Is Your Company’s Website ADA Compliant? And Does It Need to Be?

If you own a brick-and-mortar business that serves the public and has an associated website or app, read this blog, as it pertains to you directly.

Most people are familiar with the American with Disabilities Act (ADA), a landmark piece of legislation signed into law in 1990 that requires businesses serving the public to make their locations accessible to people with disabilities. This means things like installing ramps, providing accessible parking spaces, and making walkways wide enough to accommodate wheelchairs.

In this digital age, companies are learning that the ADA may apply to many websites and mobile applications, too, and what that means for them.

Domino’s Website and App Not Accessible

Normally on this blog we look at court cases from the South Carolina Court of Appeals and Supreme Court, but today’s case is actually from the US Court of Appeals for the 9th Circuit (which encompasses several western states, Alaska, and Hawaii), Robles v. Domino’s Pizza, LLC, which you can find here.

Guillermo Robles is a blind man who relies on screen-reading software to vocalize visual information of websites so he can use them. On at least two occasions, he was unable to order a pizza online from Domino’s Pizza because, he said, the company’s website and app were designed in a way that weren’t accessible to him.

In 2016, Robles filed a suit against Domino’s seeking damages and injunctive relief, arguing that Domino’s website and mobile app violated the ADA as well as the California’s Unruh Civil Rights Act (UCRA), which outlaws discrimination based on disability and other factors. Domino’s argued that the ADA didn’t apply to their website and also argued that enforcing ADA compliance standards would violate their 14th Amendment right to due process. The case went to a district court and was later appealed.

Two questions (among others) the US Court of Appeals had to answer were:

- Are Domino’s Pizza’s website and mobile app subject to the ADA?

- Does the Department of Justice have to articulate specific standards for businesses to follow before these businesses make their websites and mobile apps ADA-compliant?

Here’s what the court found.

Yes, Domino’s Websites and Mobile App Are Subject to the ADA

The district court held that the ADA (specifically, Title III) did apply to Domino’s Pizza’s website and mobile app, and the court of appeals agreed.

The intention of the ADA is to eliminate discrimination against individuals with disabilities in a variety of ways. The Act expressly states that places of public accommodation where goods and services are available to the public – like Domino’s Pizza – must take steps to ensure that people with disabilities are not excluded or denied services. These businesses must provide “auxiliary aids and services” to ensure access.

But does a website need to meet the same standards of accessibility as a place of public accommodation? The court of appeals states in its decision that a website associated with a physical location does need to be accessible. The inaccessibility of Domino’s Pizza’s website and app in this case prevented a disabled user, Robles, from accessing the goods and services of the physical location, thus violating the ADA. In making this determination, the court joins several other courts that have come to the same conclusion in similar cases.

No, the DOJ Does Not First Have to Articulate Specific Standards

The Department of Justice (DOJ) is tasked with regulating implementation of the ADA, and it promised to provide guidelines for website accessibility back in 2010. But that hasn’t happened.

One of Domino’s arguments was that it wasn’t responsible for making its website or mobile app accessible because the guidelines promised by the DOJ hadn’t materialized, so it didn’t know exactly which standards to adopt.

However, there does exist a widely known set of standards that Domino’s could have reasonably adopted and could still adopt as a possible equitable remedy. Those are the Web Content Accessibility Guidelines (WCAG) 2.0, a set of private industry standards for website accessibility. In a footnote, the court mentions that even though these guidelines are private industry standards, they have been widely adopted by many entities, including by federal agencies on their public-facing electronic content. The Department of Transportation requires airlines to adopt WCAG 2.0, and the DOJ has required several ADA-covered entities to adopt them in consent decrees and settlement agreements in the past.

The district court said that imposing WCAG 2.0 standards on Domino’s “fl[ew] in the face of due process” and stated that the DOJ needed to provide guidelines.

The court of appeals disagreed. The Constitution doesn’t require the DOJ or Congress to articulate exactly how a business should comply with the law. “The Lack of Specific Regulations Does Not Eliminate Domino’s Statutory Duty,” says the court (emphasis added). Further, though it hasn’t come out with specific guidelines, the DOJ has “repeatedly” affirmed that websites of public accommodation are subject to Title III of the ADA. Because of this, it’s reasonable to say that Domino’s Pizza has been “on notice” since at least 1996 and has been aware that it has a duty to make its website accessible.

What This Means for You, a Business Owner

Domino’s Pizza petitioned the US Supreme Court to take up the case in June 2019. Showing support for Domino’s were a number of outside parties filing amicus curiae briefs: the Washington Legal Foundation, Retail Litigation Center, Inc., et al., the Cato Institute, the Restaurant Law Center, and the Chamber of Commerce of the United States, et. al.

But the US Supreme Court denied certiorari, meaning the decision discussed above by the US Court of Appeals for the 9th Circuit stands for its district. This will likely have big ramifications for businesses not only in that district, but the rest of the country.

If you own a business with a physical location that is open to the public and you have a website that helps people acquire goods and services from your business, the smart move is to make sure that your website is accessible to people with disabilities. As the DOJ has made clear for many years, it is your legal responsibility to make sure your website is accessible. (It’s also good business.)

If you work with a web developer, ask them about your site’s accessibility. Or if you’re developing your own site and haven’t ever thought about accessibility, learning about WCAG 2.0 is a good place to start.

What if you own a business but it’s not open to the public, or you run a website that has no connection to a brick-and-mortar location? There’s no obligation for such websites to be ADA compliant, so it’s up to you whether you want your site to be accessible or not.

Strategic Business Advice and Guidance

The case above is just one example where the law and business intersect, but it happens all the time. By knowing more about your company’s legal duties, options, and potential pitfalls, you can help strengthen your business. For smart strategic advice to help protect and grow your business, contact business attorney Gem McDowell and his associates at the Gem McDowell Law Group in Mt. Pleasant, SC by calling 843-284-1021 today.

What is a Title Search and Why is It Important?

If you’ve ever bought a piece of real estate in South Carolina, then you probably remember that one of the items on the to-do list before closing was a title search. Since the sale went through, the title was likely clear and you probably didn’t think much of it. But what is a title search and why does it matter? What can happen if you fail to do a title search before buying a piece of property?

The Purpose of the Title Search in South Carolina

A title search is a thorough examination of the public record for anything relating to the property in question. That includes information such as:

- Ownership

- Rights

- Sales

- Current mortgages

- Taxes

- Judgments

- Liens

- Pending lawsuits

and anything else that may affect the property. The purpose of the title search is to bring any potential issues to the attention of the buyer and seller so they can make an informed decision before pursuing the transaction.

Although all this information is in the public record, it’s not necessarily easy to find and therefore it’s typical for an independent third party to do the title search and produce a title report, which is then reviewed by an attorney. (South Carolina is one of a number of states that requires an attorney to assist with the closing.)

If the title search reveals an issue such as an existing lien or unpaid property taxes, it’s said that the title has a “cloud” on it. Sometimes, a clouded title will simply delay the closing as the issues are cleared up and the cloud is lifted. Other times, it can kill the transaction entirely, as it can be too risky for the prospective buyer to purchase a title that’s not clear. They may find themselves on the hook for unpaid taxes, or embroiled in liens and judgments they had nothing to do with.

What is Lis Pendens?

One thing a title report might uncover is a notice of “lis pendens,” Latin for “suit pending.” If a lawsuit has been filed that affects the title of a piece of property, a notice of lis pendens may be filed by an attorney with the clerk of the county where the property is located in order to alert anyone doing a title search of the pending suit.

Someone purchasing a property with a notice of lis pendens on it is bound by the outcome of the underlying suit as the new property owner. For this reason, many people will avoid purchasing such a property. This makes a notice of lis pendens a powerful tool when used incorrectly, as it can unfairly cloud a title and prevent the sale of a property when the property wouldn’t actually be affected by the outcome of the suit.

This was an issue in a case that came before the South Carolina Court of Appeals in November, 2018, Gecy v Somerset Point (read the opinion here). Benjamin C. Gecy is the owner of River City Developers, a residential construction company that built several homes in the Hilton Head subdivision Somerset Point at Lady’s Island. Coosaw Investments was the real estate developer and in charge of the HOA at Somerset Point. River City alleged that Coosaw deviated from construction designs and standards; Coosaw alleged that River City deviated from the standards. In 2011, River City sued Coosaw, and Coosaw counterclaimed and crossclaimed. Coosaw also filed a notice of lis pendens on Lot 16 in the development.

The Court of Appeals looked at a number of issues which aren’t relevant here, but the takeaway is that the lis pendens was not legitimate, because the counterclaims and crossclaims did not affect the title to the real property. Therefore, the notice of lis pendens could only serve to deter potential buyers from buying Lot 16 when there was no danger of the suit affecting the property at all. The Court cited a 2002 SC Court of Appeals decision, Pond Place Partners, Inc. v Poole: “The lis pendens mechanism is not designed to aid either side in a dispute between private parties. Rather, [the notice of] lis pendens is designed primarily to protect unidentified third parties by alerting prospective purchasers of the property as to what is already on public record, i.e., the fact of a suit involving property.”

In short, a notice of lis pendens should only be filed when the property in question could be affected by the outcome of a lawsuit, and not as a weapon to, for example, spite the opposition or gain leverage. The Court of Appeals also confirmed in the River Point decision that “a maliciously filed notice of lis pendens can act as the primary basis for a malicious prosecution claim” in some cases. (But, unfortunately for Gecy, not in the River Point case.)

Buyer Beware

It’s not required by law that a prospective buyer does a title search before purchasing real estate in South Carolina, but skipping the title search is, frankly, reckless. Real property can come with a long list of disputes, competing rights, liens, lawsuits, and more, and a buyer may have no idea what they’re getting themselves into.

If you’re planning on purchasing commercial property in South Carolina, work with an experience commercial real estate attorney like Gem McDowell. He and his associates at the Gem McDowell Law Group in Mt. Pleasant, SC can help you through the process as well as provide strategic advice to help you grow your business. Call today to schedule your free consultation at 843-284-1021.

Timing Is Everything: When Powers of Attorney Aren’t Bulletproof

In the previous blog, we looked at the basics of financial and medical powers of attorney. Today, we’re going to look at how these documents are not as straightforward as you think, courtesy of a case heard by the South Carolina Court of Appeals, Stott v White Oak Manor, Inc. (read it here).

Facts and Background

Jolly P Davis (Decedent) was taken to Spartanburg Regional Medical Center on December 22, 2012 by EMS due to dropping oxygen saturation levels. Less than two weeks later, he was transferred to White Oak Manor for rehabilitation and care. Upon admission, White Oak found that he possessed “intact mental functioning” and was able to correctly answer questions about his age, location, the current date, and so on. Over the next couple weeks, he was transferred between the two facilities several times until he died on January 16, 2013.

Leading up to this, Decedent’s niece, Hilda Stott, was named as the agent in a durable POA for finance and a durable HPOA for Decedent in documents executed May 11, 2012. (A durable POA remains in effect even when the principal is incapacitated, so the agent can make decisions when the principal is, for example, in a coma or suffering from dementia.)

When Decedent was admitted to White Oak, Stott signed papers on her uncle’s behalf, including an Arbitration Agreement. The durable POA for finance was recorded on January 8, 2013, six days after Decedent was admitted to White Oak. The durable HPOA was never recorded. (As a reminder, South Carolina law requires that a POA, but not an HPOA, be recorded with the county in order for an agent to exercise their powers after the principal becomes incapacitated.)

On December 16, 2015, Stott filed a wrongful death suit against White Oak, alleging Decedent was “overmedicated and dehydrated,” which led to his death. White Oak filed a motion to compel arbitration based on the Arbitration Agreement that Stott had signed.

The Circuit Court’s Findings

The case when to the circuit court. Stott argued that even though she signed the Arbitration Agreement on behalf of Decedent, she actually did not have the authority to do so under the durable POA for finance and therefore was not bound to the Arbitration Agreement.

White Oak argued but the court ultimately sided with Stott, finding that (1) Decedent had full capacity to sign the Arbitration Agreement at the time of admission, (2) the durable POA for finance did not become effective until after the Arbitration Agreement was signed because it hadn’t been recorded in time, and (3) the durable HPOA also didn’t authorize Stott to sign the Arbitration Agreement because Decedent was competent when it was signed.

White Oak appealed.

The Effectiveness of the Durable POA for Finance

Here’s where things get rather complicated. Stott signed the Arbitration Agreement on January 2, 2013, but didn’t record the durable POA for finance until January 8, 2013. She argued that she didn’t have the authority to sign the Arbitration Agreement on Decedent’s behalf on the 2nd. But, White Oak noted, the agreement contained an opt-out clause giving the signer a limited time period in which to opt out of the agreement, after which the agreement “will remain and continue in full force and effect.” (Emphasis added by the SC Court of Appeals.) White Oak argued that because the agreement didn’t become binding until the opt-out period expired on January 19, 2013, Stott did, in fact, have the authority to sign it because by then, the durable POA for finance had been recorded – 11 days earlier.

The Court of Appeals disagreed, citing the language used in the opt-out clause. It was stated so that the party would “no longer” be bound by it, and after the opt-out window closed, it would “remain and continue” – language indicating that the agreement was in effect the entire time during the opt-out window. Therefore, because the durable POA for finance had not been recorded by the time she signed the Arbitration Agreement, Stott did not have the power to sign it on Decedent’s behalf.

The Effectiveness of the Durable HPOA

The other issue the Court looked at was whether Stott had the authority to sign the Arbitration Agreement based on a valid durable HPOA. White Oak argued that she did; the Court disagreed.

That’s because Decedent’s durable HPOA contained a provision entitled “EFFECTIVE DATE AND DURABILITY” that stated it would become “effective upon, and only during, any period of mental incompetence.” In other words, it was a springing POA, discussed in the previous blog, which only becomes effective once the principal becomes incapacitated.

White Oak’s own evaluation of Decedent found him to be mentally intact with full capacity upon admission and at the time Stott signed the Arbitration Agreement. Therefore, the Court concludes, the durable HPOA was also not effective to authorize Stott to sign the agreement on her uncle’s behalf.

In short, the Arbitration Agreement is invalid and White Oak cannot compel arbitration of Stott’s claims of wrongful death and survival actions.

Confusion and Lack of Clarity

In this case, the powers of attorney were executed well in advance of any need for them. They were both clear in their intentions, and the durable HPOA even used the language provided by statute. Neither POA was disputed. Decedent’s mental capacity was not called into question by White Oak Manor. And still, confusion occurred regarding whether the agent had authority to sign for the principal.

This case illustrates how complex matters of estate planning can be, even when they appear simple on the surface. This is why it’s so important to work with an experienced estate planning attorney like Gem McDowell to handle your estate planning. Gem has over 25 years of experience helping individuals and families with estate planning in South Carolina. Call him and his associates at the Gem McDowell Law Group in Mt. Pleasant, SC today at 843-284-1021 to schedule a free consultation to discuss your estate planning needs.

Do You Know the Limits of Your Powers of Attorney?

The power of attorney for finance and the power of attorney for health care are two essential documents of estate planning. These documents give a person (the agent) the power to make, respectively, financial or health-related decisions on behalf of another person (the principal). If you have gone through estate planning, you may have had one or both of these documents drawn up for you. (If you haven’t done any estate planning, now is the time!)

But having these documents may give you a false sense of security. You should know the types, conditions, and limitations of powers of attorney so that if you ever need to rely on them – either as the principal or the agent – you are already informed and know what they can and can’t do.

The Powers of Financial and Health Care Powers of Attorney

A power of attorney for finance (POA) gives an agent the power to make financial decisions on behalf of the principal, such as buying or selling property including real estate, accessing bank accounts, managing investments, signing contracts, or borrowing money. The principal can decide which particular powers they want their agent to have.

Similarly, a health care power of attorney (HPOA) gives an agent the power to make health care decisions on behalf of the principal, such as which treatment plan to follow, doctors to use, medication to give, and arrangements for care. It is a type of advance directive and is called different things in different states, including medical power of attorney or healthcare proxy.

What’s the Difference Between Limited, General, Durable, and Springing Powers of Attorney?

There are different types of powers of attorney and the kind of POA that’s best for you depends on your specific goals.

Limited. A limited power of attorney gives the agent the power to act in a limited capacity and often for a specified time period. This is useful if, for example, you’ll be traveling on the day of a real estate closing, and you want your spouse or business partner to be able to sign for you, in which case you’d want a limited POA for finance. Or if you’re going under the knife and want to give your sister the power to make decisions for you relating to the operation while you’re incapacitated, you’d want a limited HPOA.

General A general power of attorney does not limit the agent’s powers to a particular task or time period, but gives them as much discretion to control and direct the principal’s affairs as the principal chooses. The powers of this type of POA last until the principal’s death or until they revoke the POA.

Durable. A durable POA is one that is in effect even when the principal is incapacitated and unable to make their own decisions, for instance, because they are under anesthesia, have dementia, or are in a coma. South Carolina also recognizes that incapacity can also be because a person is missing, detained or incarcerated, or abroad and unable to return to the U.S. If the POA is not durable, then the agent’s powers end once the principal is incapacitated.

For the HPOA, it makes sense that you’d want it to be durable, because the point of having an HPOA is for someone else to make medical decisions for you when you’re unable to. But for a POA for finance, a principal may want a limited POA to be non-durable, as in the example above where the principal is traveling during a closing. A durable POA for finance is also common between spouses, so one may make decisions for the other in the case of incapacity.

Springing. Unless stated otherwise, in South Carolina the powers in a power of attorney commence immediately. However, some people choose to have a springing POA, where the powers “spring” into effect only once the principal becomes incapacitated. So while a durable POA remains effective once the principal becomes incapacitated, a springing POA only becomes effective once the principal becomes incapacitated.

Someone may feel more secure with this type of POA because they know that their agent doesn’t have any powers to make decisions on their behalf while they have mental capacity, and therefore do something they (the principal) wouldn’t want done. The trouble with this kind of POA, however, is that it can be extremely difficult to pinpoint the moment someone becomes incapacitated, especially in cases of dementia and Alzheimer’s, where a person can have good days and bad days. This can make it impossible to effectively use the POA for its original purpose. This is why we here at the Gem McDowell Law Group do not do springing POAS for our estate planning clients.

South Carolina Requires Powers of Attorney to Be Recorded

On January 1, 2017, South Carolina’s Uniform Power of Attorney Act went into effect, requiring durable POAs to be recorded in order for the agent to exercise their powers once the principal has become incapacitated. (POAs made before this date are subject to the laws that were in effect at the time.) Note that a POA does not have to be recorded for the agent to exercise powers while the principal still has capacity.

How do you record a power of attorney? If you work with an attorney to draft your estate planning documents, they will typically do it for you. (You can ask just to be sure.) If you printed your own off the internet or otherwise didn’t go through an attorney, you may contact your county clerk for instructions on how to record your POA. It must be done so in the same manner as a deed in the county where the principal resides at the time, and may be recorded before or after the principal’s incapacity.

Do You Know What Type Your Powers of Attorney Are?

You can see that with so many different types of powers of attorney, the occasional difficulty of pinpointing when incapacity occurs, and South Carolina’s relatively new requirements for recording POAs, things can get confusing. That’s why it’s so important to review the documents you’ve signed and understand exactly what powers you, as the principal, are giving your agent and when they come into effect.

For comprehensive estate planning that is tailored to your life and the needs of your family, contact Gem McDowell and his associates at the Gem McDowell Law Group in Mt. Pleasant, SC. They can help you draft estate planning documents including powers of attorney, wills, and trusts that will give you peace of mind and protect your family. Call to schedule a free consultation at 843-284-1021.

Why Charleston Is the Way it Is: How South Carolina’s Annexation Rules Shaped the City

What does the City of Charleston look like from above? That is, what are its boundaries? You might think that the City of Charleston comprises the peninsula, West Ashley to the west, and Daniel Island to the northeast. That would be a decent guess. But it’s wrong.

Take a look at the actual boundaries in this zoning map here. As you can see, Charleston’s city limits are all over the place and the city itself is surprisingly big. In fact, the City of Charleston is 156.6 square miles – a large area for a population of a little over 130,000. To put that in perspective, that’s about half the area of New York City, comprised of the five boroughs with around 8.4 million people, in just 302.6 square miles.

Why in the world is Charleston so big, and how did it get that way?

Adjacent and Contiguous

The City of Charleston is the way it is due to a combination of how aggressive it is in its desire to grow combined with South Carolina’s annexation rules.

Back before the mid-1970s, it wasn’t the county governments that were in charge of things, but the senators. So the legislature made it difficult for municipalities to annex land in order to keep the power in the hands of the senators and state officials. This is why South Carolina doesn’t have big cities the way that nearby North Carolina does with Charlotte (metro population over 2.5 million), or Florida with Miami (6.2 million).

This changed in 1975 with the passage of the Home Rule Act in which county governments were created, giving them the control of unincorporated land. (Read more about how this act affected the state here on our blog.) But the laws making annexation difficult were still on the books.

In South Carolina, land must be “adjacent” and “contiguous” in order for it to be annexed, meaning both pieces of land (the municipality and the land to be annexed) must be next to each other and share a border. In some other states, non-adjacent land may be annexed, which obviously makes it easier for municipalities to grow. Many other states also allow for “corridor annexation” which allows contiguity to be established by use of railroads, waterways, and other rights of ways. However, the definition of “contiguous” for the purposes of annexation in South Carolina explicitly states that contiguity cannot be established this way.

Because land to be annexed needs to be adjacent and contiguous to a municipality in South Carolina, cities and towns were greatly restricted in their ability to grow for many years.

Then the city of Columbia changed everything.

The Revolution of the 10-Foot Wide Strip

In the early 1990s, Columbia did something incredible. It wanted to annex a nearby area where a large mall was being built, as it would be a financial boon to the city. The only trouble was, the mall was 9 miles away, and the land it was on was not adjacent and contiguous to the existing city limits. So the city annexed a 10-foot-wide strip along I-26 that connected them to the mall, and voila, they were now adjacent and contiguous.

As to be expected, this ploy went through a lot of lawsuits at the time, but it withstood them all. Since then, other municipalities have followed suit and have used this concept of the thin strip of land to connect themselves to land they want to annex.

Petition for Annexation

There are a couple big benefits to a city to annex land, notably an increased tax basis and more control over how the land within its limits will be developed. A large amount of land in City of Charleston limits right now is undeveloped, and the City will have a say in how it develops in the future.

For the residents of the land in question, some may wish to remain outside of city limits and thus pay fewer taxes. But many often do want to be annexed, because while they do pay more in taxes, they also get benefits like access to utilities.

How do property owners get their land annexed? In order for a municipality to annex land in South Carolina, all or some of the owners of the land must petition in order to be annexed. There are a number of ways for annexation to occur by law, including annexation of land that’s wholly owned by a school district or by the federal government, for example. Another way to annex unincorporated land is to rely on the 75-75 method. As long as 75% of the landowners who own at least 75% of the assed value of the land want to be annexed, that land can be annexed even against the will of the remaining 25%.

Whether it’s a school district, the federal government, individual property owners in an area, or other landowners, they must sign a petition requesting annexation in order for the annexation to proceed.

A 10-Foot Strip Too Far

Several cities in the state have been aggressive in growing their limits through annexation, including Charleston, Mount Pleasant, and Columbia. But Awendaw took it a huge step further when it tried to annex some land in 2003.

Awendaw wanted to annex some land owned by the Mt. Nebo AME Church (Church Tract) but it was not adjacent and contiguous to existing Awendaw city limits. So it decide to do what any savvy South Carolina city would do and use the 10-foot-strip method to annex it.

The 10-foot-strip Awendaw had its eye on was a 1.25-mile-long piece of land in the National Forest managed by the United States Forest Service. Awendaw sent letters to the Forest Service to get its approval for annexation, as it needed a signed petition to proceed. They never got approval, and in fact the Forest Service wasn’t in favor of giving up the rights to that land because it would impede their ability to conduct controlled fire burns. The Forest Service also said a petition would need to come from federal officials in D.C. and the process could take several years.

Awendaw Decided to Annex the Land Anyway

That’s right, even though Awendaw never got a petition from the owners of that 10-foot strip of land, it went ahead and passed an ordinance under the 100% petition method in May 2004, relying on an old letter from 1994 for its authority. The letter was from a representative of the Forest Service who said there was “no objection” to annexing parcels of land in the vicinity – though it did not reference the particular land in question.

With this new addition of land, Awendaw then passed an ordinance annexing the Church Tract (for which it did receive a legitimate petition from church representatives).

In 2009, another piece of land referred to as the Nebo Tract by the SC Court of Appeals petitioned for annexation, and in October of that year Awendaw passed an ordinance to do so. This 360-acre parcel of land was contiguous to Awendaw through the Church Tract and the 10-foot strip.

Challenging Awendaw

This move was challenged the following month. In Nov 2009, Lynne Vicary, Kent Prause, and the South Carolina Coastal Conservation League filed a complaint, stating that Awendaw did not have the authority to annex the 10-foot strip because the Forest Service never submitted a petition for annexation.

The circuit court found that Awendaw’s annexation of the 10-foot strip was void ab initio – invalid from the start – and therefore the later annexation of the Nebo Tract was also void ab initio.

The case went to the SC Supreme Court, which determined that the Respondents had standing and then sent it down to the Court of Appeals to address the remaining issues. It reinforced the fact that “an annexation is complete only upon the acceptance of a petition requesting annexation.” (Emphasis theirs.)

The bottom line is, Awendaw got caught with its hand in the cookie jar and the South Carolina courts are not having it. (Read the full decision here.)

Watch This Space

Although Awendaw greatly overstepped its authority by annexing the Forest Service’s land, it seems that the underlying tactic of using a 10-foot strip of land to connect to desirable land is a legitimate way for municipalities to grow in South Carolina. How much more can Charleston grow? If it continues on its way, it will likely keep annexing land until it’s surrounded on all sides by incorporated land it can’t annex. Keep an eye on Charleston’s borders.

To Disclose or Not to Disclose? The Importance of Disclosure in Prenuptial Agreements

What are the three most important things when it comes to real estate? That’s right: Location, location, location.

Likewise, when it comes to prenuptial and postnuptial agreements, the three most important things are disclosure, disclosure, disclosure!

In pre- and postnuptial agreements, the spouses lay out terms for how assets will be divided should the marriage end in divorce. For example, the agreement may state that each spouse will leave the marriage with the same assets they entered with and anything acquired by the pair during the course of the marriage will be divided equitably, but assets can be retained or divided in any manner as long as both parties agree. Each party must disclose their assets – what they are and what they are valued at – so that the other party has full knowledge of what they are potentially waiving their rights to. They must also disclose their debts. They need to disclose what they own, if it’s of value.

Disclosure is a fundamental concept when it comes to pre- and postnuptial agreements. Yet a case that went before the South Carolina Court of Appeals calls into question the absolute necessity for full disclosure. Frankly, we do not agree with the court’s decision, but it has been upheld so we decided to look at this important case today.

Hudson v Hudson Background

This case (read it here) was heard in the SC Court of Appeals in early 2014. H. Eugene Hudson (Husband) and Mary Lee Hudson (Wife) began dating in the mid-90s and became engaged in 1999. On February 4, 2000, they entered into a prenuptial agreement (Agreement) and married a couple weeks later, on February 19, 2000. They separated in October 2018 and Husband subsequently filed for divorce.

There are a number of interesting things about this case. For one, Wife testified Husband insisted she consult a particular attorney – who was allegedly a close friend of his – and was not free to choose her own attorney. Also, the Agreement was presented to her just two weeks and a day before the wedding date when wedding preparations were in full swing and after she had already sold her car and quit her job in anticipation of getting married.

But the pertinent issue here is that Husband did not disclose everything he had an interest in. He did include his own business, Myrtle Beach Lifeguards, Inc., in the Agreement, but did not include a flea market that his family owned or a franchise fee agreement.

In family court, Husband said he didn’t include the flea market because his mother had a life estate in the flea market and he had just a remainder interest (meaning he would take control of it upon his mother’s death). As for the franchise fee agreement, he said he didn’t include it because he leased it to Myrtle Beach Lifeguards and considered it the company’s asset even though the agreement was in his name.

The family court found that the Agreement was “unconscionable” in the way that it dealt with division of the marital property and ordered that marital earnings of over half a million dollars should be split by Husband and Wife.

What Makes a Prenuptial or Postnuptial Agreement “Unconscionable”?

The case went to the SC Court of Appeals on appeal, where, among several other issues, Wife argued that Husband’s failure to disclose the flea market and the franchise fee agreement rendered the Agreement unconscionable.

In South Carolina, whether or not a prenuptial or postnuptial agreement is unconscionable is one of the tests to determine if such an agreement can be enforced. Citing a 2003 SC Supreme Court Case, Hardee v Hardee (read it here), the Court of Appeals lays out the three prongs to determine enforceability:

- Was agreement obtained through fraud, duress, or mistake, or through misrepresentation or nondisclosure of material facts?

- Is the agreement unconscionable? [emphasis added]

- Have the facts and circumstances changed since the agreement was executed, so as to make its enforcement unfair and unreasonable?

“Unconscionability,” as defined in Hardee, is “the absence of meaningful choice on the part of one party due to one-sided contract provisions together with terms that are so oppressive that no reasonable person would make them and no fair and honest person would accept them.”

The Court of Appeals stated that in this case, Husband’s failure to disclose the assets was “not substantially significant” and “did not affect the unconscionability of the Agreement.” That’s all it had to say on the subject. It reversed the lower court’s decision and therefore reversed the award to Wife.

Disclose, Disclose, Disclose Anyway

Despite the findings of the SC Court of Appeals, which we already stated we don’t agree with, we still think it’s wise to disclose all assets (and debts) when entering into a prenuptial or postnuptial agreement.

For help drafting or reviewing a prenuptial or postnuptial agreement, or other estate planning needs, contact Gem McDowell and his associates at the Gem McDowell Law Group in Mt. Pleasant, SC by calling 843-284-1021. Gem has decades of experience working with individuals and families to ensure their interests are protected so they can have peace of mind. Call today to schedule a free consultation.

Why You Don’t Want to Be a Trustee

I once saw a bumper sticker on a car that said “Smile. You Could Be a Trustee.” I thought it was great because it’s true.

Being a trustee can be a challenging, and often litigious, job. In estate planning, the role may fall to a family member or trusted friend who is typically not well versed in the law but who must now navigate the complexities of the trust’s provisions in service of the grantor’s wishes. I’ve seen many trustees become mired in litigation as they battle to follow the trust’s provisions while keeping the beneficiaries happy.

Still, if you are a current or prospective trustee, you may be willing to put up with all that. You may also believe that you can’t be held personally liable for any mistakes made in your role as trustee. Right?

Wrong. Today I want to look at a case from the South Carolina Court of Appeals, filed in April 2019, in some detail. It covers this exact topic and is a warning to any trustee out there that when he/she takes on the role, he/she is at risk.

The Background of Deborah Dereede Living Trust v. Karp

Eight months before she died, Deborah Dereede executed a revocable trust naming herself as trustee and her daughter, Courtney Feely Karp, as successor trustee. The only asset in the trust was Dereede’s home in Lake Wylie, SC, which Karp sold several months after her death, netting $356,242.86.

People with interest in the sale included Karp’s stepfather, Hugh Dereede (Hugh), and his company, Tyre Dealer Network Consultants, Inc. (Tyre).

An important provision in the trust essentially said the following:

- After Dereede’s death, sell the house “as soon as practicable”

- Proceeds from the sale should be distributed in this manner:

- First, pay off the mortgage

- Then pay off the promissory note to Tyre, which is currently $250,000

- Then half of remaining net sale to Hugh

- Finally, the remainder to the following Articles…

The Disagreement

The disagreement that took Karp to court stemmed from that provision.

After the house was sold, Hugh demanded immediate payment to himself and to Tyre, in accordance with the trust’s provision.

But Karp didn’t pay him immediately. She was also the personal representative for her mother’s estate, and she believed she could not yet distribute proceeds. She wanted to be sure of the net assets of the trust and estate and give time for creditors’ claims, if any.

Hugh filed action in probate court for declaratory judgment for immediate payment. Hugh and Karp battled over the issue but Karp still refused to pay and also claimed that by suing her, Hugh and Tyre had triggered the no-contest clause and were therefore giving up their claim to the money owed them. (Incidentally, if Hugh and Tyre did forfeit that money, it would instead go to Karp and her siblings.)

Enter the Trust Protector

After ten months of litigation, Karp appointed Catherine H. Kennedy as trust protector. A trust protector is someone who watches over the trustee as the trustee watches over the trust. In some cases, it may be an individual who actually knew the grantor (the person who set up the trust), while the trustee did not (if, for example, the trustee is a bank).

If the protector believes the trustee is not doing their job or is engaged in misconduct, they can terminate the trustee. Depending on the trust, the protector may have different powers, but this is the essential one. The role actually has its origins in offshore trusts but has become more popular in domestic trusts in recent years.

As trust protector, Kennedy reviewed Karp’s actions and determined that Karp was justified in waiting for creditors’ claims before disbursement. She further said that issues regarding the no-contest clause – whether Karp exercised good faith in bringing it up, and whether Hugh and Tyre had probable cause – should be decided by a court.

Bench Trial

After a bench trial, the court ruled that:

- Karp had breached her fiduciary trust by not distributing the proceeds of the house sale to Hugh and Tyre in a timely manner

- Hugh did have probable cause to bring the action and therefore the no-contest clause was not invoked

- Tyre was a creditor, so the no-contest clause wouldn’t have applied anyway

- Tyre and Hugh were entitled to attorneys’ fees and costs, payable by Karp

Karp appealed and the case went to the South Carolina Court of Appeals. (Read its decision here.)

Good Faith Isn’t Enough to Protect a Trustee

South Carolina Trust Code says that a trustee “shall administer the trust in good faith, in accordance with its terms and purposes and the interests of the beneficiaries…” A breach of trust is “violation by a trustee of a duty the trustee owes to a beneficiary…”

Karp stated that she wanted to wait until she was certain of the net assets of the trust and estate before making disbursements. The Court of Appeals states that such a delay is “common” and “often required” in the probate of an estate, but rules are different for trusts. Also noted is that if Karp had followed the trust exactly and made the distributions quickly, she would have risked no personal liability.

Though Karp’s actions were understandable and appeared to have been done in good faith, she was nevertheless found in breach of trust. The Court of Appeals says “There is no evidence Karp acted in bad faith” and goes on to cite a District Court case, saying that good faith “counts for nothing” when it comes to breach of trust.

Ultimately, the Court of Appeals affirmed the lower court’s decision and found that Karp was personally liable, as well as liable in her capacity as trustee. “Although Karp acted in good faith, a trustee is nevertheless personally liable for breach of trust.”

Additionally, the Court of Appeals affirmed the lower court’s finding that Hugh did have probable cause, therefore the no-contest clause did not come into effect.

Think Twice Before Becoming a Trustee

If you are already a trustee, or if someone has asked you to be a trustee, consider the responsibility – and the liability – of the role. It’s easy to believe that you’re doing someone a favor and that if you’re doing your best, you can’t get into trouble. As you’ve seen illustrated in the case above, that’s not true. As a trustee, you can be held personally liable – meaning money can come out of your pocket – for your actions with respect to the trust, even if everything you do is in good faith and the courts recognize that.

For questions on creating a trust, managing a trust, or other issues of estate planning, contact estate planning attorney Gem McDowell. He and his associates at the Gem McDowell Law Group in Mt. Pleasant, SC work with many individuals and families to create estate plans to provide peace of mind. Call today to schedule a free consultation at 843-284-1021.

Can You Be Held Personally Liable for Your LLC’s Debts?

Entrepreneurs who create a limited liability company (LLC) are protected from putting their personal assets at risk for business debts. Right? After all, that’s the main purpose of the LLC. “Limited liability” is even in the name.

Well, not always. There are situations in which a member of an LLC is not protected and can be held personally responsible for business debts.

Today we’re going to look at a 2019 case from the South Carolina Court of Appeals, Johnson v Little (read it here), that touches on a number of issues that are important for business owners to know, including limited liability and breach of contract.

Johnson v Little: The Facts of the Case

Robin Johnson of CQI Pharmacy Services, LLC and Robert Little of CQI Oncology/Infusion Services, LLC, had a rather unusual situation. Both were the sole owners of their companies and at the same time were employees at the other’s company, with the power to write checks from the other’s business.

In spring 2013, Johnson paid invoices in the amount of $25,568.59 to settle vendor accounts for Little’s company, CQI Oncology. At some point, Little removed Johnson as an authorized signatory for his business and the checks Johnson had signed and sent to the vendors ended up not going through.

Shortly thereafter, the two entered into a contract for Johnson to purchase assets of Little’s company for the price of $30,000. The contract stated that “the Property is free and clear of any liens or encumbrances” but due to the bounced checks, that turned out not to be the case. Johnson discovered that the invoices were still outstanding and that as the new owner, she owed the outstanding amount to the vendors.

Johnson sued Little for breach of contract, among other things. The matter was tried by a master, who found in favor of Johnson. An appeal followed.

The Three Elements of Breach of Contract

The master found that the following three elements of breach of contract were satisfied in this situation:

- There was a valid contract. Neither party disputed this.

- There was a breach of the contract. The contract contained language stating the Property was free and clear of “encumbrances” when that was not true. The outstanding invoices were a clear encumbrance. Little tried to argue this point unsuccessfully.

- There were damages resulting from the breach. Johnson had to pay the vendors’ invoices herself, costing her over $25,000.

All three criteria must be satisfied in order to find a breach of contract occurred, as they were in this case.

The standard remedy for a breach of contract is for the breaching party to reimburse the nonbreaching party so that it’s as if the breach had never happened. The Court of Appeals reaffirmed this standard in this case, by rejecting the master’s decision to award Johnson an additional $30,000 above the amount of the invoices. This would have put her in a better position than she would have been had the breach never occurred, which violates the general rule for breach of contract remedy.

A Lesson on the Limits of Limited Liability

Now we come to the part about personal liability for company debts. In the appeal, Little argued that the master erred in finding him personally liable in addition to his company. The contract he entered into with Johnson was done so and signed by Little as the sole member and manager of the LLC, and as an individual.

This is so important, it bears repeating: Little entered into the contract and signed it as a representative of his LLC and on his own behalf.

The Court of Appeals states that because Little “was a party to the contract as an individual and his actions caused the contract to be breached, the master did not err in holding him individually liable.”

A simple lesson here is to always sign anything relating to your business as the LLC’s owner. When signing a contract or endorsing a check, include the full name of the LLC and sign as “John Q. Smith, Manager.” Sign a company check (which already has the LLC’s name on it) with your name and role.

Other Limits of Limited Liability

If Little had signed only as a member/owner and not as himself, could he still have been found personally liable? Possibly. In its decision, the Court of Appeals cites a 2012 South Carolina Supreme Court case, Dutch Fork Dev. Grp. II, LLC v. SEL Props: “as a matter of law, a manager of a limited liability company can wrongfully interfere with his company’s contracts and be held individually liable for his acts.” In the case at hand, the Court did determine that Little’s actions constituted “wrongful interference” with the company contracts, whether he signed the contract as an individual or not.

Another way a business owner may be held personally liable is if they commit a tort, or wrongful act, such as fraud. Liability can also be suspended due to piercing the corporate veil. Learn more about this important concept on our blog, here.

Get Help with Contracts Strategic Business Advice

This is just a brief overview of the ways in which an LLC owner may be held personally liable for business debts, and the true lesson is that business law is often not as straightforward as it appears. For that reason, it’s smart to have an experienced business attorney in your corner who can provide you with strategic business advice like Gem McDowell.

Gem is a problem solver and a business attorney with over 25 years of experience who can advise you whether you’re looking to buy a company, start a new company, or grown an existing company. Call Gem and his associates at their Mt. Pleasant office at 843-284-1021 to schedule a free consultation today and get the help you need.

Why Common Law Marriage was Just Abolished in South Carolina

Common law marriage will no longer be recognized in South Carolina. In making this determination, the Supreme Court of South Carolina joins the trend of several other states who have already put an end to the practice over the years.

This decision comes in the context of a case from family court and offers some interesting insights into the purpose of public policy and how society’s changing mores affect the law and its interpretation.

Where Did Common Law Marriage Come From?

Before we look at why it was abolished in SC, let’s look at where it came from.

Common law marriage comes from pre-Reformation Europe and arrived in the new world from England during colonization. Not all states adopted common law marriage, but the majority did at some point.

At the time, this institution made a lot of sense. America was sparsely populated, particularly in the Midwest and the West, and it was difficult to find and/or travel to religious or government officials to marry two people. It was also a way to add some legitimacy to a situation that would otherwise be seen as objectionable, e.g., living together, children out of wedlock, and women with children who might otherwise rely on the state for assistance.

However, times and situations have changed drastically, and the institution doesn’t make as much sense as it once did.

Common Law Marriage in Modern Times

In its decision (which you can read here), the Court states that “the common law changes when necessary to serve the needs of the people” and that it will act when it is “apparent that the public policy of the State is offended by outdated rules of law.”

Common law marriage is, indeed, outdated. Cohabitation before marriage, children born out of wedlock, and single mothers are widely accepted today without stigma, and rights to child support and inheritance no longer depend on marital status. Getting married legally is easy and inexpensive, and therefore there are no substantial practical barriers to marriage as there once were.

In addition, common law marriage presents some thorny problems. Namely, how do you know when you have entered into a common law marriage, since (by definition) there is no formal ceremony or documentation, and how are courts supposed to make that determination when asked? What if one party of a couple believes they are married, but the other party doesn’t? What happens when a couple like this decides to split? These issues were central in the case at hand.

Married or Not Married?

A. Marion Stone, III and Susan B. Thompson met in the 1980s and began dating. In 1987, they had a child together, and in 1989 they had a second child and began living together. For approximately twenty years following this, they lived together, raised kids, and managed rental properties. The relationship ended when Thompson discovered Stone was having an affair.

In 2012, Stone sought declaratory judgement that the two were common law married, a divorce, and an equitable distribution of alleged marital property. The family court held a trial to determine whether the two were common law married. After hearing evidence from both sides – including witness testimony on how they introduced themselves as a couple, proof of cohabitation, joint financial documents, and so on – the court concluded that Stone and Thompson were common law married starting in 1989, and so awarded over $125,000 to Stone in attorney’s fees and costs. The family court stated that the evidence showed a “presumption of marriage that could only be refuted by strong, cogent evidence they never agreed to marry.”

The South Carolina Supreme Court Disagreed

The Supreme Court disagreed, not finding the evidence as overwhelming as the family court did. Some witnesses said Stone and Thompson introduced each other as husband and wife, while others didn’t; some documents were signed jointly, others singly; and the children had their mother’s last name only until 2000, when their father’s last name was added. There was a period of time from 2005-2008 where documents were signed as though a married couple – medical documents and an application for a mortgage loan – but the Supreme Court viewed these as evidence of seeking financial benefits through the appearance of marriage, not as an indication of actual marriage.

Ultimately, common law marriage requires mutual understanding and assent. Both parties must understand what common law marriage is and express a desire for it, and understand that the other feels the same way. The Court didn’t find that this was the case with Stone and Thompson, and therefore reversed the family court’s decision (and the decision for Thompson to pay Stone’s attorney’s fees).

Prospective, Not Retrospective – and a Stronger Test

The Court notes that while it does have the power to “undo” current common law marriages, it’s reserving this right of retrospective power and its decision applies only prospectively. From the date of the Supreme Court’s decision (July 24, 2019) forward, you may only be married in South Carolina with a valid license.

At the same time, the Court took the opportunity to strengthen the test of validity of current common law marriages. “A heightened burden of proof is warranted,” which it calls an “intermediate” standard: more than a preponderance of the evidence but not to the level of beyond a reasonable doubt. The “clear and convincing evidence” standard used for matters of probate “should also apply to living litigants.”

The Supreme Court states that the “right to marry is fundamental, and so is the right not to marry” so it cannot be an institution that people enter into unwittingly. Furthermore, the Court can’t “see inside the minds” of litigants, it “must yield to the most reliable measurement of marital intent: a valid marriage certificate.”

Keeping Up with Changes in the Law

Though South Carolina is following in the footsteps of other states in ridding the practice of common law marriage, this is still a big step. It’s important to remember that laws can change, as can the interpretation of them, and that these changes can have very real consequences for residents of the state.

This is especially true for estate planning when it comes to complicated family dynamics. To make sure you’re covered, work with an experienced estate planning attorney Gem McDowell. He and his associates at the Gem McDowell Law Group in South Carolina can help you plan ahead and make sure your estate planning documents are in order. Schedule your free consultation by calling 843-284-1021.

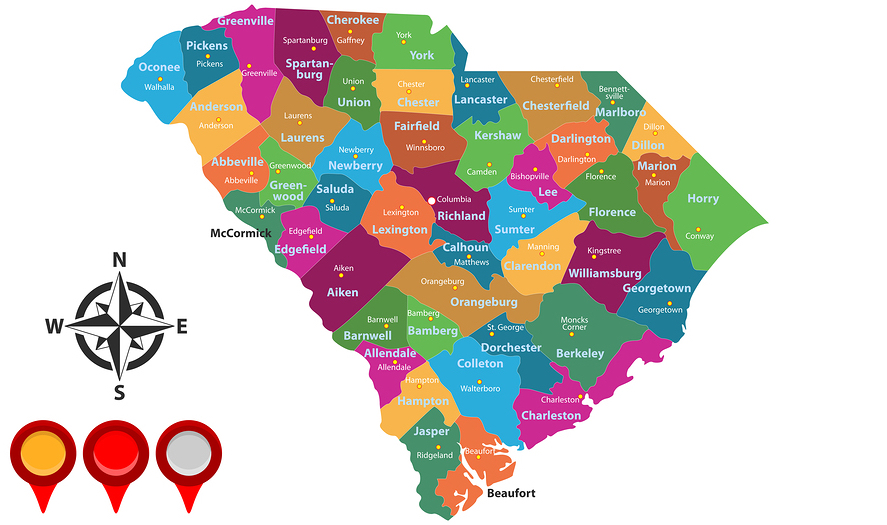

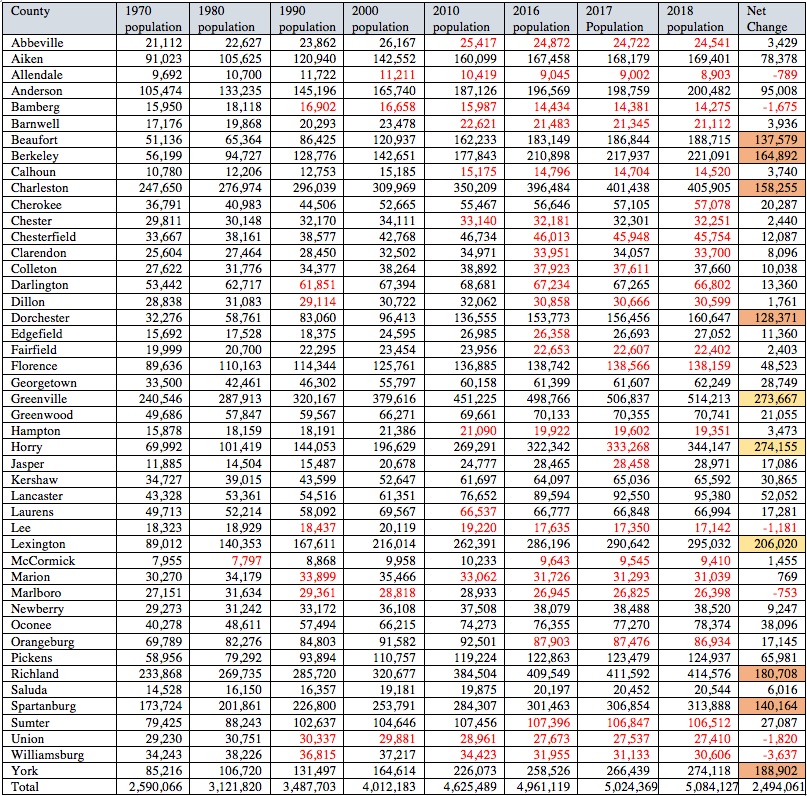

See How South Carolina’s Counties Are Growing and Shrinking

We know that of South Carolina’s 46 counties, some are growing and some are shrinking, but knowing that alone doesn’t tell the whole story. Today we’re going to look a little more in depth at the actual numbers.

South Carolina Counties That Have Grown Consistently 1970-2018

Forty counties have grown in population since 1970, including Aiken, Anderson, Beaufort, Georgetown, Greenwood, Jasper, Kershaw, Lancaster, Laurens, Newberry, Oconee, Pickens, and Saluda Counties.

Some have grown by an impressive amount. The growth of the state capital Columbia is largely responsible for the growth of mid-state counties Lexington and Richland. Lexington more than doubled its population, growing from 89,012 to 295,032, while Richland grew from 233,868 to 414,576. Upstate, Greenville County, Spartanburg County, and York County grew significantly, too. Greenville County went from 240,546 in 1970 to 514,213; Spartanburg County from 173,724 to 313,888; and York from 85,216 to 274,118.

Unsurprisingly, the Charleston tri-county area has seen huge growth in the last 50 years. Charleston County grew from 247,650 in 1970 to 405,905 in 2018. Even more impressive, Dorchester County went from 32,276 to 160,647 and Berkeley County from 56,199 to 221,091. That’s a net gain of nearly half a million people (451,518 to be exact), from 336,125 to 787,643.

But the county that takes the cake is Horry County. Horry County exploded in population with the development of Myrtle Beach and the surrounding area, taking the population from 69,992 in 1970 to 344,147 in 2018 – a net gain of 274,155 people, or nearly quadrupling the number of people.

All of these counties have seen consistent growth over this time, with no losses in population at each 10-year census mark.

Chart of South Carolina counties with population changes from 1970 to 2018. Red text = decline. Orange shading = gain 100,000-199,999. Yellow shading = gain 200,000+. Click to enlarge.

South Carolina Counties That Have Shrunk 1970-2018

From 1970 to 2018, six counties have had a net loss in population. This is significant since the state as a whole nearly doubled its population, from 2,590,066 in 1970 to 5,084,127 in 2018 – a net change of 2,494,061. The fact that any county lost population is notable.

Allendale County and Marlboro County lost the least, with a net loss of 789 people for Allendale and 753 for Marlboro. The counties that lost between 1,000-2,000 people are Bamberg County, from 15,950 to 14,275; Lee County, from 18,323 to 17,142; and Union County, from 29,230 to 27,410.

The unfortunate “leader” in this category is Williamsburg County, which lost more than 10% of its population between 1970 and 2018, going from 34,243 to 30,606.

What About the Rest?

That accounts for 28 of South Carolina’s 46 counties, but what about the remaining 18?

These counties have had net growth in that time but have seen population losses in recent years. For some counties, it’s not too concerning: Cherokee County lost just 27 people from 2017 to 2018, and had a net gain of 20,287 since 1970. Likewise, Edgefield County has had a net gain of 11,360, but saw a dip in numbers between 2010 and 2016.

But others look like they’re beginning to see a steady downward trend. Marion County has had a net growth of 769 from 1970 to 2018, going from 30,270 to 31,039. But it’s actually lost over 4,000 people since a high of 35,466 in 2000, and has been steadily losing people since 2010. Similarly, Orangeburg went from a high of 92,501 in 2010 to 86,934 in 2018 – a loss of 5,567 people – and has been on the decline, despite an overall gain of 17,145 from 1970.

This story is repeated in several other counties, though to a lesser degree. Abbeville, Barnwell, Calhoun, Chester, Chesterfield, Clarendon, Colleton, Darlington, Dillon, Fairfield, Florence, Hampton, McCormick, and Sumter Counties have all seen population declines over the last several years.

Whether these 18 counties are headed for continued decline can’t be predicted, but it’s something to keep an eye on.

A Strategic Partner for the Growth of Your Business

Business attorney Gem McDowell of the Gem McDowell Law Group in Mt. Pleasant is a problem solver with over 20 years of experience helping business owners start, acquire, grow, and run their businesses soundly. He and his associates can help you with legal matters and provide strategic advice for the long-term health of your company. Call the Gem McDowell Law Group today at 843-284-0120 to schedule your free consultation.

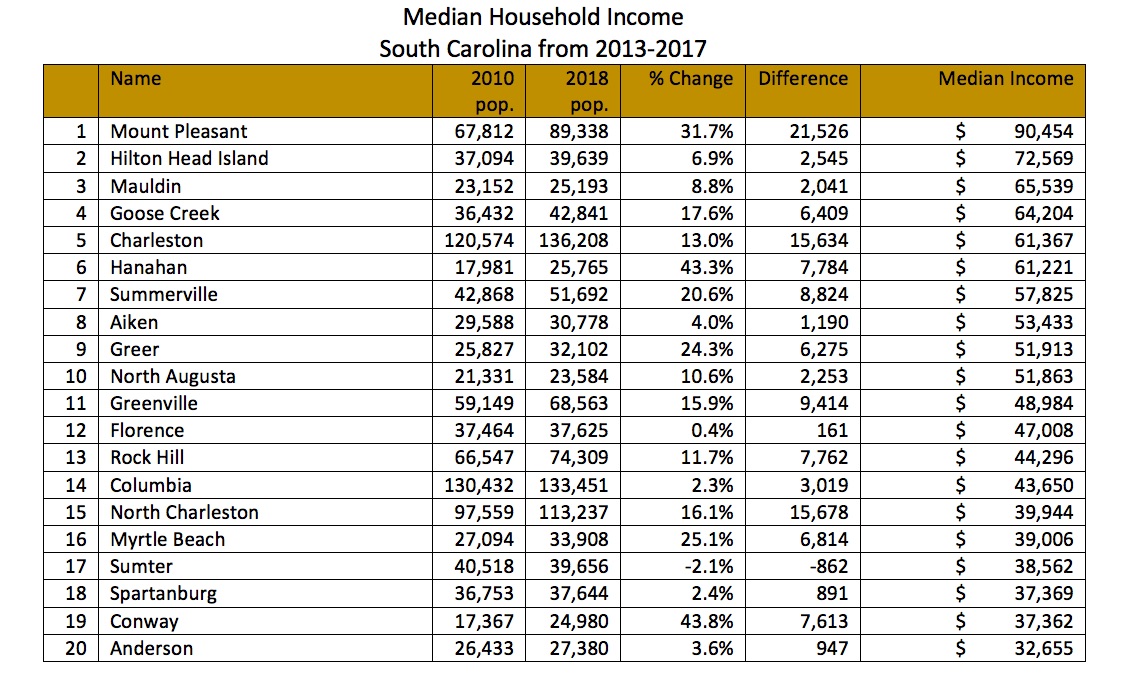

How Much Money Do People Earn in South Carolina?

In a previous blog, we looked at population trends in South Carolina over the last decade in the context of how that information could impact business owners looking to do business in the state. Today we’re going to look at another factor that has affects businesses: median household income. Specifically, the median household incomes in select cities in South Carolina.

Median Household Income in South Carolina’s Cities

According to the U.S. Census Bureau, the median household income (MHI) in the U.S. in 2017 was $60,336. That same number in South Carolina was $50,570. Interestingly, looking at the 2013-2017 median income of the top 20 cities in S.C. by population, half fall above this number and half fall below.

Of the ten South Carolina municipalities with a MHI higher than the state average, the Town of Mount Pleasant leads with $90,454, with Hilton Head Island coming second with $72,569. Median household income was between $51,863-$65,539 for the other eight cities on the list, Maudlin, Goose Creek, Charleston, Hanahan, Summerville, Aiken, Greer, and North Augusta.

Of the ten where the MHI is lower than the state average, Greenville is at the high end with $48,984, and Anderson comes in last with $32,655. The other eight falling in between are, in descending order, Florence, Rock Hill, Columbia, North Charleston, Myrtle Beach, Sumter, Spartanburg, and Conway.

Chart showing median household income of 20 cities in South Carolina in the time period 2013-2017, along with each city’s population count in 2010 and 2018 and difference in percentage and absolute numbers.

What This Means for Business Owners

If you’re thinking of starting a business in South Carolina, or opening a branch or plant of an existing business here, median household income is another factor to consider (along with population) when deciding where to set up shop.

A city’s MHI could have a significant impact on your business, depending on what it is. If you’re a manufacturer, like Volvo, that doesn’t depend on selling your product to the local market, you’re in a much different position than a baker or a doctor who depends on the residents for their living. If you do depend on making sales in the local market, consider whether your product or service is a necessity or a luxury, since households with a higher MHI have more for discretionary spending.

More Strategic Advice for Business Owners

If you’re an entrepreneur looking for strategic or legal advice on how to start or grow your business, contact Gem McDowell of the Gem McDowell Law Group. He and his associates help with matters of incorporation, corporate governance documents, business planning, acquisition, and more. Call the Mount Pleasant office today to schedule a free consultation at 843-284-1021.

Is Your Lawyer Legit?

The legal profession is one of the most heavily regulated professions in the U.S. Every state requires attorneys to be licensed, yet people still practice law when they shouldn’t, which can lead to huge complications for their unwitting clients.

If you are considering hiring, or have already hired, a lawyer to represent you in any capacity in South Carolina, do your due diligence and check their standing first.

How to Determine if Your Attorney is In Good Standing in South Carolina

There are a few different online resources you can use. The South Carolina Bar’s directory tool allows you to search for attorneys in the state and returns information on their law school, the year they passed the bar in South Carolina, and their Status. You want to see “Good Standing” here. The South Carolina Bar also maintains an ongoing list of Member Discipline, which includes instances of reprimands and reinstatements.

The South Carolina Bar is not the agency responsible for disciplining judges and attorneys; that’s the Disciplinary Counsel of the South Carolina Judicial Branch. Use the search at the top to look for your attorney’s name, and if they’ve been disciplined in the past then the South Carolina Supreme Court’s published opinion will show up in the search results. (If you’re looking for the disciplinary agency in a state other than South Carolina, check out the American Bar Association’s Directory of Lawyer Disciplinary Agencies instead. Link to pdf.)

Finally, while it’s not as official as the sites listed above, Avvo.com does list instances of professional misconduct, or lack thereof, on each attorney’s page. Use the search tool to find your attorney’s profile and check for a history of disciplinary action.

Licensed in Your State?

As you likely know, each state requires attorneys to be licensed to practice in that state. Still, sometimes people licensed in one state decide to practice in another. In South Carolina, this can lead to being Debarred, which is different from Disbarred. Disbarred means the person was once licensed to practice in the state, but now no longer is. Debarred means they were never licensed to practice in the state, and now they never will be allowed to (without first obtaining an order from the Supreme Court of South Carolina).

This is exactly what happened to two people earlier this spring, Farzad Naderi and Christopher Michael Ochoa, who were (separately) debarred for providing legal services to people despite not being members of the South Carolina Bar. In Ochoa’s case, he accurately represented himself as being “licensed in the State of Florida” and not able to practice in South Carolina, but implied that he had a “network of attorneys” allowing him to take cases in South Carolina when in fact that was a misrepresentation. The attorneys he worked with in South Carolina and other states were hired on a piecemeal basis and in various instances, he provided the legal services himself. (You can read the details in the Supreme Court’s opinions in this PDF here.) The lesson here is to be very careful when entering into an arrangement for legal services with someone who is licensed in another state so you understand exactly what you’re getting.

There is an important exception to this rule, however. A lawyer who is not a member of the South Carolina bar but who is admitted and authorized to practice in the highest court of another state or D.C. may apply for pro hac vice admission in South Carolina. “Pro hac vice” means “for or on this occasion only” (literally “for this turn”) and adds an attorney to a case in a jurisdiction in which they are not licensed to practice so that they are, for that case, legally allowed to practice in another state.

Finding a Lawyer in Good Standing to Represent You

The South Carolina Bar has information online to help the public locate pre-screened attorneys, certified mediators, and even free legal aid, all of which you can find links to here. You can also ask your friends, family, and colleagues for a referral to someone they trust.

If you’re looking for help or advice on estate planning or business law, give Gem McDowell and his associates at the Gem McDowell Law Group in Mt. Pleasant, SC a call at 843-284-1021. Gem is a problem solver with over 20 years of experience and he and his associates are ready to help you. Call to schedule a free consultation today.