protection is important, and there are ways to do it correctly. This is when it’s vital to talk to an attorney with experience in estate planning. Gem McDowell of the Law Offices of Gem McDowell is a corporate, tax, and estate planning lawyer with 25 years of experience helping people grow and protect their assets. Call him at their Mount Pleasant office at (843) 284-1021 or by filling out this contact form online.

Law Is Not A DIY Field: When Not To Represent Yourself

Individuals have the right to represent themselves and “act as their own attorney,” but do businesses? Not necessarily. Try to DIY, and you may discover you’ve overstepped the bounds.

That’s what happened to Community Management Group, LLC, which manages HOAs and condo associations in the Charleston tri-county area, in a recent case. Beyond the typical duties of property management companies, such as property upkeep and enforcement of association rules, CMG also engaged in the practice of law without the help of an attorney. Specifically, CMG “prepared and recorded a notice of lien and related documents; brought an action in magistrate’s court to collect the debt; and after obtaining a judgment in magistrate’s court, filed the judgment in circuit court,” and advertised the fact that they did these things, according to the South Carolina Supreme Court decision.

The Supreme Court in South Carolina has the power to regulate the practice of law, and has made some allowances for non-lawyers to act in place of a lawyer in certain instances. In its decision, the Court clarifies instances where it’s not appropriate for non-lawyers to practice, including the things that CMG did.

Hire an attorney to look out for your interests instead

There’s a reason the South Carolina Bar gives out licenses to practice law. Despite the proliferation of information available on legal issues on the web, it doesn’t mean it’s a good idea – or even legal – to take legal matters into your own hands. Instead, work with an experienced attorney who can help with your business and estate planning needs, like Gem McDowell of Gem McDowell Law Group in Mt. Pleasant, SC. Gem has 25 years of experience in business law, tax law, commercial real estate, and estate planning. You can reach him by calling (843) 284-1021 or by filling out this contact form online.

When Covenants Not to Compete and NDAs Reach Too Far

South Carolina courts are clear in their general dislike of covenants not to compete and any provisions that restrict an individual’s ability to work. They are also clear in their tendency to rule in favor of the employee rather than the employer in related cases. This was the issue at hand in a recent case decided by the South Carolina Court of Appeals.

Covenants not to compete and non-disclosure agreements (NDA) were covered on this blog previously, because it’s so important for employers to be extremely careful in their wording on non-compete and non-disclosure agreements. If they try to restrict their employees’ actions too much, an employer may discover their agreement has reached too far and is invalid.

Fay vs. Total Quality Logistics

That’s essentially what happened in the case at hand, Fay vs. Total Quality Logistics. TQL, an Ohio-based transportation and logistics company, hired Joshua Fay in late 2012. As required by the company, Fay signed TQL’s Non-Compete, Confidentiality, and Non-Solicitation Agreement before commencing work. The Agreement was signed in Ohio and was to be enforced under Ohio law.

The following summer, Fay was fired. He then founded JF Progressions, LLC, in Mount Pleasant, SC, providing logistics services to another company. TQL found out and notified Fay that TQL intended to pursue legal action if he didn’t stop what he was doing. Fay then filed suit against TQL to seek a declaratory judgment that the Agreement he had signed was invalid and not enforceable. He argued that the Court must invalidate the Agreement if it is contrary to SC public policy, even if Ohio law applied to the interpretation of the Agreement.

The case made it to the South Carolina Court of Appeals which sided with Fay and found that, though it was to be enforced under Ohio law, the Agreement offended South Carolina public policy and was therefore not enforceable. The Court of Appeals found that the lower court (the Circuit Court) erred when it ruled against Fay, stating that the Agreement was enforceable under Ohio law and did not offend SC public policy.

When non-compete and non-disclosure agreements are too broad

To understand why the South Carolina Court of Appeals ruled as it did, it’s important to understand the basics of non-compete agreements. Two important clauses in a non-compete agreement are about time and geography; agreements place limits on the length of time and the geographical area in which an employee or former employee can work. An enforceable agreement strikes a balance between protecting the employer’s interests and giving the employee or former employee the freedom to earn a living in their profession.

South Carolina has determined that these limits must be “reasonable.” In the Agreement Fay signed, the limits were not reasonable under South Carolina’s standards. The non-disclosure agreement was worded so as to effectively be a non-compete agreement, which was to be in effect “at all times.” Under the Agreement, Fay was restricted from working with “Competing Businesses,” which was defined as “any person, firm, corporation, or entity that is engaged in the Business anywhere in the Continental United States.” If TQL’s Agreement were enforced, Fay would not be able to work in the field of transportation and logistics in the Continental U.S. “for an indefinite time, if not forever,” in the Court of Appeal’s wording. South Carolina determined that these restrictions were too broad and violated the state’s public policy, as they restrict an individual’s right to exercise their trade.

The Court of Appeal’s decision cited the Stonhard case, quoting “The agreement fails to limit the covenant to a particular geographical area. To add and enforce such a term requires this [c]ourt to bind these parties to a term that does not reflect the parties’ original intention. Therefore, we hold that the covenant, despite any reformation, is void and unenforceable as a matter of public policy.”</P

In addition, the Court of Appeal’s decisions reaffirmed the fact that South Carolina does not follow the “blue pencil” rule. In non-compete cases, this rule allows courts the discretion to invalidate certain portions of an agreement while maintaining others and to create terms the court believes the parties should have agreed on in the first place.

(It’s important to note that this discussion is about the March 2017 decision of the South Carolina Court of Appeals. It’s possible that the South Carolina Supreme Court may take up this issue at a future date, at which point this decision could be reversed or affirmed.)

Lesson for employers on covenants not to compete and NDAs

The lesson here for employers is to be extremely careful in the wording on covenants not to compete, NDAs, and other contracts that have any limiting effect on your employees’ current or future ability to work. As we can see from this case, strict wording of an NDA can effectively be interpreted as a non-compete agreement, even if that wasn’t the original intention.

Employers also need to be cognizant of these issues with regards to different states’ laws. Even if your state’s courts find your contracts “reasonable,” another state’s courts may not, depending on the state’s public policy. The internet cannot provide reliable guidance on this topic, which is why it’s important to discuss it with an attorney who’s well versed in this topic.

For guidance on how to craft your company’s covenants not to compete and NDAs, or for advice on one you’ve already signed, contact Mt. Pleasant business attorney Gem McDowell. He can be reached at Gem McDowell Law Group in Mount Pleasant at (843) 284-1021 or by filling out this contact form online. Contact them today.

Coming Soon to a Town Near You

For many years, South Carolina has limited the number of liquor stores an owner may have within the state to three. However, that law is no longer enforceable thanks to a recent South Carolina Supreme Court decision.

Total Wine & More, a large wine and liquor retailer that’s likely familiar to residents of Charleston, Greenville, and Columbia, was denied a fourth liquor license to open a new store in Aiken. In response, it brought an action seeking a declaratory judgment that the limitations in the law were unconstitutional.

The trial court found the provisions constitutional because they presume laws are constitutional, but when the issue was appealed, the Supreme Court found the reverse.

Now that the law has been declared unconstitutional, expect to see some bigger name stores dominate the alcohol landscape across the state, perhaps starting with Total Wine in Aiken.

Business guidance from an experienced corporate attorney

For legal and strategic advice, contact Gem McDowell of Gem McDowell Law Group. Gem has 25 years of experience in business law, including business creation; contracts, NDAs, covenants not to compete, buy-sell agreements and more; handling large commercial real estate transactions; tax law; and estate planning. You can reach him at (843) 284-1021 or by filling out this contact form online.

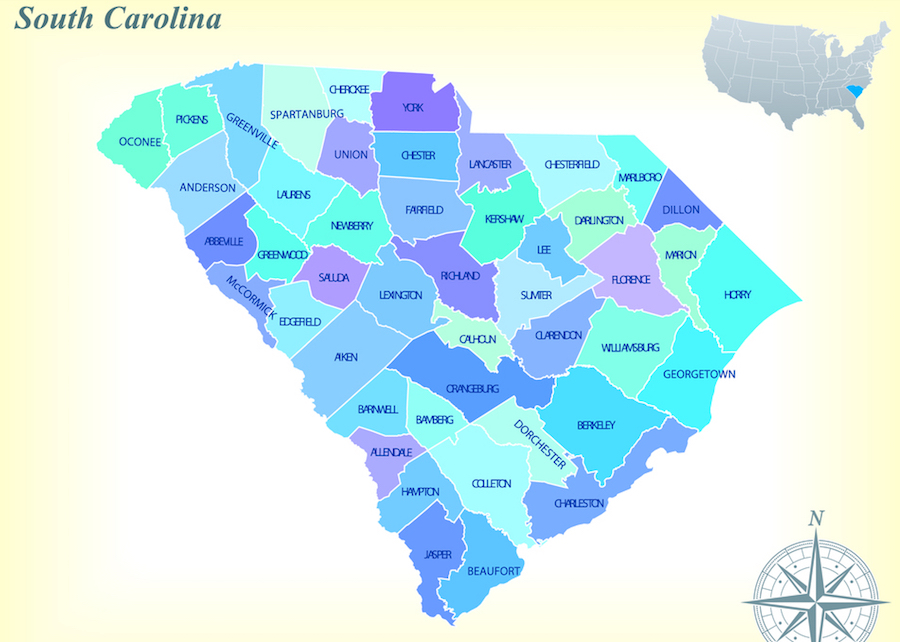

Where Should I Open My Business In South Carolina?

Note: this blog was updated in October 2019 to reflect the most recent data available

In recent years, South Carolina has attracted numerous companies to the state that want to take advantage of various business incentives. Two such headline-making companies include Boeing, which opened its Charleston facility in 2011, and Volvo, which officially opened its Ridgeville plant in 2018.

Business owners looking to open a store, plant, office, or other business here first need to consider where they’re most likely to encounter success. While available facilities, infrastructure, and local incentives may play a factor, undoubtedly the largest factor that will affect success is population.

South Carolina is Growing in Population

Companies opening a new factory or branch look for available work force to hire from. To forecast their success, they need to look not only at current population but at population trends, too.

South Carolina has been growing in population for years and was #9 on the U.S. Census Bureau’s list of Top 10 States in Numeric Growth (with 62,908 people) and #9 on the Top 10 States in Percentage Growth (at 1.3%) for 2017-2018. It’s a safe bet that this trend will continue for many more years and that South Carolina will remain an attractive destination for businesses.

But where are all the newcomers moving to? Is the influx evenly distributed through the state? The Charleston tri-county area sees 28 people move into the area every day, and the Charleston metro area alone is growing at three times the U.S. average. Meanwhile, several cities and counties lose people every day to other areas of the state and the country.

What’s going on?

A Quick Lesson on South Carolina Demographics

At the end of the Civil War, South Carolina had 31 counties. By 1919, we had 46. Fifteen new counties were added in between, many to honor prominent men in South Carolina’s history.

For years, the state ran everything and counties had very limited power. Adding counties essentially meant drawing new lines on the map. New counties were carved out of existing counties: Marion became Marion and Dillon; Charleston became Charleston, Berkeley, and Dorchester; Barnwell became Barnwell, Allendale, and Bamberg; and so on. County populations were slashed as more counties were added, but again, that had no real practical consequences, as the state was mostly in charge.

When counties gained more power after the Home Rule Act was passed in 1975, however, the number of counties – and their smaller sizes – began to matter. Where the state had previously been in charge, suddenly counties were responsible. Many counties found themselves without the ability to raise adequate funds from their low populations to provide the police and emergency services, public schools, infrastructure, parks, libraries, and other services and amenities they were now responsible for. That issue persists for some counties to this day.

Which S.C. Counties Are Growing and Which Are Shrinking?

It appears to be a vicious cycle. As counties are able to provide less to their residents, residents leave for greener pastures, leaving the county with even fewer people to tax and even less money to provide for their remaining residents.

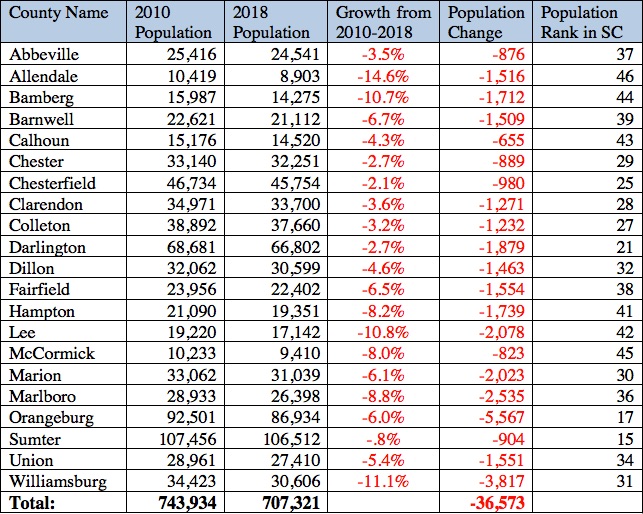

You can see this happening in census numbers. Between 2010 and 2018, 21 of South Carolina’s 46 counties have declined in population: Abbeville, Allendale, Bamberg, Barnwell, Calhoun, Chester, Chesterfield, Clarendon, Colleton, Darlington, Dillon, Fairfield, Hampton, Lee, Marion, Marlboro, McCormick, Orangeburg, Sumter, Union, and Williamsburg.

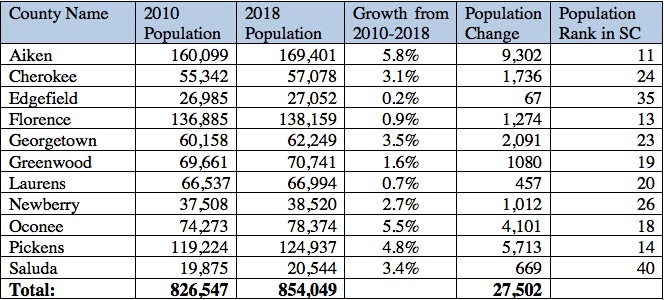

A further 11 grew more slowly than the U.S. growth rate of 6.0%: Aiken, Cherokee, Edgefield, Florence, Georgetown, Greenwood, Laurens, Newberry, Oconee, Pickens, and Saluda.

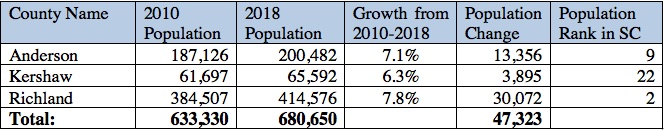

Three counties grew faster than the U.S. growth rate of 6.0% but slower than the South Carolina growth rate of 9.9%: Anderson, Kershaw, and Richland.

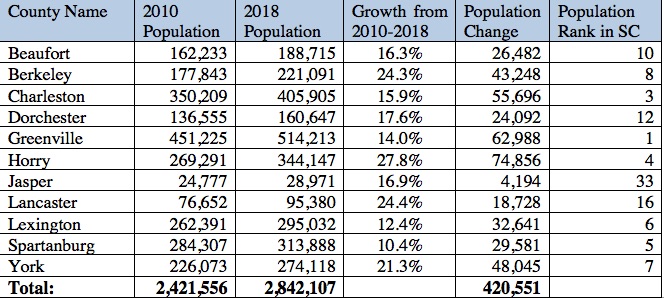

The remaining 11 counties grew faster than the South Carolina growth rate of 9.9%: Beaufort, Berkeley, Charleston, Dorchester, Greenville, Horry, Jasper, Lancaster, Lexington, Spartanburg, and York.

See the charts at the end of this post for all the numbers.

What This Means for Businesses Moving To South Carolina

Be strategic before selecting a place to open your business.

South Carolina as a whole is a great place to run a business, but some counties are more attractive than others due to available workforce and infrastructure. Counties with a growing population will be more likely to support your business for years to come.

In general, counties on the coast (with the exception of Georgetown) and in the northwest part of the state (which include fast-growing cities Spartanburg, Greenville, and Rock Hill) have been trending upwards in terms of population over the past decade.

Get strategic advice from Mt. Pleasant corporate attorney Gem McDowell

Population is just one factor when it comes to deciding where to open your business in South Carolina. To discuss legal aspects of your business, contact business attorney Gem McDowell of the Gem McDowell Law Group.

Business owners need more than corporate legal services to make their businesses thrive – they need strategic advice. Gem McDowell has over 20 years of experience helping businesses grow in South Carolina. He can advise on a number of topics including complex real estate transactions, where to open a new factory or office, what to do about corporate taxes, and much more.

Contact Gem and his associates at the Mount Pleasant office today by calling (843) 284-1021 or filling out this contact form online.

South Carolina counties that grew at a rate of less than the U.S. growth rate of 6.0%. Click to enlarge.

South Carolina counties that grew faster than U.S. growth rate of 6.0% but slower than S.C. rate of 9.9%. Click to enlarge.

Are You Protected? What You May Not Know About “Piercing the Corporate Veil.”

One of the first things to do when going into business is to select the appropriate business structure for your venture and set it up correctly. A primary advantage of doing so is gaining the protection of the entity so that your personal finances are safe from being used to settle company debts or pay the company’s bills. Having the right business structure also allows for the business to be considered a separate entity, with its own income and debts separate from other businesses that you may also own.

But don’t assume that just because you’ve set up a legal structure that you and your business are fully protected; that protection is only valid if you follow all the rules. In other words, you are not guaranteed liability protection just because you have created a limited liability company or a corporation. (Note that sole proprietorships and partnerships do not offer the same liability protection and so are excluded from this discussion.)

Today we’ll look at the concept of “piercing the corporate veil” (PCV), which is when a court suspends the liability protection your business entity gives you, what it means, and how you can avoid it.

What Can Happen When You Fail to Keep Business and Personal Accounts Separate

One of most important ways to maintain your personal liability protection is to be scrupulous about keeping business and personal finances separate. Maintain separate checking and savings accounts and use different credit cards for your business and for yourself. The key idea is not to “commingle” your personal finances with your company’s finances. You pay your own bills from your personal account and you make sure to pay the company’s bills from the company’s account.

Let’s say you aren’t meticulous about keeping finances separate. Then your business hits a rough patch and is unable to pay a debt it owes. Since your finances aren’t separate, it may look like you and your business are essentially the same, and you personally may be on the hook. Your assets – including investments, cash, your car, and your house – could be taken to satisfy your company’s debt. That’s why it’s crucial to keep separate accounts.

What Can Happen When You Fail to Keep Individual Businesses Separate

PCV isn’t just an issue of separate business from personal accounts. It’s also a matter of keeping businesses distinct from each other.

Imagine a scenario like this. Alpha Corp. and Bravo Corp. are run by the same management group. About 60% of the shareholders are the same between the two, as well. Alpha Corp. runs into trouble and needs to pay a creditor immediately, but has no money. No problem, because Bravo Corp. has plenty of money. Bravo Corp. writes a check directly to pay Alpha Corp.’s debt.

The companies have now commingled funds. When this happens, they may be considered “alter egos” of one another under the alter ego doctrine, a.k.a. the instrumentality rule. Here are two examples of what can happen next:

- Three shareholders of Bravo Corp. who are not also shareholders of Alpha Corp. are, understandably, not happy that Bravo’s funds are being used to pay off Alpha’s debts. They bring a type of lawsuit called a derivative action against the management group arguing that there’s one giant pool of money, and the companies are in fact not separate.

- Another creditor sues Alpha Corp. for not paying its debt. During discovery, it’s determined that Alpha and Bravo have commingled funds. Now Bravo Corp. can be compelled to pay Alpha Corp.’s debts, as the two are alter egos.

It’s not just about money, either. Even seemingly simple things as sharing the same mailing address, office space, and letterhead may lead to trouble, as the “blurred identity theory” addresses situations where individual businesses don’t have individual identities. The two companies may be confused with each other as their identities are “blurred” into one another.

Proving PCV in Court

The concept of piercing the corporate veil (also known as “lifting the corporate veil”) was put to the test in the 1976 case that originated in South Carolina, DeWitt Truck Brokers v. W. Ray Flemming Fruit Co. The U.S. Court of Appeals for the Fourth Circuit upheld the District Court’s decision to pierce the corporate veil and impose individual liability on the owner. Flemming was found personally liable for debts owed by his company after it was discovered the business did not follow basic corporate protocols and that he, as the dominant shareholder, had drawn a salary, leaving the company undercapitalized and in debt.

In its decision, the court reiterated that while it recognizes a corporation is a separate entity that’s distinct from its owners and officers, it can “decline” to recognize that autonomy when doing so would “produce injustices or inequitable consequences.” Still, it will do so “reluctantly” and “cautiously.”

Bases for PCV noted in the DeWitt decision include:

- Fraud

- Inadequacy of capital

- Complete domination of the corporate entity

- Instrumentality theory (discussed above)

- Failure to observe corporate formalities

- Non-payment of dividends

- Insolvency of the debtor corporation at the time

- Siphoning of funds by the dominant shareholder

- Non-functioning of the other officers and directors

- Absence of corporate records

- Existence of the corporation as a façade for the operations of the dominant stockholder(s)

Ultimately, the court may pierce the corporate veil when “a number” of the above factors exist in order to right an injustice or unfairness.

How to Avoid PCV

You can make it less likely for a plaintiff/complainant to win (and less likely to sue in the first place) over this issue if you follow proper procedures.

- Keep finances separate between individual and company or company and company

- Move funds between entities through loans or other above-the-board methods

- Keep distinct business identities through separate addresses, trademarks, letterheads, etc. for each company

- *Hold regular shareholder meetings

- *Keep minutes

- *Pay dividends if applicable

*Applicable to corporations, not LLCs.

It’s not difficult to follow protocols to avoid PCV, it just takes discipline. When people get lazy and let basic things slip, that’s when problems arise.

Speak with a corporate attorney about your business

This is a very general overview of some elements of PCV; the topic is extensive and can become very complex. Maintaining the liability protection your business entity gives you is one of the most important things you can do. Make sure you’ve got your bases covered by speaking with a corporate attorney like Gem McDowell.

Gem handles a wide range of corporate law issues and advises on business matters. Contact Gem at their Mount Pleasant office today by calling (843) 284-1021 or filling out this contact form online. They are ready to help you with your business.