Accretion and Property Rights on Sullivan’s Island

Imagine you own beachfront property in South Carolina just steps away from the ocean. Now imagine that over time, the distance between your home and the ocean gets larger and larger as the beach grows, putting you further and further from the water.

This was the situation for homeowners on Sullivan’s Island, a small island town just outside Charleston, SC. They sued the town in a case that was heard by the South Carolina Supreme Court in November 2019, Bluestein vs. Town of Sullivan’s Island. At the center of the case was the concept of accretion.

Accretion

South Carolina’s coastline is subject to a number of natural phenomena including erosion and accretion. Erosion occurs when sand, sediment, and other land matter is carried away from the coast, causing the beach to shrink as the high-water line creeps further in. It’s caused by strong waves, storm surge, and coastal flooding.

The contrary of this is accretion, where sand, sediment, and other land matter is deposited on the coast by the waves. Over time, this causes the beach to grow bigger.

Sullivan’s Island experiences both of these forces, with erosion affecting the coastline in the northern part of the island and accretion affecting the southern and central areas.

Suing Over the Town’s Approach to Managing Accretion

Accretion is a natural phenomenon, so what’s the basis for someone to sue over it? While accretion is something that can’t be controlled by humans, the consequences of it can be.

In the case at hand, two couples – Nathan Bluestein and Ettaleah Bluestein, MD, and Theodore Albenesius and Karen Albenesius (collectively, the Petitioners) – brought a suit against the Town of Sullivan’s Island and Sullivan’s Island Town Council (collectively, the Town).

The Petitioners separately bought front-row property on Sullivan’s Island, the Bluesteins around 1980, the Albenesiuses around 2009. Their properties were considered oceanfront when purchased and were a short distance from the shoreline. Today, due to accretion, the shoreline is much further away from their homes, approximately 500 feet or more. (In a footnote in its opinion, the court notes that the rate of accretion is approximately 17 feet per year.)

This does not mean that the Petitioners’ properties have increased – the land between their properties and the shoreline doesn’t belong to them. That property is subject to a 1991 deed, created in the aftermath of Hurricane Hugo, under which the Town has duties to upkeep the land.

How to interpret the deed was the main issue in the case, with the court noting “The parties have cherrypicked language from the 1991 deed which ostensibly supports their respective interpretations of the deed.”

The Town’s Duties to the Land

The Petitioners argue that the 1991 deed means the Town should keep the vegetation on that land between their properties and the shoreline in the same condition as it was in 1991. In 1991, the vegetation was mostly sea oats and wild flowers, no taller than 3 feet high. In contrast, the Town argues that the deed gives it unfettered license to allow the vegetation to grow unchecked, which is what it has done.

Over the years, a maritime forest has grown up on that land. The tall and thick vegetation harbors coyotes, snakes, and other “varmints” (in the word of the court) and is a fire hazard, complain the Petitioners. The Petitioners also complain that their homes are taxed like beachfront property, but they now have no ocean views or ocean breezes due to the vegetation growth and are farther away from the ocean. In the case heard by the Court of Appeals, they claimed their properties have lost more than $1,000,000 in value because of this.

The Court of Appeals affirmed summary judgment for the Town in its decision, which the Supreme Court reversed in its February 2020 decision, remanding the case. The Supreme Court stated that this case can’t be settled as a matter of law, as the 1991 deed is too ambiguous, and there are still issues of material fact that must first be resolved.

Just recently, in October 2020, the parties reached a settlement resolution together, ending further litigation. As described in the settlement, the Town will “implement selective thinning of the Accreted Land” zone by zone using funds from the Town, Plaintiffs, and Homeowners. This should mitigate the effects of accretion on the property in question. Read about the full settlement resolution here.

Caring for Land in the Public Interest

As South Carolina residents, we all have an interest in the health of our coastlines, even if we live far from the beach. Just as we saw in the case covered on this blog about the Public Trust Doctrine, it’s up to the entities in charge of these precious stretches of land to balance the needs of the individuals who live there with the public good, while respecting Mother Nature.

Doing Good While Making Money: Benefit Corporations in South Carolina

You’ve heard of C-corps and S-corps, but what about B Corps?

B Corp is short for benefit corporation, a type of for-profit business entity that is regulated by state law. Currently, 35 states and DC have enacted legislation to create benefit corporations, including South Carolina.

As stated in the 2012 South Carolina Benefit Corporation Act (find it here), “a benefit corporation shall have as one of its corporate purposes the creation of a general public benefit.” Here, “general public benefit” is defined as “a material positive impact on society and the environment taken as a whole.”

Who Benefits from a Benefit Corporation?

Traditionally, corporations are run with the primary driver of making money for their shareholders. High-level decisions are made with this question in mind: How can we maximize profits for the benefit of the shareholders? Though it’s not actually a legal requirement for corporations to make the most money possible, this is often the way it works in the real world. After all, a CEO who doesn’t make enough money for the shareholders can be ousted by the board of directors.

But in a B Corp, making money is not the primary driving force. Instead, business decisions are guided, in part, by the desire to create a particular benefit in the world.

Examples of some benefits that a B Corp might have include:

- Donating a portion of income to charitable causes

- Operating in a way to reduce environmental impact or actively preserve the environment

- Providing goods and services to a specific group of people such as low-income families

- Providing employment and economic opportunities for underserved groups

- Promoting education or awareness of a certain subject

- Advancing the welfare of other groups besides in addition to the shareholders, like the employees, the customers, or particular minority groups

A well-known business that’s also a B Corp is Patagonia, which amended their articles of incorporation in 2012 to include a commitment to sustainability and treating workers well. Ben & Jerry’s also became a B Corp in 2012, with a goal of advancing social change for good.

What It Means to Be a B Corp

The decision to be a B Corp is a big one. It can drastically change the way you approach decisions and run your business. Of course, that’s the exact reason why some people want to run a B Corp.

For instance, let’s say your stated public benefit is to protect the environment. You may choose packing for your product that is biodegradable and more environmentally-friendly but is more expensive to produce. A regular corporation may be bound to sticking with less environmentally-friendly options, because that’s the decision that maximizes profits and increases shareholder value. But as a B Corp with a stated intention of helping the environment, you can choose to forsake some of those profits for the public benefit of a better environment.

Requirements for Becoming and Being a B Corp

Entrepreneurs can incorporate their business as a benefit corporation in South Carolina by including a provision in its articles of incorporation that it is a benefit corporation and specifying its benefit purpose. Existing entities can also become B Corps by changing their status.

In South Carolina, there are some requirements that come along with being a benefit corporation. One is the submission of an annual report to the Secretary of State which must include, among other things, an assessment of the business against a third-party standard. Though the law says that a B Corp need not have an outside party certify them, there are organizations that do that, such as the independent nonprofit B Lab.

Additionally, a director on the board must be the elected and serve as the benefit director, and you may also have an officer designated as the benefit officer. (The same person can fill both roles at the same time.) Their roles and duties are described by law, but in short, both are responsible for making sure that the company is carrying out its mission as a benefit corporation in terms of the benefits it creates.

Advantages and Disadvantages

As with all types of business entities, there are pros and cons of being a B Corp.

Pros of being a B Corp:

- Furthering a cause you believe in and making a positive change in the world through your company

- Ability to make decisions in your company that align with your values rather than focusing solely on making more money

- Attracting and working with talented people who share the same values (especially important to younger workers who increasingly want to work at ethical, mission-driven companies)

- Attracting impact investors

- Good for public relations and consumer perception of your business

- Being part of a values-based global movement

- If you change your mind later, you can easily drop your B Corp your status

Cons of being a B Corp:

- Additional burdens of paperwork, certification, and maintaining benefit director and benefit officer roles

- Converting to a B Corp may be difficult for existing publicly traded companies (which is why Etsy gave up its B Corp status and Warby Parker did, too)

- Uncertainty due to how new B Corps are, and the potential increase in liability exposure

Though there many more advantages than disadvantages listed here, the disadvantages still merit consideration.

However, if you are driven to do good via your business and you want more control over how your company can make that happen, a B Corp is something to look into.

Is Becoming a B Corp Right for Your Business?

Changing your status or incorporating as a B Corp is a big step. Before taking that step, speak to an experienced business attorney like Gem McDowell. Gem has over 25 years of experience working with clients, giving them strategic advice on how to start, grow, and protect their businesses. Contact Gem and his associates at the Gem McDowell Law Group in Mt. Pleasant to schedule your free consultation by calling 843-284-1021 today.

Can Your HOA Foreclose on Your Home for Non-Payment of Dues?

Losing your home in a foreclosure because you missed a $250 HOA payment – can that actually happen? Is it even legal?

Yes and yes. This exact situation happened to Tina and Devery Hale. Our past two blogs went into detail on their case, Winrose Homeowners’ Association v Hale (read the opinion here), which went before the South Carolina Supreme Court in 2019. Those blogs are linked here and here.

But we’re not done yet because there’s even more to it. This case exposes bad parties acting in bad faith that every homeowner should be aware of.

Can Your HOA Take Your Home for Non-Payment of Dues?

Did you know that it’s not only the bank that has the power to foreclose on your home? It may seem absurd that your HOA can foreclose on your home because you missed paying your assessment, but it is legal in South Carolina and it does happen.

In the Winrose case, the Hales agreed to the following covenants and restrictions when they bought their house:

“If the [HOA dues] assessment is not paid within thirty (30) days after the delinquency date, the assessment shall bear interest from the date of delinquency at the rate of eight percent per annum, and the [HOA] may bring legal action against the owner personally obligated to pay the same or may enforce or foreclose the lien against the lot or lots […]”

The HOA was within their legal rights to do what they did. However, that doesn’t mean the SC Supreme Court was happy about it.

HOAs Making a Buck Off Unsuspecting Homeowners

Typically, once the court has stated its decision, that’s the end of the opinion. But not here. Writing the opinion for Winrose v Hale, Justice Kittredge had more to say. “We note our concern about this foreclosure proceeding,” he begins.

Recognizing the right of the HOA to pursue a lien and a foreclosure on the Hales’ house, the court characterizes this as a tactic to “capitalize on a small debt.” Though the amount past due was small, the HOA’s attorney went straight to the strongest measures possible as a next step – placing a lien and foreclosing on a house valued at $128,000 for a past due amount of $250.

Why? “The true nature of this foreclosure action is illustrated by the service and filing fees (which are more than double the amount of the principal due) and attorney’s fees (which were eight times the amount of the principal due),” writes the court (emphasis original). “A foreclosure proceeding is a last resort, not a business model to be swiftly invoked for the purpose of exploiting property owners.”

The Hales’ HOA was willing to let them lose their home and their equity in it in order to make some money in fees. Luckily for The Hales, they got their house back in the end, but that’s not always how this scenario plays out. Many people have lost their homes to HOA foreclosures.

Buyers Extorting Homeowners

The HOA was not the only bad actor here; the court was also “especially troubled” by the actions of the party that bought the Hales’ home, Regime Solutions, LLC.

In the majority of judicial sales, like the kind that was used to sell the Hales’ home, the purchaser of the foreclosed home takes on the property’s mortgage and other debts. This is necessary because the house is only free and clear once the associated debts are settled.

But Regime never took on the Hales’ mortgage. Not only that, but their business model appears to be based on not assuming the mortgage of the properties it purchases. After buying a foreclosure at a very low price, Regime either lets the bank foreclose on the property or it negotiates with the homeowners to let them have their house back for a large fee.

Between 2013-2016, Regime bought 38 properties that were later foreclosed on by the bank and 15 properties that it gave back to the original owners through a quitclaim deed for a profit of between $2,911-$13,984 per property. In the present case, the Hales offered to pay Regime $9,000 to settle the matter, but Regime asked for $35,000. The Hales didn’t pay it.

Summing up this section, the court states, “We do not countenance the improper use of foreclosure proceedings by the HOA, its attorney, or Regime” (emphasis original).

Could This Happen to You?

Yes, possibly. Depending on what covenants and restrictions you agreed to with your own HOA or regime, you could potentially find yourself in a similar situation as the Hales.

What can you do to avoid it?

First, make good decisions. Towards the end of its opinion, the court states “Our decision today should not be read as a shift toward providing relief to homeowners despite their own poor choices, in particular here, falling behind on a minimal amount of HOA dues and subsequently failing to respond to the summons and complaint.”

So take action on any and all legal matters that come your way. Fulfill your legal obligations as you promised to do in a timely manner by paying your mortgage and dues on time every month. Don’t assume that there could be no legal ramifications to paying late just because it’s a relatively small amount of money. This thinking can get you in trouble.

Next, review the paperwork you signed with your HOA or regime. It’s common for buyers to skim over these documents during a long real estate closing and therefore have no idea what it is they’re actually agreeing to. But you can take the time now to look at your covenants so you’re aware of the powers your HOA or regime has to charge you interest, place a lien on your property, pursue a foreclosure, and so on.

Finally, contact an attorney if you have any questions, especially if you’ve been served with papers.

Smart Legal Advice

If you need help with estate planning, business documents, commercial real estate, or strategic advice in a legal matter, contact Gem and his associates at the Gem McDowell Law Group in Mt. Pleasant, SC. Gem is a problem solver with over 35 years of experience helping families and business owners alike protect their interests and make smart decisions for peace of mind. Schedule a free consultation by calling 843-284-1021 today.

What Makes a “Grossly Inadequate” Sales Price: The Debt Method vs. the Equity Method

In South Carolina, a judicial sale of a property can be set aside if the sales price is “inadequate.” Either the sales price must be “inadequate” and also involve fraud, or the price must be “so grossly inadequate so as to shock the conscience of the court.”

What makes a sales price “grossly inadequate”? Just how low does it have to be? In South Carolina, there is no set amount or percentage that a court must apply to make that determination. However, looking back at past cases in the state, courts have consistently determined that sales prices of 10% or less of the property’s value are “grossly inadequate.”

Based on this, the 10% threshold was used as a benchmark in Winrose Homeowners’ Association v Hale (read the opinion here) which went before the South Carolina Supreme Court in 2019, and which we discussed in a previous blog.

How to Calculate the Sales Price: Debt Method vs Equity Method

In Winrose, Tina and Devery Hale’s home was sold in a judicial sale after they missed an HOA payment of $250 and their HOA foreclosed. Regime Solutions, LLC, bought it with a high bid of $3,036. The fair market value of the house was $128,000, with an unpaid mortgage balance of $66,004.

Since fraud was not an issue in this case, the question for the court to decide was whether the sales price of the house in question was “so grossly inadequate” that the sale could be set aside. If so, the foreclosure could be vacated and the home returned to the Hales. If not, the judicial sale would stand and Regime would retain the house.

With the 10% benchmark in place, the court needed to determine what the sales price was. There are two methods for determining whether a bid price is so grossly inadequate as to shock the conscience:

- The Debt Method. This assumes that the party that purchases the foreclosed property will become responsible for the mortgage and other associated debts. This method focuses on how much the foreclosure purchaser must pay before having a free-and-clear title to the property, so the value of the outstanding mortgage is added to the bid price.

In this case, Regime would have paid ($3,036 bid) + ($66,004 mortgage balance) = $69,040. This is 53.9% of the Property’s fair market value of $128,000.

- The Equity Method. This method focuses not on the debt the foreclosure purchaser is taking on, but the equity they would gain through the transaction. Instead of adding the outstanding mortgage balance to the bid, the balance is subtracted from the fair market value and compared to the bid.

In this case, Regime would stand to gain ($128,000 fair market value) – ($66,004 mortgage balance) = $61,996. The amount Regime paid, $3,036, is 4.9% of the equity it would stand to gain.

The majority of the time, the party that purchases the foreclosure does take on the obligations of the mortgage, because associated debts needs to be settled in order to have a free-and-clear title. For these situations, the Debt Method is appropriate.

But in the present case, Regime never took on the Hales’ mortgage and never took any positive steps to do so. As Justice Lockemy pointed out in his dissenting opinion in the Court of Appeals decision, it didn’t make sense to credit Regime with having taken on the mortgage. Furthermore, the Hales continued to pay their mortgage, substantially reducing the outstanding debt on the house over time. Therefore, using the Equity Method in this case is, in the words of the SC Supreme Court decision, “the only logical option.”

Since 4.9% is clearly below the 10% threshold, the court concluded that the bid was, indeed, “so grossly inadequate as to shock the conscience of the court.” The court set aside the foreclosure sale.

Get Strategic Legal Advice

For guidance and legal help on business matters, estate planning, and commercial real estate in South Carolina, call Gem of the Gem McDowell Law Group in Mount Pleasant, SC. Gem and his associates are experienced problem solvers who are here to help you and your family. Call 843-284-1021 today to schedule a free consultation at the Mount Pleasant office.

How A South Carolina Couple Missed an HOA Payment and Lost Their Home

Imagine this situation:

You miss an HOA payment. Then you receive some legal documents in the mail, put them in a drawer, and forget about them. When the HOA sends a bill for the outstanding amount, you pay it and later receive confirmation that the situation is resolved.

The next thing you know, you discover that your house has been foreclosed on, someone bought it at auction, and now they are trying to evict you.

Though this may sound crazy, this is exactly what happened to Tina Hale and her husband Devery Hale. Their case, Winrose Homeowners’ Association v Hale (read it here), went all the way to the Supreme Court of South Carolina. It’s a good cautionary tale about what can happen when you ignore legal proceedings and an eye-opening look at the way some parties try to take advantage of unsuspecting homeowners.

The Hales Miss an HOA Payment

Tina and Devery Hale bought their home (the Property) in 1998 for $104,250. In addition to paying their mortgage regularly, they were also obligated to pay a monthly assessment of $250 to their HOA, Winrose Homeowners’ Association, Inc.

In January 2011, the Hales fell behind in HOA dues. In response, the HOA first filed a lien against the Property and then pursued a foreclosure, seeking $556.41, which was the amount of the late dues plus accrued interest. The right of the HOA to charge interest on late payments, put a lien on the lot, and pursue foreclosure was part of the covenants and restrictions that the Hales agreed to when they bought their house.

The Hales didn’t respond to the complaint (in an affidavit, Tina Hale said that she simply put it in a drawer and forgot about it), so the HOA submitted an affidavit of default. From then on, the Hales didn’t receive any further notices of what was going on with respect to the foreclosure and sale.

It was here that the HOA sent the Hales a bill for the outstanding $250, which they paid. The HOA’s law firm then sent the Hales a letter saying that the lien had been satisfied, and the Hales thought that was the end of it. But the HOA didn’t withdraw their suit.

Foreclosure and Sale

The matter first went to a master-in-equity (Master), who entered a default judgment of foreclosure and sale against the Hales. He calculated an amount due of $2,898.67, comprised of $250 in principal, $80.87 in interest, and $2,025 in attorney’s fees. The Master noted that the sale of the property would be subject to the existing mortgage.

The Property sold at public auction two weeks later to Regime Solutions, LLC (Regime) with the high bid of $3,063. At that time, the fair market value of the Property was approximately $128,000, with an outstanding mortgage balance of approximately $66,000.

The Hales remained unaware of all of this. It wasn’t until Regime tried to evict them from their house – which they continued to make mortgage payments on – that they discovered what was happening.

The Hales Fight Back

Upon discovering what was going on, the Hales filed a motion to vacate the foreclosure sale on the basis of the sale price being “so grossly inadequate as to shock the conscience of the court.” Vacating the sale would give the Hales back ownership of their house.

The Master denied the motion to vacate. Though the amount of $3,063 is low, when taking into account the outstanding mortgage amount of $66,004, he calculated an effective sales price of $69,0404. At a little over half the fair market value of $128,000, this is a great deal for the buyer but is not low enough to shock the conscience of the court.

The matter next went to the South Carolina Court of Appeals, where a majority of the panel affirmed the Master’s decision. Notably, Chief Justice Lockemy dissented, saying it didn’t make sense to consider the outstanding mortgage amount in the effective sales price, since Regime had not, in fact, assumed the Hales’ mortgage and never took any steps to do so.

The South Carolina Supreme Court’s Decision

The matter then went to the South Carolina Supreme Court, where it was heard in September, 2019. The issues at hand were whether the judicial sale of the Property should be set aside due to an inadequate sales price and how to calculate that price.

Ultimately, the SC Supreme Court agreed with Chief Justice Lockemy’s take that it wasn’t right to credit Regime with having taken on the debt of the mortgage. Using the Debt Method, the court determined that the sales price of $3,036 on a house with a fair market value of $128,000 was, indeed, so grossly inadequate so as to shock the conscience of the court. The court set aside the foreclosure sale and remanded the case back to the Master.

(Read more on how the court determined the sales price and what exactly constitutes a “grossly inadequate” price in this follow-up blog.)

Take Care of Legal Matters Promptly

Though the Hales ultimately won, it took over eight years to get a verdict in their favor and surely caused a lot of stress and expense in the meantime. While they weren’t in control of the actions of their HOA or Regime, there are a couple lessons to be learned here.

First, do not ignore a summons, lawsuit, or any other legal document, and don’t put it in a drawer and forget about it; speak to an attorney right away about it. Second, understand the contracts you’re involving yourself in. Most people would probably find it inconceivable that their HOA would foreclose on their house for a simple missed payment of $250. But that’s exactly what happened here, and it was because of the terms in the contract both parties agreed to. It’s important to understand what you’re agreeing to anytime you sign a contract.

For help or advice on contracts, or for issues of business law or estate planning, contact Gem McDowell. Gem and his associates at the Gem McDowell Law Group can give you the strategic advice you need to make smart, informed decisions. Call 843-284-1021 today to schedule a free consultation or to book an appointment at the Mount Pleasant office.

Why Charleston Is the Way it Is: How South Carolina’s Annexation Rules Shaped the City

What does the City of Charleston look like from above? That is, what are its boundaries? You might think that the City of Charleston comprises the peninsula, West Ashley to the west, and Daniel Island to the northeast. That would be a decent guess. But it’s wrong.

Take a look at the actual boundaries in this zoning map here. As you can see, Charleston’s city limits are all over the place and the city itself is surprisingly big. In fact, the City of Charleston is 156.6 square miles – a large area for a population of a little over 130,000. To put that in perspective, that’s about half the area of New York City, comprised of the five boroughs with around 8.4 million people, in just 302.6 square miles.

Why in the world is Charleston so big, and how did it get that way?

Adjacent and Contiguous

The City of Charleston is the way it is due to a combination of how aggressive it is in its desire to grow combined with South Carolina’s annexation rules.

Back before the mid-1970s, it wasn’t the county governments that were in charge of things, but the senators. So the legislature made it difficult for municipalities to annex land in order to keep the power in the hands of the senators and state officials. This is why South Carolina doesn’t have big cities the way that nearby North Carolina does with Charlotte (metro population over 2.5 million), or Florida with Miami (6.2 million).

This changed in 1975 with the passage of the Home Rule Act in which county governments were created, giving them the control of unincorporated land. (Read more about how this act affected the state here on our blog.) But the laws making annexation difficult were still on the books.

In South Carolina, land must be “adjacent” and “contiguous” in order for it to be annexed, meaning both pieces of land (the municipality and the land to be annexed) must be next to each other and share a border. In some other states, non-adjacent land may be annexed, which obviously makes it easier for municipalities to grow. Many other states also allow for “corridor annexation” which allows contiguity to be established by use of railroads, waterways, and other rights of ways. However, the definition of “contiguous” for the purposes of annexation in South Carolina explicitly states that contiguity cannot be established this way.

Because land to be annexed needs to be adjacent and contiguous to a municipality in South Carolina, cities and towns were greatly restricted in their ability to grow for many years.

Then the city of Columbia changed everything.

The Revolution of the 10-Foot Wide Strip

In the early 1990s, Columbia did something incredible. It wanted to annex a nearby area where a large mall was being built, as it would be a financial boon to the city. The only trouble was, the mall was 9 miles away, and the land it was on was not adjacent and contiguous to the existing city limits. So the city annexed a 10-foot-wide strip along I-26 that connected them to the mall, and voila, they were now adjacent and contiguous.

As to be expected, this ploy went through a lot of lawsuits at the time, but it withstood them all. Since then, other municipalities have followed suit and have used this concept of the thin strip of land to connect themselves to land they want to annex.

Petition for Annexation

There are a couple big benefits to a city to annex land, notably an increased tax basis and more control over how the land within its limits will be developed. A large amount of land in City of Charleston limits right now is undeveloped, and the City will have a say in how it develops in the future.

For the residents of the land in question, some may wish to remain outside of city limits and thus pay fewer taxes. But many often do want to be annexed, because while they do pay more in taxes, they also get benefits like access to utilities.

How do property owners get their land annexed? In order for a municipality to annex land in South Carolina, all or some of the owners of the land must petition in order to be annexed. There are a number of ways for annexation to occur by law, including annexation of land that’s wholly owned by a school district or by the federal government, for example. Another way to annex unincorporated land is to rely on the 75-75 method. As long as 75% of the landowners who own at least 75% of the assed value of the land want to be annexed, that land can be annexed even against the will of the remaining 25%.

Whether it’s a school district, the federal government, individual property owners in an area, or other landowners, they must sign a petition requesting annexation in order for the annexation to proceed.

A 10-Foot Strip Too Far

Several cities in the state have been aggressive in growing their limits through annexation, including Charleston, Mount Pleasant, and Columbia. But Awendaw took it a huge step further when it tried to annex some land in 2003.

Awendaw wanted to annex some land owned by the Mt. Nebo AME Church (Church Tract) but it was not adjacent and contiguous to existing Awendaw city limits. So it decide to do what any savvy South Carolina city would do and use the 10-foot-strip method to annex it.

The 10-foot-strip Awendaw had its eye on was a 1.25-mile-long piece of land in the National Forest managed by the United States Forest Service. Awendaw sent letters to the Forest Service to get its approval for annexation, as it needed a signed petition to proceed. They never got approval, and in fact the Forest Service wasn’t in favor of giving up the rights to that land because it would impede their ability to conduct controlled fire burns. The Forest Service also said a petition would need to come from federal officials in D.C. and the process could take several years.

Awendaw Decided to Annex the Land Anyway

That’s right, even though Awendaw never got a petition from the owners of that 10-foot strip of land, it went ahead and passed an ordinance under the 100% petition method in May 2004, relying on an old letter from 1994 for its authority. The letter was from a representative of the Forest Service who said there was “no objection” to annexing parcels of land in the vicinity – though it did not reference the particular land in question.

With this new addition of land, Awendaw then passed an ordinance annexing the Church Tract (for which it did receive a legitimate petition from church representatives).

In 2009, another piece of land referred to as the Nebo Tract by the SC Court of Appeals petitioned for annexation, and in October of that year Awendaw passed an ordinance to do so. This 360-acre parcel of land was contiguous to Awendaw through the Church Tract and the 10-foot strip.

Challenging Awendaw

This move was challenged the following month. In Nov 2009, Lynne Vicary, Kent Prause, and the South Carolina Coastal Conservation League filed a complaint, stating that Awendaw did not have the authority to annex the 10-foot strip because the Forest Service never submitted a petition for annexation.

The circuit court found that Awendaw’s annexation of the 10-foot strip was void ab initio – invalid from the start – and therefore the later annexation of the Nebo Tract was also void ab initio.

The case went to the SC Supreme Court, which determined that the Respondents had standing and then sent it down to the Court of Appeals to address the remaining issues. It reinforced the fact that “an annexation is complete only upon the acceptance of a petition requesting annexation.” (Emphasis theirs.)

The bottom line is, Awendaw got caught with its hand in the cookie jar and the South Carolina courts are not having it. (Read the full decision here.)

Watch This Space

Although Awendaw greatly overstepped its authority by annexing the Forest Service’s land, it seems that the underlying tactic of using a 10-foot strip of land to connect to desirable land is a legitimate way for municipalities to grow in South Carolina. How much more can Charleston grow? If it continues on its way, it will likely keep annexing land until it’s surrounded on all sides by incorporated land it can’t annex. Keep an eye on Charleston’s borders.

Why Common Law Marriage was Just Abolished in South Carolina

Common law marriage will no longer be recognized in South Carolina. In making this determination, the Supreme Court of South Carolina joins the trend of several other states who have already put an end to the practice over the years.

This decision comes in the context of a case from family court and offers some interesting insights into the purpose of public policy and how society’s changing mores affect the law and its interpretation.

Where Did Common Law Marriage Come From?

Before we look at why it was abolished in SC, let’s look at where it came from.

Common law marriage comes from pre-Reformation Europe and arrived in the new world from England during colonization. Not all states adopted common law marriage, but the majority did at some point.

At the time, this institution made a lot of sense. America was sparsely populated, particularly in the Midwest and the West, and it was difficult to find and/or travel to religious or government officials to marry two people. It was also a way to add some legitimacy to a situation that would otherwise be seen as objectionable, e.g., living together, children out of wedlock, and women with children who might otherwise rely on the state for assistance.

However, times and situations have changed drastically, and the institution doesn’t make as much sense as it once did.

Common Law Marriage in Modern Times

In its decision (which you can read here), the Court states that “the common law changes when necessary to serve the needs of the people” and that it will act when it is “apparent that the public policy of the State is offended by outdated rules of law.”

Common law marriage is, indeed, outdated. Cohabitation before marriage, children born out of wedlock, and single mothers are widely accepted today without stigma, and rights to child support and inheritance no longer depend on marital status. Getting married legally is easy and inexpensive, and therefore there are no substantial practical barriers to marriage as there once were.

In addition, common law marriage presents some thorny problems. Namely, how do you know when you have entered into a common law marriage, since (by definition) there is no formal ceremony or documentation, and how are courts supposed to make that determination when asked? What if one party of a couple believes they are married, but the other party doesn’t? What happens when a couple like this decides to split? These issues were central in the case at hand.

Married or Not Married?

A. Marion Stone, III and Susan B. Thompson met in the 1980s and began dating. In 1987, they had a child together, and in 1989 they had a second child and began living together. For approximately twenty years following this, they lived together, raised kids, and managed rental properties. The relationship ended when Thompson discovered Stone was having an affair.

In 2012, Stone sought declaratory judgement that the two were common law married, a divorce, and an equitable distribution of alleged marital property. The family court held a trial to determine whether the two were common law married. After hearing evidence from both sides – including witness testimony on how they introduced themselves as a couple, proof of cohabitation, joint financial documents, and so on – the court concluded that Stone and Thompson were common law married starting in 1989, and so awarded over $125,000 to Stone in attorney’s fees and costs. The family court stated that the evidence showed a “presumption of marriage that could only be refuted by strong, cogent evidence they never agreed to marry.”

The South Carolina Supreme Court Disagreed

The Supreme Court disagreed, not finding the evidence as overwhelming as the family court did. Some witnesses said Stone and Thompson introduced each other as husband and wife, while others didn’t; some documents were signed jointly, others singly; and the children had their mother’s last name only until 2000, when their father’s last name was added. There was a period of time from 2005-2008 where documents were signed as though a married couple – medical documents and an application for a mortgage loan – but the Supreme Court viewed these as evidence of seeking financial benefits through the appearance of marriage, not as an indication of actual marriage.

Ultimately, common law marriage requires mutual understanding and assent. Both parties must understand what common law marriage is and express a desire for it, and understand that the other feels the same way. The Court didn’t find that this was the case with Stone and Thompson, and therefore reversed the family court’s decision (and the decision for Thompson to pay Stone’s attorney’s fees).

Prospective, Not Retrospective – and a Stronger Test

The Court notes that while it does have the power to “undo” current common law marriages, it’s reserving this right of retrospective power and its decision applies only prospectively. From the date of the Supreme Court’s decision (July 24, 2019) forward, you may only be married in South Carolina with a valid license.

At the same time, the Court took the opportunity to strengthen the test of validity of current common law marriages. “A heightened burden of proof is warranted,” which it calls an “intermediate” standard: more than a preponderance of the evidence but not to the level of beyond a reasonable doubt. The “clear and convincing evidence” standard used for matters of probate “should also apply to living litigants.”

The Supreme Court states that the “right to marry is fundamental, and so is the right not to marry” so it cannot be an institution that people enter into unwittingly. Furthermore, the Court can’t “see inside the minds” of litigants, it “must yield to the most reliable measurement of marital intent: a valid marriage certificate.”

Keeping Up with Changes in the Law

Though South Carolina is following in the footsteps of other states in ridding the practice of common law marriage, this is still a big step. It’s important to remember that laws can change, as can the interpretation of them, and that these changes can have very real consequences for residents of the state.

This is especially true for estate planning when it comes to complicated family dynamics. To make sure you’re covered, work with an experienced estate planning attorney Gem McDowell. He and his associates at the Gem McDowell Law Group in South Carolina can help you plan ahead and make sure your estate planning documents are in order. Schedule your free consultation by calling 843-284-1021.

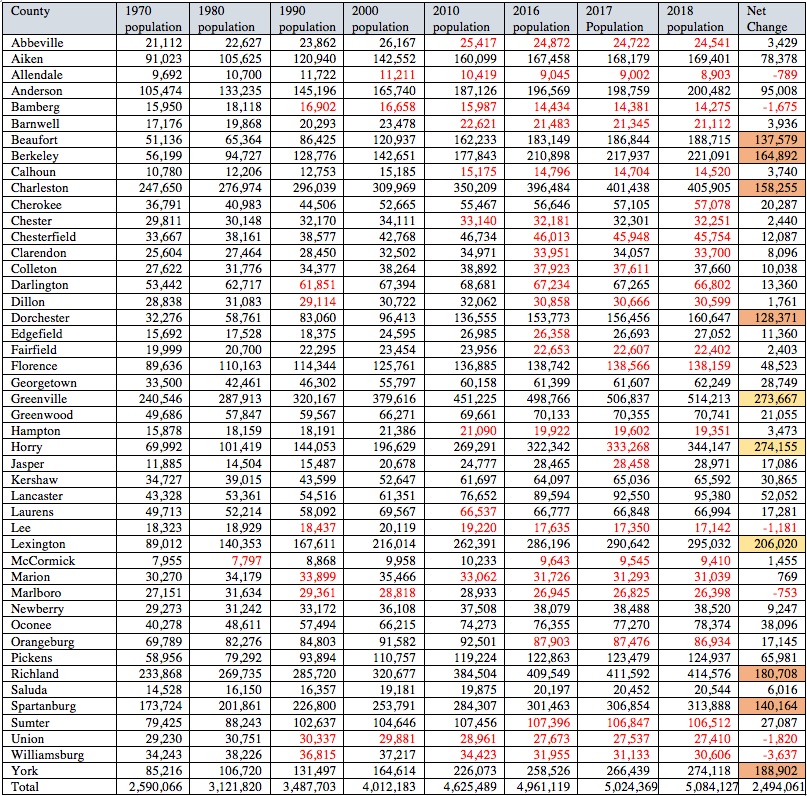

See How South Carolina’s Counties Are Growing and Shrinking

We know that of South Carolina’s 46 counties, some are growing and some are shrinking, but knowing that alone doesn’t tell the whole story. Today we’re going to look a little more in depth at the actual numbers.

South Carolina Counties That Have Grown Consistently 1970-2018

Forty counties have grown in population since 1970, including Aiken, Anderson, Beaufort, Georgetown, Greenwood, Jasper, Kershaw, Lancaster, Laurens, Newberry, Oconee, Pickens, and Saluda Counties.

Some have grown by an impressive amount. The growth of the state capital Columbia is largely responsible for the growth of mid-state counties Lexington and Richland. Lexington more than doubled its population, growing from 89,012 to 295,032, while Richland grew from 233,868 to 414,576. Upstate, Greenville County, Spartanburg County, and York County grew significantly, too. Greenville County went from 240,546 in 1970 to 514,213; Spartanburg County from 173,724 to 313,888; and York from 85,216 to 274,118.

Unsurprisingly, the Charleston tri-county area has seen huge growth in the last 50 years. Charleston County grew from 247,650 in 1970 to 405,905 in 2018. Even more impressive, Dorchester County went from 32,276 to 160,647 and Berkeley County from 56,199 to 221,091. That’s a net gain of nearly half a million people (451,518 to be exact), from 336,125 to 787,643.

But the county that takes the cake is Horry County. Horry County exploded in population with the development of Myrtle Beach and the surrounding area, taking the population from 69,992 in 1970 to 344,147 in 2018 – a net gain of 274,155 people, or nearly quadrupling the number of people.

All of these counties have seen consistent growth over this time, with no losses in population at each 10-year census mark.

Chart of South Carolina counties with population changes from 1970 to 2018. Red text = decline. Orange shading = gain 100,000-199,999. Yellow shading = gain 200,000+. Click to enlarge.

South Carolina Counties That Have Shrunk 1970-2018

From 1970 to 2018, six counties have had a net loss in population. This is significant since the state as a whole nearly doubled its population, from 2,590,066 in 1970 to 5,084,127 in 2018 – a net change of 2,494,061. The fact that any county lost population is notable.

Allendale County and Marlboro County lost the least, with a net loss of 789 people for Allendale and 753 for Marlboro. The counties that lost between 1,000-2,000 people are Bamberg County, from 15,950 to 14,275; Lee County, from 18,323 to 17,142; and Union County, from 29,230 to 27,410.

The unfortunate “leader” in this category is Williamsburg County, which lost more than 10% of its population between 1970 and 2018, going from 34,243 to 30,606.

What About the Rest?

That accounts for 28 of South Carolina’s 46 counties, but what about the remaining 18?

These counties have had net growth in that time but have seen population losses in recent years. For some counties, it’s not too concerning: Cherokee County lost just 27 people from 2017 to 2018, and had a net gain of 20,287 since 1970. Likewise, Edgefield County has had a net gain of 11,360, but saw a dip in numbers between 2010 and 2016.

But others look like they’re beginning to see a steady downward trend. Marion County has had a net growth of 769 from 1970 to 2018, going from 30,270 to 31,039. But it’s actually lost over 4,000 people since a high of 35,466 in 2000, and has been steadily losing people since 2010. Similarly, Orangeburg went from a high of 92,501 in 2010 to 86,934 in 2018 – a loss of 5,567 people – and has been on the decline, despite an overall gain of 17,145 from 1970.

This story is repeated in several other counties, though to a lesser degree. Abbeville, Barnwell, Calhoun, Chester, Chesterfield, Clarendon, Colleton, Darlington, Dillon, Fairfield, Florence, Hampton, McCormick, and Sumter Counties have all seen population declines over the last several years.

Whether these 18 counties are headed for continued decline can’t be predicted, but it’s something to keep an eye on.

A Strategic Partner for the Growth of Your Business

Business attorney Gem McDowell of the Gem McDowell Law Group in Mt. Pleasant is a problem solver with over 20 years of experience helping business owners start, acquire, grow, and run their businesses soundly. He and his associates can help you with legal matters and provide strategic advice for the long-term health of your company. Call the Gem McDowell Law Group today at 843-284-0120 to schedule your free consultation.

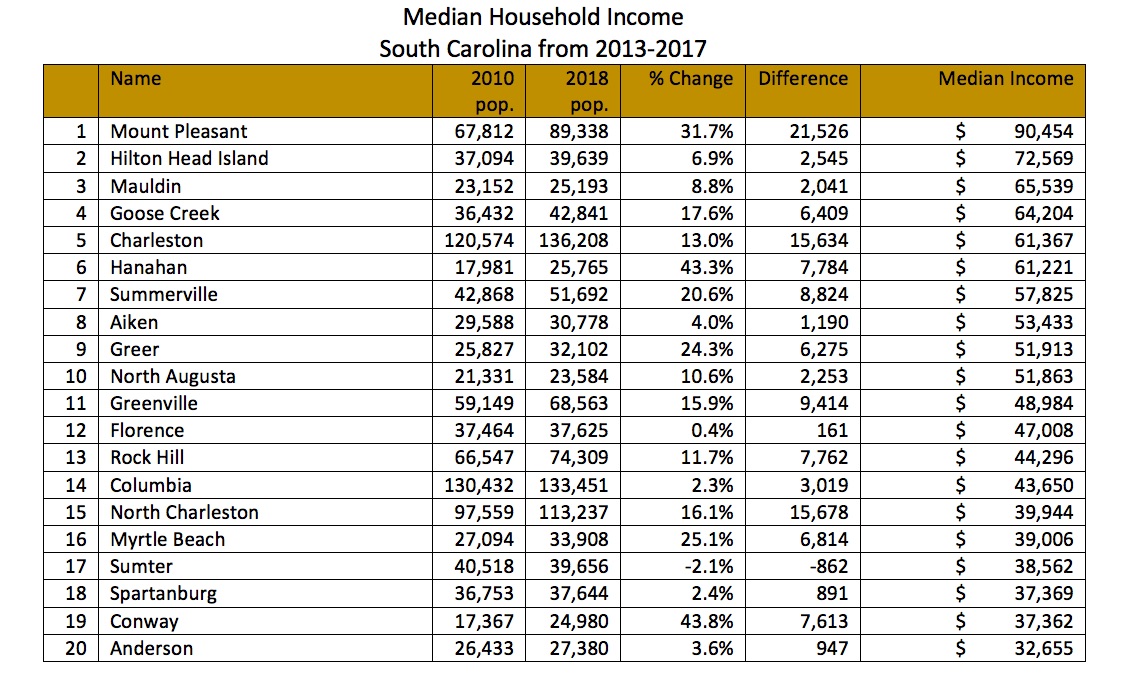

How Much Money Do People Earn in South Carolina?

In a previous blog, we looked at population trends in South Carolina over the last decade in the context of how that information could impact business owners looking to do business in the state. Today we’re going to look at another factor that has affects businesses: median household income. Specifically, the median household incomes in select cities in South Carolina.

Median Household Income in South Carolina’s Cities

According to the U.S. Census Bureau, the median household income (MHI) in the U.S. in 2017 was $60,336. That same number in South Carolina was $50,570. Interestingly, looking at the 2013-2017 median income of the top 20 cities in S.C. by population, half fall above this number and half fall below.

Of the ten South Carolina municipalities with a MHI higher than the state average, the Town of Mount Pleasant leads with $90,454, with Hilton Head Island coming second with $72,569. Median household income was between $51,863-$65,539 for the other eight cities on the list, Maudlin, Goose Creek, Charleston, Hanahan, Summerville, Aiken, Greer, and North Augusta.

Of the ten where the MHI is lower than the state average, Greenville is at the high end with $48,984, and Anderson comes in last with $32,655. The other eight falling in between are, in descending order, Florence, Rock Hill, Columbia, North Charleston, Myrtle Beach, Sumter, Spartanburg, and Conway.

Chart showing median household income of 20 cities in South Carolina in the time period 2013-2017, along with each city’s population count in 2010 and 2018 and difference in percentage and absolute numbers.

What This Means for Business Owners

If you’re thinking of starting a business in South Carolina, or opening a branch or plant of an existing business here, median household income is another factor to consider (along with population) when deciding where to set up shop.

A city’s MHI could have a significant impact on your business, depending on what it is. If you’re a manufacturer, like Volvo, that doesn’t depend on selling your product to the local market, you’re in a much different position than a baker or a doctor who depends on the residents for their living. If you do depend on making sales in the local market, consider whether your product or service is a necessity or a luxury, since households with a higher MHI have more for discretionary spending.

More Strategic Advice for Business Owners

If you’re an entrepreneur looking for strategic or legal advice on how to start or grow your business, contact Gem McDowell of the Gem McDowell Law Group. He and his associates help with matters of incorporation, corporate governance documents, business planning, acquisition, and more. Call the Mount Pleasant office today to schedule a free consultation at 843-284-1021.

Is Your Lawyer Legit?

The legal profession is one of the most heavily regulated professions in the U.S. Every state requires attorneys to be licensed, yet people still practice law when they shouldn’t, which can lead to huge complications for their unwitting clients.

If you are considering hiring, or have already hired, a lawyer to represent you in any capacity in South Carolina, do your due diligence and check their standing first.

How to Determine if Your Attorney is In Good Standing in South Carolina

There are a few different online resources you can use. The South Carolina Bar’s directory tool allows you to search for attorneys in the state and returns information on their law school, the year they passed the bar in South Carolina, and their Status. You want to see “Good Standing” here. The South Carolina Bar also maintains an ongoing list of Member Discipline, which includes instances of reprimands and reinstatements.

The South Carolina Bar is not the agency responsible for disciplining judges and attorneys; that’s the Disciplinary Counsel of the South Carolina Judicial Branch. Use the search at the top to look for your attorney’s name, and if they’ve been disciplined in the past then the South Carolina Supreme Court’s published opinion will show up in the search results. (If you’re looking for the disciplinary agency in a state other than South Carolina, check out the American Bar Association’s Directory of Lawyer Disciplinary Agencies instead. Link to pdf.)

Finally, while it’s not as official as the sites listed above, Avvo.com does list instances of professional misconduct, or lack thereof, on each attorney’s page. Use the search tool to find your attorney’s profile and check for a history of disciplinary action.

Licensed in Your State?

As you likely know, each state requires attorneys to be licensed to practice in that state. Still, sometimes people licensed in one state decide to practice in another. In South Carolina, this can lead to being Debarred, which is different from Disbarred. Disbarred means the person was once licensed to practice in the state, but now no longer is. Debarred means they were never licensed to practice in the state, and now they never will be allowed to (without first obtaining an order from the Supreme Court of South Carolina).

This is exactly what happened to two people earlier this spring, Farzad Naderi and Christopher Michael Ochoa, who were (separately) debarred for providing legal services to people despite not being members of the South Carolina Bar. In Ochoa’s case, he accurately represented himself as being “licensed in the State of Florida” and not able to practice in South Carolina, but implied that he had a “network of attorneys” allowing him to take cases in South Carolina when in fact that was a misrepresentation. The attorneys he worked with in South Carolina and other states were hired on a piecemeal basis and in various instances, he provided the legal services himself. (You can read the details in the Supreme Court’s opinions in this PDF here.) The lesson here is to be very careful when entering into an arrangement for legal services with someone who is licensed in another state so you understand exactly what you’re getting.

There is an important exception to this rule, however. A lawyer who is not a member of the South Carolina bar but who is admitted and authorized to practice in the highest court of another state or D.C. may apply for pro hac vice admission in South Carolina. “Pro hac vice” means “for or on this occasion only” (literally “for this turn”) and adds an attorney to a case in a jurisdiction in which they are not licensed to practice so that they are, for that case, legally allowed to practice in another state.

Finding a Lawyer in Good Standing to Represent You

The South Carolina Bar has information online to help the public locate pre-screened attorneys, certified mediators, and even free legal aid, all of which you can find links to here. You can also ask your friends, family, and colleagues for a referral to someone they trust.

If you’re looking for help or advice on estate planning or business law, give Gem McDowell and his associates at the Gem McDowell Law Group in Mt. Pleasant, SC a call at 843-284-1021. Gem is a problem solver with over 20 years of experience and he and his associates are ready to help you. Call to schedule a free consultation today.

What Makes a Will Invalid? Common Challenges to a Will’s Validity in South Carolina

We write a lot on this blog about the last will and testament. That’s because it’s an extremely important document to have, particularly when you have a large estate or a complicated family situation. It’s the only legal document that speaks for you after you’re gone to ensure your wishes are carried out with respect to your estate. But it can only do that if it’s valid.

The proliferation of fill-in-the-blank, do-it-yourself wills online may make it seem like last wills are simple documents. They can be, but they can also be a legal minefield. A number of cases having to do with the validity of a will make it as far as the South Carolina Court of Appeals or even the South Carolina Supreme Court every year. The underlying issue in these cases is almost always the same: the validity of the will.

With that in mind, today we’re going to look at a few of the most common challenges to the validity of a will in the state of South Carolina.

Procedural Errors

South Carolina code states that “An individual who is of sound mind and who is not a minor […] may make a will” with the following basic requirements for validity:

- The will must be in writing

- It must be signed by the testator, or by someone else in the testator’s name and presence

- It must be signed by at least two individuals who witness the testator’s signing or the testator’s acknowledgement of signing the will

- Amendments to a will must also be witnessed by two individuals (as we looked at in a recent blog)

An error such as a missing signature can lead to challenges of the validity of the will.

Note that South Carolina does not require a will to be notarized, as the law provides for self-proving (but it is strongly recommended). Also note that South Carolina generally accepts out-of-state wills as valid, even if the will does not meet South Carolina’s criteria, as long as it meets the requirements of the state in which it was executed.

Lack of Testamentary Capacity

South Carolina code quoted above states that the testator must be of “sound mind.” This may be surprising, but the required level of what’s called “testamentary capacity” to execute a will is relatively low. To put it in perspective, a higher level of mental competency is required to sign a contract.

In South Carolina, testamentary capacity demands that you know at a minimum two things:

- The nature and extent of your bounty (that is, what you own)

- The natural objects of your bounty (that is, your heirs and close relatives)

The presumption is that adults have the testamentary capacity to make a will. If someone challenges a will on the basis of testamentary capacity, claiming the testator was not of sound mind, it’s up to them to provide clear and convincing evidence of that fact. This may be evidence of senility, dementia, insanity, mental illness that compromises sound judgment, declining cognitive function or memory, or the like. Proof may come in the form of medical records or sworn statements by the testator’s health care providers, caretakers, or friends and family who witnessed the testator’s condition during the time in question.

Undue Influence

Another argument to challenge the validity of a will is undue influence. Undue influence occurs when a person influences or pressures the testator to change the terms of their will in the influencer’s favor. This influence takes away the testator’s free will and substitutes their own interests for those of the testator.

Undue influence may be tied together with lack of testamentary capacity, because it’s often an older person suffering from a degree of dementia or senility who is unduly influenced to change their will. The influencer may use tactics like physical force, threats, or isolation from family member and friends to get what they want.

If a will is challenged on these grounds, again, it’s up to the challenger to provide clear and convincing evidence that this is the case. (We recently touched on this issue of undue influence on a blog about no-contest clauses in wills, which you can read here.) Since undue influence can be more challenging to prove, let’s look at it more in-depth.

The Standard for Undue Influence

A recent case filed by the South Carolina Court of Appeals in April 2019 looks at the issue of undue influence, as well as testamentary capacity, when the validity of a will was challenged.

In short, Vinto Willis Tucker (Decedent) died in March 2012. He executed a will in January 2012 the same evening he discovered he had suffered an aneurysm. He did so by dictating the terms of his will to his niece in the presence of two witnesses, who confirmed that he raised the subject of a will and that his niece wrote down the terms as he requested.

The will divided his estate among twelve nieces and nephews but left out one niece and two nephews. In May 2013, Decedent’s sister, Mary Jean Tucker Swiger, petitioned for formal testacy, a proceeding to establish a valid will. She asserted that Decedent’s personal representatives (the niece who had written down Decedent’s will and a nephew) had exerted undue influence on him and sought to remove them as personal representatives.

In its decision, the Court of Appeals cited South Carolina code and other cases to establish a standard of review, including the following:

“Contestants of a will have the burden of establishing undue influence, fraud, duress, mistake, revocation, or lack of testamentary intent or capacity” S.C. Code Ann. § 62-3-407

“Undue influence must be shown by unmistakable and convincing evidence, which is usually circumstantial.” Russell v Wachovia (2003)

“Generally, in cases where a will has been set aside for undue influence, there has been evidence either of threats, force, and/or restricted visitation, or of an existing fiduciary relationship.” Russell v Wachovia (2003)

“A mere showing of opportunity or motive does not create an issue of fact regarding undue influence.” In re Estate of Cumbee (1999)

In the Swiger v Smith case at hand, the challenger presented no evidence of undue influence. The opinion states that “significantly,” the challenger didn’t provide any evidence that the nephew and niece restricted visitation of the challenger’s side of the family (which included the disinherited niece and nephews). The Court concluded that the challenger “failed to provide more than a scintilla of evidence to establish undue influence” and that “Decedent had the testamentary capacity to dispose of his estate.” Therefore, the Court affirmed the lower court’s decision.

Ensuring Your Will is Valid

Having a last will go through litigation is something no one wants. It’s a time-consuming process that strains and destroys family relationships, eats up the estate’s resources, and makes private family information public. The best way to avoid this is to have a valid, up-to-date will.

Work with an experienced estate planning attorney to ensure your will is valid and is worded to carry out your wishes after you’re gone. Gem McDowell and his associates at the Gem McDowell Law Group in Mount Pleasant near Charleston, South Carolina can help you. They are experienced at handling estate planning for all kinds of estates whether they’re small, large, straightforward, or complicated. Call to schedule a consultation to discuss your estate plan. Call 843-284-1021 today.

Want to Make Changes to Your Will in South Carolina? Read This First

We’ve stressed before on this blog why it’s important to have a last will and testament and why you need to keep it up to date. Not doing so can mean that your wishes aren’t carried out, which can lead to drawn out litigation and cause strife between family members and heirs.

It’s also important to make any changes to your will in a way that is valid and legally recognized. Here’s the right way to amend your will – and what happens if you don’t.

How to Correctly Amend Your Will in South Carolina

When you make your last will and testament, South Carolina code states that it must be signed by you (or by someone else in your name, in your presence and at your direction) and two individuals who either witnessed you signing it or your acknowledgement of signing it.

If you want to revoke your will entirely, you can do that either by getting a new one that contradicts the old one or by physically destroying the old one with the intent of revoking it.

However, if you want to make changes to just a section or two, you have to amend it. This requires a codicil, which is a legal document that amends specific parts of the will but leaves the rest as is. A codicil has the same requirements as the will in order for it to be valid: your signature and the signature of two witnesses.

Handwritten Changes Don’t Count

You may wonder whether you can simply strike out a clause in your will and/or make handwritten notes in order to change it. For example, let’s say you want to give your niece $20,000 instead of $10,000, or you want to cut out your nephew entirely.

The answer is no.

A recent case, filed by the South Carolina Court of Appeals in April 2019, centered around this issue. William D. Paradeses died in January 2016, leaving a will dated October 2008. The will was submitted to the probate court and was found to contain handwritten changes. Item IV(2), which would have given Faye Greeson (Eleanor Glisson) $50,000, was struck out, with the handwritten note “Omit #2 W.D. Paradeses” next to it. This led to a disagreement between family members over whether or not the handwritten changes – which were not witnessed – were valid.

The probate court said no, and the Court of Appeals agreed. It stated that this was an attempt at a codicil but didn’t meet the standards of a properly executed codicil, and therefore was invalid. The $50,000 bequest stands.

The lesson here is simple: if you want to make changes to your will, do it by correctly executing a codicil with witnesses, ideally after consulting with an estate planning attorney.

Written Memoranda: An Exception

There is an exception worth noting here. In South Carolina, you can include language in your will that allows for written memoranda. This is a document that’s in addition to the will that doesn’t require the signature of witnesses to be valid. However, it must either be written in the testator’s handwriting or signed by the testator.

The key point is that written memoranda only allows for the dispersal of tangible personal property. For example, you may use it to leave a beloved rocking chair to your grandchild, or a cuckoo clock to your sister. You may not use written memoranda to dispose of assets like stocks, bonds, or real property (real estate).

Experienced Advice for Your Estate Plan

Whether you want to make (valid) changes to your will, update it, or you don’t yet have will at all, you can get the help you need from estate planning attorney Gem McDowell and his associates at the Gem McDowell Law Group in Mount Pleasant, SC. Call today at 843-284-1021 to schedule your free consultation.