Changing the Rules Mid-Game: What the Connelly v U.S. Decision Means for Closely Held Corporations

If you are a shareholder in a closely held corporation, you need to know about the June 2024 decision from the U.S. Supreme Court case Connelly v. United States (2024). This decision (find it here) could have dramatic consequences for your business and for you, personally, as a shareholder.

Here’s the central issue:

Should life insurance proceeds paid to a closely held corporation to buy out a deceased shareholder’s portion of the business be counted as a non-offsettable asset for the purposes of calculating the decedent’s federal estate taxes?

The U.S. Supreme Court says YES.

The issue is somewhat convoluted. The upshot is that this decision allows the IRS, in some circumstances, to essentially “tax” a portion of previously untaxable life insurance proceeds without directly taxing them. Instead, it’s done by counting the life insurance proceeds as a business asset that cannot be offset, thus increasing the deceased shareholder’s share of the company at time of death and increasing their taxable estate – and possibly creating a federal estate tax liability.

This is a drastic change from what has previously been done. It’s like changing the rules while you’re in the middle of the game; you were expecting to pass Go and collect $200, but now you owe $300.

Below, we’ll look at the background of Connelly and the court’s reasoning, then discuss what it could mean for you and the other shareholders in your closely held corporation.

Note that today’s blog is just an introduction to the topic. Since this decision is so new, it’s not clear how things will shake out; it will take some time for business owners and their attorneys to determine the best course of action moving forward. But for now, we wanted to put this on your radar. We recommend speaking with your own business attorney and/or estate planning attorney about the potential consequences for you if you are an owner in a closely held corporation. (And if you do not yet have a business attorney or estate planning attorney in South Carolina, call us at the Gem McDowell Law Group at 843-284-1021 to talk.)

Connelly vs United States (2024) Summary

Briefly: Michael and Thomas Connelly were brothers and together owned a building supply company, Crown C Supply (Crown). They had an agreement to ensure the business would stay in the family if either brother died. The surviving brother would have the option to purchase the shares first, and if not, then Crown would be required to purchase the deceased brother’s shares. The corporation purchased life insurance policies of $3.5 million on each brother to this end.

Michael died in 2013 owning 77.18% of the business (385.9 of 500 shares) at death, with his brother Thomas owning the remaining 22.82%. Thomas declined to buy the shares, so Crown redeemed them for $3 million, an amount agreed upon by Michael’s son and Thomas.

Michael’s federal tax return for the year of his death was audited by the IRS. As part of the audit, an accounting firm valued the business at Michael’s death at $3.86 million, with his 77.18% share amounting to approximately $3 million. The analyst followed the holding of Estate of Blount v Commissioner of Internal Revenue (2005) that stated life insurance proceeds should be deducted from the value of a corporation when the proceeds are “offset by an obligation to pay those proceeds to the estate in a stock buyout.”

But the IRS argued that Crown’s obligation to buy back the stock did not offset the life insurance proceeds. The $3 million in life insurance proceeds should be added to the assets of the business, the IRS argued, making the total value of Crown at Michael’s death $3.86 million + $3 million = $6.86 million. Michael’s 77.18% share of this larger amount would be approximately $5.3 million, and based on this, the IRS said Michael’s estate owed an additional $889,914 in taxes.

Michael’s estate paid these taxes, and Thomas, as Michael’s executor, later sued the United States for a refund. The case went before the Supreme Court in March 2024.

The Supreme Court’s Reasoning

In its decision, the court states two points that “all agree” on:

- The value of a decedent’s shares in a closely held corporation must reflect the corporation’s fair market value for the purposes of calculating federal estate tax; and

- Life insurance proceeds payable to a corporation are an asset that increase the corporation’s fair market value.

The question, then, is whether the obligation to pay out those life insurance proceeds offset the asset, effectively canceling itself out.

The Supreme Court’s answer: No.

The reasoning: “An obligation to redeem shares at fair market value does not offset the value of the life-insurance proceeds set aside for the redemption because a share redemption at fair market value does not affect any shareholder’s economic interest.” The court says that no willing buyer would treat the obligation as a factor that reduced the value of the shares.

Also, for the calculating estate taxes, the point is to assess how much an owner’s shares are worth at the time of death. In this case, it was before Crown paid out the $3 million to buy Michael’s shares. Therefore, that $3 million should be added to the value of the business’s assets and income generating potential, valued at $3.86 million.

This decision will likely affect millions of business owners and trillions of dollars. Depending on your personal and business circumstances, it could affect you, too.

What This Means for You: Federal Estate Taxes

The most important thing to know about federal estate taxes is that the laws affecting them can and do change regularly. (This is one big reason it’s important to have your estate plan reviewed regularly to ensure it’s up to date with current law. Read about the unintended consequences of an out-of-date estate plan here on our blog.)

The majority of individuals subject to U.S. taxes who die in 2024 will not be subject to federal estate taxes; only about 0.2% were expected to in 2023, according to a Tax Policy Center estimate. Currently, if an individual dies in 2024 with a taxable estate valued below $13,610,000, no federal estate tax needs to be paid. This amount doubles to $27,220,000 for married couples filing jointly.

But the “applicable exclusion amount” (also called the “unified tax credit” or “unified credit”) has not always been so high. For many years, it was just $600,000. The current unified tax credit amount is set to expire at the end of 2025, after which it will revert to a lower amount (expected to be around $7 million), unless Congress passes more legislation changing it first.

When Michael Connelly died in 2013, the unified tax credit amount according to the IRS was $5,250,000. Valuing his share of the business at death at $5.3 million rather than $3 million meant he had a larger taxable estate and owed additional federal taxes.

What does this mean for you? This makes estate planning tricky. You can’t know for sure when you’ll die or what the applicable exclusion amount will be that year. Depending on the value of your business and your personal assets, your estate may owe federal estate taxes you weren’t anticipating. The bottom line: If you have a buy-sell agreement and it is funded with life insurance, have it reviewed by an attorney ASAP.

What This Means for You: Succession Planning Going Forward

It’s common for shareholders in a family-owned closely held corporation to have buy-sell agreements that would keep the business in the family should a shareholder die. (Read more about buy-sell agreements on our blog here.) To that end, life insurance policies are often taken out on the shareholders to ensure funds are available to buy out the deceased shareholder’s shares at death.

For years, many business owners have had the corporation itself buy and maintain those life insurance policies on each shareholder. The proceeds went directly to the corporation and were not taxed. Additionally, they did not increase the value of the business, and thus the value of the deceased shareholder’s portion, at the time of the shareholder’s death.

Until now.

What does this mean for you? Now that this has changed after Connelly, shareholders in a closely held corporation may reconsider having the corporation purchase and maintain life insurance policies on its owners.

One option suggested in the Connelly opinion is for the shareholders to take out life insurance policies on each other in a “cross-purchase agreement.” The court acknowledges that this comes with its own set of problems, however, including different tax consequences and the necessity for each shareholder to maintain policies on the other shareholders.

Another potential option is to set up a separate LLC to maintain life insurance policies on the shareholders. In the event of a shareholder death, the LLC – not the corporation itself – would buy out the decedent’s share. This is one possible new solution to this new problem, but it is not yet tried and tested.

Finally, shareholders may continue to have the corporation purchase and maintain life insurance policies with the knowledge that each shareholder should create an estate plan for their personal assets that helps avoid federal estate taxes.

Watch This Space

As the dust settles from this decision, we’ll keep on top of it and come back with more information and advice.

Just remember – the law is not set in stone. Congress passes new legislation and courts render decisions regularly that can affect individuals and business owners. It can be hard to keep up with all the changes, which is why it’s important to have an attorney you can rely on to help keep your estate plan current and your business thriving.

Call Gem at the Gem McDowell Law Group in Myrtle Beach and Mt. Pleasant, SC. He and his team help South Carolina individuals and families create and review estate plans to protect assets and avoid family disputes. He also helps with the creation, purchase, sale, protection, and growth of South Carolina businesses through the creation of corporate governance documents, contracts, problem solving, and more. Call 843-284-1021 today to schedule a free consultation or fill out this form. We look forward to hearing from you.

Employee or Independent Contractor? A Closer Look at the Four-Factor Model

How do you know whether a worker in South Carolina should be classified as an employee or an independent contractor? The decision has big consequences for both employer and worker, as that classification impacts taxes, workers’ compensation, and more.

While the IRS has its own standard for determining whether a worker should receive a 1099 or a W-2 (which you can read about in this blog), right now we’ll focus on how the State of South Carolina approaches this question.

The Four-Factor Model to Determine Employment Status

For many decades, South Carolina courts have used what is called the four-factor model or four-factor test to determine whether a worker should be considered an employee or an independent contractor.

The four factors are:

- The right or exercise of control;

- Furnishing of equipment;

- Method of payment; and

- The right to fire.

Let’s look a closer look at all four.

The right or exercise of control. When an employer controls or directs the worker – or has the right to, even if that right is not exercised – that denotes an employer-employee relationship. An employee is told when to do their job, how to do it, and is typically supervised to some degree. In contrast, an independent contractor decides their own hours, determines how to do their work, and works without supervision.

Furnishing of equipment. When equipment is furnished by the employer to the worker to complete their job, that’s evidence in favor of an employee classification. An employee uses, for example, the computer and desk, or truck and tools, of the employer at the employer’s expense. An independent contractor uses their own materials and tools at their own expense.

Method of payment. Time-based payment tends to show an employee relationship while project-based payment tends to show an independent contractor relationship.

Right to fire. South Carolina is an at-will employment state meaning that an employer can fire an employee and end the relationship immediately with no further obligations or liabilities (assuming the termination was not unlawful). In contrast, many independent contracts include clauses in their contracts that require full or partial payment if a job is terminated unexpectedly before its conclusion.

When determining the status of a worker, no single factor is determinative, and South Carolina courts weigh all the evidence to come to a conclusion. The examples above are as black-and-white as possible, but when these types of cases reach the Court of Appeals or the Supreme Court of South Carolina, they are never as clear cut.

The Four-Factor Model Put to the Test in Ramirez v May River Roofing, Inc.

A case heard in the South Carolina Court of Appeals in November 2020, Ramirez v May River Roofing, Inc. (read the opinion here), shows the four-factor model in action and how SC courts approach the issue of determining a worker’s classification.

The Background

Francisco Cedano Ramirez started a business as a sole proprietor called Cedano Roofing. About a year later, he began working for a company called May River Roofing, Inc., and he worked “continuously and exclusively” with them for approximately three years.

In January 2016, Ramirez was on a roofing job when he fell to the ground, a fall of about 16 feet, and sustained “significant injuries to his back, neck, shoulders, chest, ribs, lungs, and upper extremities” as a result.

The Claims

Ramirez filed a claim for workers’ compensation on the basis that he was May River’s direct or statutory employee.

The Single Commissioner at the SC Workers’ Compensation Commission determined that Ramirez was neither a direct employee nor a statutory employee of May River, but an independent contractor, and therefore was not eligible for workers’ compensation benefits. Ramirez appealed and an appellate panel affirmed the decision.

This appeal followed in which the SC Court of Appeals looked at the evidence de novo to come to its own conclusion about whether Ramirez was an employee of May River and thus eligible for workers’ comp benefits.

Weighing the Evidence to Determine Employee or Independent Contractor Classification

Statutory employee: A statutory employee is worker whose income is treated as if they’re an independent contractor but whose taxes are treated as if they’re an employee. In South Carolina, “settled law commands” a sole proprietor may not be considered a statutory employee, so Ramirez’s claim that he was a statutory employee of May River was denied.

Direct employee: Here the court spends time looking at the evidence using the four-factor model.

- Right or Exercise of Control

Factors in favor of independent contractor classification:

- Ramirez had “a great deal of autonomy”

- Ramirez set his own schedule

- Ramirez did not punch a time clock

- Ramirez was free to negotiate for additional payment or decline the job

- Ramirez was free to hire additional help on a job without approval from May River

Factors in favor of employee classification:

- Ramirez was required to wear a May River branded t-shirt at the jobsite

- Ramirez was required to display a magnetic May River decal on his truck

- Ramirez worked exclusively with May River for three years, which suggested to the court that May River had the right to control Ramirez by withholding work

There was also conflicting testimony about the level of supervision, so that was not considered as a factor in favor of either party.

The court acknowledges that May River’s control over Ramirez’s appearance and their exclusive working relationship might seem “trivial” but thinks they are not. It concluded that May River’s control over Ramirez was more than that of a typical employer-independent contractor relationship and concluded that this factor weighed in favor of an employee relationship.

- Furnishing Equipment

Factors in favor of independent contractor classification:

- Ramirez provided his own tools

- Ramirez provided his own vehicle

Factors in favor of employee classification:

- May River provided Ramirez with all the materials used in the roofing jobs

- May River gave Ramirez a branded t-shirt and magnetic truck decal he was required to display

The court concluded that May River furnishing all the materials at its own expense showed “direct evidence of control” over Ramirez and found that this factor also weighed in favor of employee classification.

- Method of Payment

Factors in favor of independent contractor classification:

- Ramirez was paid “per roofing square” for roofing work (the majority of the work he did)

Factors in favor of employee classification:

- Ramirez was paid by the hour for repair work (a minority of the work he did)

Because the majority of Ramirez’s work was paid on a project or piecemeal basis and his payment did not depend on the amount of time he spent working, the court concluded that this favored an independent contractor relationship.

- Right to Fire

The court did not find any evidence that weighed in favor of either party.

Conclusion: Employee Relationship

The evidence in this case was a mix of factors in favor of both employee relationship and independent contractor relationship. However, after considering all the evidence the court concluded that May River and Ramirez did have an employer-employee relationship, meaning that Ramirez was eligible for workers’ compensation benefits.

Employers Take Note – South Carolina Courts Favor the Employee Classification

Even though Ramirez set his own schedule, had freedom to negotiate payment, could hire help without approval, was paid per roofing square the majority of the time, and used his own vehicle and tools, the SC Court of Appeals still found that the relationship he had with May River constituted an employer-employee relationship.

This reflects the tendency of South Carolina courts to strongly favor the employee classification over the independent contractor classification when it comes to cases involving benefits for injured workers. “The general rule is that workers’ compensation law is to be liberally construed in favor of coverage in order to serve the beneficent purpose of the [Workers’ Compensation] Act; only exceptions and restrictions on coverage are to be strictly construed,” the SC Court of Appeals states in this opinion. While this has long been a general rule, this bias towards employee classification has been even stronger since the Lewis v L. B. Dynasty (2015) case (covered briefly in the 1099/W-2 blog).

If you’re an employer, keep this in mind when hiring and classifying workers. You must treat independent contractors like independent contractors. Seemingly small things, like asking your worker to wear a branded t-shirt, can become evidence of an employer-employee relationship, as seen in this case. Otherwise, hire the worker as an employee so they have the protections they’re entitled to under South Carolina law.

Business Law and Strategic Advice

For help with starting, running, or ending a business, call attorney Gem McDowell of the Gem McDowell Law Group. He and his team help business owners in the Charleston area and across South Carolina with forming LCCs and corporations, drafting corporate governance documents like buy-sell agreements, handling commercial real estate transactions, and more. Gem is also a problem solver who can give you strategic advice so you can avoid problems and protect yourself and your assets. Call him at his Mt. Pleasant office today at 843-284-1021 to schedule a free consultation.

Doing Good While Making Money: Benefit Corporations in South Carolina

You’ve heard of C-corps and S-corps, but what about B Corps?

B Corp is short for benefit corporation, a type of for-profit business entity that is regulated by state law. Currently, 35 states and DC have enacted legislation to create benefit corporations, including South Carolina.

As stated in the 2012 South Carolina Benefit Corporation Act (find it here), “a benefit corporation shall have as one of its corporate purposes the creation of a general public benefit.” Here, “general public benefit” is defined as “a material positive impact on society and the environment taken as a whole.”

Who Benefits from a Benefit Corporation?

Traditionally, corporations are run with the primary driver of making money for their shareholders. High-level decisions are made with this question in mind: How can we maximize profits for the benefit of the shareholders? Though it’s not actually a legal requirement for corporations to make the most money possible, this is often the way it works in the real world. After all, a CEO who doesn’t make enough money for the shareholders can be ousted by the board of directors.

But in a B Corp, making money is not the primary driving force. Instead, business decisions are guided, in part, by the desire to create a particular benefit in the world.

Examples of some benefits that a B Corp might have include:

- Donating a portion of income to charitable causes

- Operating in a way to reduce environmental impact or actively preserve the environment

- Providing goods and services to a specific group of people such as low-income families

- Providing employment and economic opportunities for underserved groups

- Promoting education or awareness of a certain subject

- Advancing the welfare of other groups besides in addition to the shareholders, like the employees, the customers, or particular minority groups

A well-known business that’s also a B Corp is Patagonia, which amended their articles of incorporation in 2012 to include a commitment to sustainability and treating workers well. Ben & Jerry’s also became a B Corp in 2012, with a goal of advancing social change for good.

What It Means to Be a B Corp

The decision to be a B Corp is a big one. It can drastically change the way you approach decisions and run your business. Of course, that’s the exact reason why some people want to run a B Corp.

For instance, let’s say your stated public benefit is to protect the environment. You may choose packing for your product that is biodegradable and more environmentally-friendly but is more expensive to produce. A regular corporation may be bound to sticking with less environmentally-friendly options, because that’s the decision that maximizes profits and increases shareholder value. But as a B Corp with a stated intention of helping the environment, you can choose to forsake some of those profits for the public benefit of a better environment.

Requirements for Becoming and Being a B Corp

Entrepreneurs can incorporate their business as a benefit corporation in South Carolina by including a provision in its articles of incorporation that it is a benefit corporation and specifying its benefit purpose. Existing entities can also become B Corps by changing their status.

In South Carolina, there are some requirements that come along with being a benefit corporation. One is the submission of an annual report to the Secretary of State which must include, among other things, an assessment of the business against a third-party standard. Though the law says that a B Corp need not have an outside party certify them, there are organizations that do that, such as the independent nonprofit B Lab.

Additionally, a director on the board must be the elected and serve as the benefit director, and you may also have an officer designated as the benefit officer. (The same person can fill both roles at the same time.) Their roles and duties are described by law, but in short, both are responsible for making sure that the company is carrying out its mission as a benefit corporation in terms of the benefits it creates.

Advantages and Disadvantages

As with all types of business entities, there are pros and cons of being a B Corp.

Pros of being a B Corp:

- Furthering a cause you believe in and making a positive change in the world through your company

- Ability to make decisions in your company that align with your values rather than focusing solely on making more money

- Attracting and working with talented people who share the same values (especially important to younger workers who increasingly want to work at ethical, mission-driven companies)

- Attracting impact investors

- Good for public relations and consumer perception of your business

- Being part of a values-based global movement

- If you change your mind later, you can easily drop your B Corp your status

Cons of being a B Corp:

- Additional burdens of paperwork, certification, and maintaining benefit director and benefit officer roles

- Converting to a B Corp may be difficult for existing publicly traded companies (which is why Etsy gave up its B Corp status and Warby Parker did, too)

- Uncertainty due to how new B Corps are, and the potential increase in liability exposure

Though there many more advantages than disadvantages listed here, the disadvantages still merit consideration.

However, if you are driven to do good via your business and you want more control over how your company can make that happen, a B Corp is something to look into.

Is Becoming a B Corp Right for Your Business?

Changing your status or incorporating as a B Corp is a big step. Before taking that step, speak to an experienced business attorney like Gem McDowell. Gem has over 25 years of experience working with clients, giving them strategic advice on how to start, grow, and protect their businesses. Contact Gem and his associates at the Gem McDowell Law Group in Mt. Pleasant to schedule your free consultation by calling 843-284-1021 today.

Sharing the Cost of Liability: What is Contribution?

Let’s say there’s an accident that leaves a person injured. The injured party sues the party at fault – the tortfeasor – who ends up paying damages. The injured party has received compensation for their injury, and the tortfeasor has paid what they owe. End of story.

But what if more than one party is liable for the accident? What is a party to do when they have paid the full amount of damages for an accident they’re only partly responsible for?

The answer: seek contribution.

What is Contribution in Civil Law?

Contribution is the “tortfeasor’s right to collect from others responsible for the same tort after the tortfeasor has paid more than his or her proportionate share, the shares being determined as a percentage of fault,” as defined in United States v. Atl. Research Corp.

In other words, a defendant (tortfeasor) who has paid out more than their fair share of money to a plaintiff has the right to seek contribution (money) from other parties who also bear liability for the injury or wrongful death in question. That money must be in a proportional amount, so the tortfeasor is limited to recovering an amount equal to the excess paid to the plaintiff.

This right of contribution does not exist for any party that intentionally caused or contributed to the injury or wrongful death in question. (For more on the ins and outs of contribution, read the South Carolina Contribution Among Tortfeasors Act in the SC Code here.)

A Case Concerning Contribution: The Background

The South Carolina Court of Appeals heard a case in December 2018 that concerned contribution, Charleston Electrical Services, Inc. v. Rahall. (Find the decision here.) The situation is nuanced and involves a party seeking contribution from a daughter for an injury to her mother, which makes it especially interesting.

In August 2010, Wanda Rahall and her mother, Elsie Rabon, visited Rahall’s fiancé at his apartment in Charleston. The apartment of her fiancé, George Kornahrens, was located in a building on property he owned but was leasing to Charleston Electrical Services (CES). He was the business manager of CES but had no ownership in the company.

During the August visit to the property to see Kornahrens, Rabon was knocked down and injured by Gunner, an “overly friendly” German shepherd owned by CES. Rabon was hospitalized and it was determined she had a broken hip.

In December 2010, Rabon filed a lawsuit against CES for negligence and strict liability. The parties later settled for $200,000, and Rabon released CES, Rahall, and Kornahrens from liability.

In July 2013, CES and Selective, its insurance carrier, filed a lawsuit against Rahall seeking contribution in the amount of half the settlement paid to Rahall’s mother Rabon. The issue went before a master-in-equity in August 2016, who found against CES and Selective. They appealed to the SC Court of Appeals.

Here’s Where Contribution Comes In

A party can only successfully seek contribution if there is another party partially responsible for the injury. CES and Selective needed to show that Rahall was also responsible for her mother’s injury in order to recover money from her.

CES and Selective argued that Rahall was negligent, and therefore was partially liable for the accident. To show negligence, the following points must be established: 1) the defendant (Rahall) owed a duty of care to the plaintiff (Rabon); 2) the defendant breached the duty of care by negligent act or omission; 3) the defendant’s breach was the cause of the plaintiff’s injury; and 4) the plaintiff suffered damages as a result.

Premises liability

Rahall owed her mother a duty of care, CES and Selective argued, under a premises liability theory. In SC, a landowner owes a duty of care to guests on their property. This includes a duty to warn a guest of potential dangers they should know about.

Remember that Rahall was not the owner of the property where the accident occurred; her fiancé was, and he was leasing it to CES who had full control of the property at the time when the injury occurred. However, Rahall had been engaged to her fiancé for four years and lived in the apartment on the property with him when she was in Charleston. She kept things there and had a key. Based on this, CES and Selective argued that she was a “possessor of the Property” and therefore owed a duty of care to Rabon.

The Court of Appeals disagreed. Rahall didn’t pay utilities, rent, or taxes on the apartment, she kept a separate home in a different city, and she had no ownership interest or control of any part of the property. (The master had even called the idea that she was liable under a theory of premises liability “patently meritless.”) Therefore, she had no duty of care and negligence could not be established as a basis of liability under a premises liability theory.

Special relationship exception

In SC, no one owes a duty to warn another person about potential danger or to control their conduct with these five exceptions: 1) where the defendant has a special relationship to the victim; 2) where the defendant has a special relationship to the injurer; 3) where the defendant voluntarily undertakes a duty; 4) where the defendant negligently or intentionally creates the risk; and 5) where a statute imposes a duty on the defendant.

CES and Selective argued that Rahall owed a duty to Rabon under this “special relationship exception” rule. She knew that Gunner had previously jumped on visitors, they asserted, and should have known that the dog would pose a threat to her elderly mother – and warned her.

But the master and later the Court of Appeals disagreed with this argument. “Our jurisprudence has not extended a legal duty to children to protect, warn, or supervise a parent,” stated the Court of Appeals in its decision.

Ultimately, the Court of Appeals affirmed the master-in-equity’s decision, and CES and Selective were unsuccessful in their attempt to seek contribution.

The Challenges of Seeking Contribution

CES believed it was not wholly responsible for the accident that injured Rabon and so sought contribution from another party they believed was also partially liable. But you can see that seeking contribution can be challenging – they had to prove liability, and they failed. It’s also a large commitment of time and finances on the part of the defendant. It’s something no business wants to go through.

In situations like these, sound legal advice is a necessity. If you’re a business owner looking for help with a legal issue, contact Gem McDowell and his team at the Gem McDowell Law Group in Mt. Pleasant, SC. With over 25 years in business law in SC, Gem has the experience to not only handle legal matters but also offer sound strategic advice that can protect your business and help it grow. Schedule a free consultation to discuss your business with him by calling 843-284-1021 today.

Is Your Company’s Website ADA Compliant? And Does It Need to Be?

If you own a brick-and-mortar business that serves the public and has an associated website or app, read this blog, as it pertains to you directly.

Most people are familiar with the American with Disabilities Act (ADA), a landmark piece of legislation signed into law in 1990 that requires businesses serving the public to make their locations accessible to people with disabilities. This means things like installing ramps, providing accessible parking spaces, and making walkways wide enough to accommodate wheelchairs.

In this digital age, companies are learning that the ADA may apply to many websites and mobile applications, too, and what that means for them.

Domino’s Website and App Not Accessible

Normally on this blog we look at court cases from the South Carolina Court of Appeals and Supreme Court, but today’s case is actually from the US Court of Appeals for the 9th Circuit (which encompasses several western states, Alaska, and Hawaii), Robles v. Domino’s Pizza, LLC, which you can find here.

Guillermo Robles is a blind man who relies on screen-reading software to vocalize visual information of websites so he can use them. On at least two occasions, he was unable to order a pizza online from Domino’s Pizza because, he said, the company’s website and app were designed in a way that weren’t accessible to him.

In 2016, Robles filed a suit against Domino’s seeking damages and injunctive relief, arguing that Domino’s website and mobile app violated the ADA as well as the California’s Unruh Civil Rights Act (UCRA), which outlaws discrimination based on disability and other factors. Domino’s argued that the ADA didn’t apply to their website and also argued that enforcing ADA compliance standards would violate their 14th Amendment right to due process. The case went to a district court and was later appealed.

Two questions (among others) the US Court of Appeals had to answer were:

- Are Domino’s Pizza’s website and mobile app subject to the ADA?

- Does the Department of Justice have to articulate specific standards for businesses to follow before these businesses make their websites and mobile apps ADA-compliant?

Here’s what the court found.

Yes, Domino’s Websites and Mobile App Are Subject to the ADA

The district court held that the ADA (specifically, Title III) did apply to Domino’s Pizza’s website and mobile app, and the court of appeals agreed.

The intention of the ADA is to eliminate discrimination against individuals with disabilities in a variety of ways. The Act expressly states that places of public accommodation where goods and services are available to the public – like Domino’s Pizza – must take steps to ensure that people with disabilities are not excluded or denied services. These businesses must provide “auxiliary aids and services” to ensure access.

But does a website need to meet the same standards of accessibility as a place of public accommodation? The court of appeals states in its decision that a website associated with a physical location does need to be accessible. The inaccessibility of Domino’s Pizza’s website and app in this case prevented a disabled user, Robles, from accessing the goods and services of the physical location, thus violating the ADA. In making this determination, the court joins several other courts that have come to the same conclusion in similar cases.

No, the DOJ Does Not First Have to Articulate Specific Standards

The Department of Justice (DOJ) is tasked with regulating implementation of the ADA, and it promised to provide guidelines for website accessibility back in 2010. But that hasn’t happened.

One of Domino’s arguments was that it wasn’t responsible for making its website or mobile app accessible because the guidelines promised by the DOJ hadn’t materialized, so it didn’t know exactly which standards to adopt.

However, there does exist a widely known set of standards that Domino’s could have reasonably adopted and could still adopt as a possible equitable remedy. Those are the Web Content Accessibility Guidelines (WCAG) 2.0, a set of private industry standards for website accessibility. In a footnote, the court mentions that even though these guidelines are private industry standards, they have been widely adopted by many entities, including by federal agencies on their public-facing electronic content. The Department of Transportation requires airlines to adopt WCAG 2.0, and the DOJ has required several ADA-covered entities to adopt them in consent decrees and settlement agreements in the past.

The district court said that imposing WCAG 2.0 standards on Domino’s “fl[ew] in the face of due process” and stated that the DOJ needed to provide guidelines.

The court of appeals disagreed. The Constitution doesn’t require the DOJ or Congress to articulate exactly how a business should comply with the law. “The Lack of Specific Regulations Does Not Eliminate Domino’s Statutory Duty,” says the court (emphasis added). Further, though it hasn’t come out with specific guidelines, the DOJ has “repeatedly” affirmed that websites of public accommodation are subject to Title III of the ADA. Because of this, it’s reasonable to say that Domino’s Pizza has been “on notice” since at least 1996 and has been aware that it has a duty to make its website accessible.

What This Means for You, a Business Owner

Domino’s Pizza petitioned the US Supreme Court to take up the case in June 2019. Showing support for Domino’s were a number of outside parties filing amicus curiae briefs: the Washington Legal Foundation, Retail Litigation Center, Inc., et al., the Cato Institute, the Restaurant Law Center, and the Chamber of Commerce of the United States, et. al.

But the US Supreme Court denied certiorari, meaning the decision discussed above by the US Court of Appeals for the 9th Circuit stands for its district. This will likely have big ramifications for businesses not only in that district, but the rest of the country.

If you own a business with a physical location that is open to the public and you have a website that helps people acquire goods and services from your business, the smart move is to make sure that your website is accessible to people with disabilities. As the DOJ has made clear for many years, it is your legal responsibility to make sure your website is accessible. (It’s also good business.)

If you work with a web developer, ask them about your site’s accessibility. Or if you’re developing your own site and haven’t ever thought about accessibility, learning about WCAG 2.0 is a good place to start.

What if you own a business but it’s not open to the public, or you run a website that has no connection to a brick-and-mortar location? There’s no obligation for such websites to be ADA compliant, so it’s up to you whether you want your site to be accessible or not.

Strategic Business Advice and Guidance

The case above is just one example where the law and business intersect, but it happens all the time. By knowing more about your company’s legal duties, options, and potential pitfalls, you can help strengthen your business. For smart strategic advice to help protect and grow your business, contact business attorney Gem McDowell and his associates at the Gem McDowell Law Group in Mt. Pleasant, SC by calling 843-284-1021 today.

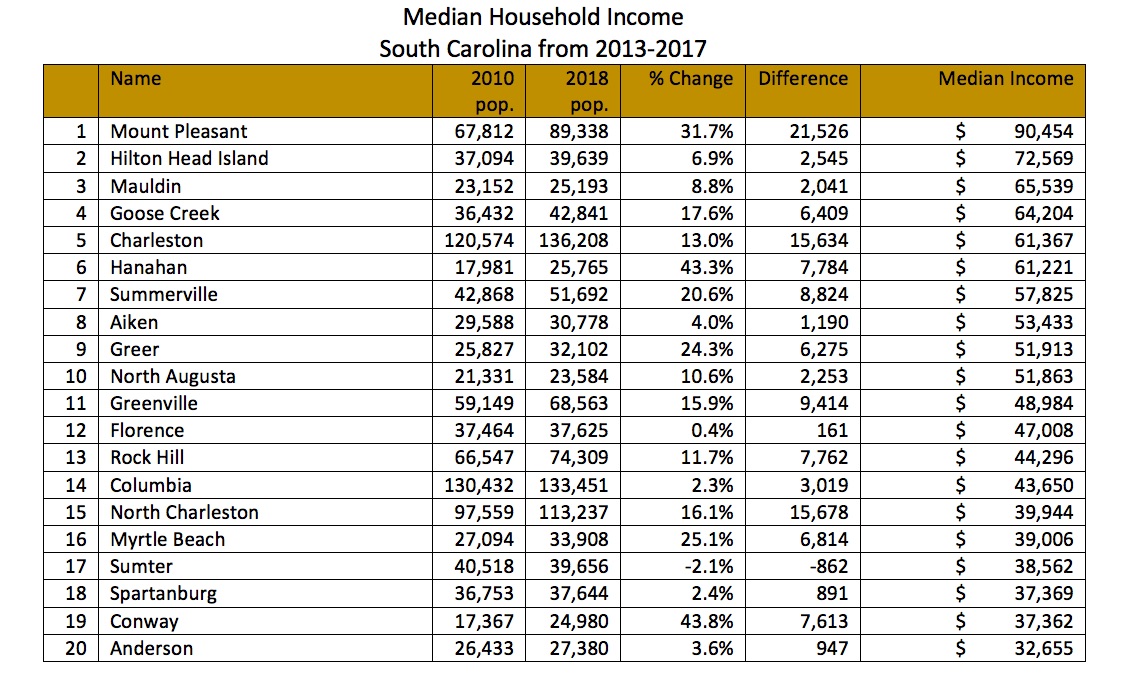

How Much Money Do People Earn in South Carolina?

In a previous blog, we looked at population trends in South Carolina over the last decade in the context of how that information could impact business owners looking to do business in the state. Today we’re going to look at another factor that has affects businesses: median household income. Specifically, the median household incomes in select cities in South Carolina.

Median Household Income in South Carolina’s Cities

According to the U.S. Census Bureau, the median household income (MHI) in the U.S. in 2017 was $60,336. That same number in South Carolina was $50,570. Interestingly, looking at the 2013-2017 median income of the top 20 cities in S.C. by population, half fall above this number and half fall below.

Of the ten South Carolina municipalities with a MHI higher than the state average, the Town of Mount Pleasant leads with $90,454, with Hilton Head Island coming second with $72,569. Median household income was between $51,863-$65,539 for the other eight cities on the list, Maudlin, Goose Creek, Charleston, Hanahan, Summerville, Aiken, Greer, and North Augusta.

Of the ten where the MHI is lower than the state average, Greenville is at the high end with $48,984, and Anderson comes in last with $32,655. The other eight falling in between are, in descending order, Florence, Rock Hill, Columbia, North Charleston, Myrtle Beach, Sumter, Spartanburg, and Conway.

Chart showing median household income of 20 cities in South Carolina in the time period 2013-2017, along with each city’s population count in 2010 and 2018 and difference in percentage and absolute numbers.

What This Means for Business Owners

If you’re thinking of starting a business in South Carolina, or opening a branch or plant of an existing business here, median household income is another factor to consider (along with population) when deciding where to set up shop.

A city’s MHI could have a significant impact on your business, depending on what it is. If you’re a manufacturer, like Volvo, that doesn’t depend on selling your product to the local market, you’re in a much different position than a baker or a doctor who depends on the residents for their living. If you do depend on making sales in the local market, consider whether your product or service is a necessity or a luxury, since households with a higher MHI have more for discretionary spending.

More Strategic Advice for Business Owners

If you’re an entrepreneur looking for strategic or legal advice on how to start or grow your business, contact Gem McDowell of the Gem McDowell Law Group. He and his associates help with matters of incorporation, corporate governance documents, business planning, acquisition, and more. Call the Mount Pleasant office today to schedule a free consultation at 843-284-1021.

Choosing the Right Business Entity at the Federal and State Level

As a business owner, it’s important to understand the differences between various business entities. Some of the differences include how the entity is structured, how it’s taxed, and what kind of liability protection if offers its owners.

Another difference that’s often overlooked is whether the entity is defined at the federal level or the state level. For instance, the corporation, partnership, and sole proprietorship are defined by the IRS at the federal level. The limited liability company, on the other hand, exists because of state statute. It’s treated as a corporation, partnership, or disregarded entity by the IRS for federal tax purposes.

Some entities look so similar at first glance, it can be hard to see the distinction between a business entity defined at the federal level and one at the state level. One example of this is the S-Corp versus the statutory close corporation.

Case in Point: Pertuis vs Front Roe

Even the Supreme Court of South Carolina failed to make the distinction between state and federal statute in a recent decision filed in July, 2018, Pertuis vs. Front Roe Restaurants, Inc.

In short, Kyle Pertuis was the manager of three restaurants owned by three separate S-Corporations: Lake Point and Beachfront, both in North Carolina, and Front Roe, in South Carolina. All three S-Corporations were owned by Mark and Larkin Hammond. After working with the Hammonds for several years, Pertuis decided to leave, and this case is primarily about his ownership in the three restaurants and their valuation.

That’s not relevant to our discussion here, but what is relevant is the South Carolina Supreme Court’s assessment of whether the three S-Corporations should be amalgamated into a single entity or not. If yes, that means the three would be considered together as if they were one company. If no, the three should continue to be considered as three distinct businesses.

The Trial Court said yes, the three should be amalgamated, citing in part the fact that the Hammonds had “disregarded corporate formalities” including shareholder and board of director meetings. The Supreme Court said the trial court erred, because it overlooked the fact that all three companies were S-Corporations, which are statutorily permitted to disregard various corporate formalities including those of having shareholder and board of director meetings. The Court cites SC Code Section 33 Chapter 18, -200, -210, -220, and -230 to make these points.

But here’s where the Supreme Court erred: it failed to make a distinction between an S-Corporation (federal) and a statutory close corporation (state). The SC Code it cited is about statutory close corporations, not about S-Corporations.

S-Corporation Versus Statutory Close Corporation

An S-Corporation is a business entity that is defined by the IRS. A statutory close corporation is a business entity allowed by some states, including South Carolina.

S-Corporation

An S-Corporation is a business entity with shares and shareholders, just like a C-Corporation. Certain entities may elect to become an S-Corp by filing Form 2553 with the IRS. Unlike a C-Corp, S-Corp income, losses, deductions, and credits “pass through” to shareholders, who pay taxes on the income (or deduct the losses) on their individual federal income tax returns. This is the biggest advantage of the S-Corp and why many businesses elect to become one – to avoid the “double taxation” of the C-Corp. (Read more on C-Corp versus S-Corp here on this blog.)

Statutory Close Corporation

A statutory close corporation is a type of corporation that is defined by state statute. A “close” corporation is typically one where the shareholders are actively involved in managing the business. Not all states allow for statutory close corporations, but South Carolina does. Any corporation in South Carolina with one or more shareholder may elect statutory close corporation status by filing with the South Carolina Secretary of State.

The main reason corporations in the state elect statutory close corporation status is because it offers business owners greater freedom from corporate formalities and greater organizational flexibility than does a standard corporation.

Some provisions to ease the formalities are automatically put in place for your business once the election is made to statutory close corporation status. Other provisions are only put in place if those incorporating make an affirmative selection. These may be made by checking the appropriate boxes on the form articles. Lastly, business owners also have the option to have documents laying out management, elimination of by-laws, dissolution rights, and buy-sell provisions.

The election of filing for a statutory close corporation at the state level does not affect how the corporation is taxed at the federal level. An important thing to note is that the statutory close corporation is automatically taxed as a C-Corp unless it makes the election to be taxed as an S-Corp.

Corporations that elect statutory close corporation status find that under these less rigid rules, they can operate more like a partnership, with greater organizational flexibility and freedom from standard corporate formalities.

Understand How the Law Affects Your Business: Work with Business Attorney Gem McDowell

Choosing the right entity and structure for your business may be more complex than simply deciding on LLC or corporation or partnership. By not understanding the difference between federal and state levels of business entities, and what options are available to you, you could be missing out on some great advantages in your business.

For a better understanding of your options, or for help drafting contracts and corporate governance documents, call Gem and his associatess at Gem McDowell Law Group in Mt. Pleasant, SC. Schedule an initial consultation by calling 843-284-1021 today.

How to Word an Enforceable Provision: Invention Assignment Agreements and Confidentiality Agreements

Some of the most valuable assets a company can own are its trade secrets, patents, and inventions. Losing control of these assets can be very costly, so protection is a must.

To protect their intellectual property, companies often include clauses and provisions regarding trade secrets and inventions. Confidentiality agreements and nondisclosure agreements stop employees from sharing trade secrets and sensitive information. Assignment of Inventions clauses ensure that relevant inventions made by employees during their time at the company are assigned to the company. Trailer Clauses do the same thing but cover a period after the employee leaves the company’s employment.

For businesses in South Carolina with sensitive information, trade secrets, and other intellectual property to protect, it’s important to understand that having such clauses and agreements with your employees isn’t enough. They must be worded precisely in order to be enforceable by a South Carolina court.

A case in point, decided by the South Carolina Supreme Court in 2012, gives a real-life example of what happens when these types of agreements come under the scrutiny of the state’s highest court.

Background to the Milliken & Company v. Morin case

Brian Morin is a research physicist who started working for Milliken, an industrial chemical and textile producer, in April 1995. While employed, he began working on a new multifilament fiber, but Milliken did not agree to support its research and development. Morin resigned from Milliken in May 2004 and filed for a patent for the new fiber which he assigned to Innegrity, a company he founded the same week he quit Milliken.

Milliken found out about what Morin was doing and demanded he stop working with the fiber and furthermore said that under an employment agreement Morin had signed, the invention rightfully belonged to Milliken.

Eventually, Milliken and Morin’s case ended up in the South Carolina Supreme Court. The issue of interest to us here is Morin’s argument that the agreement he signed was overbroad and therefore unenforceable. He argued that the inventions assignment provision and confidentiality clause in his agreement should be scrutinized and enforced to the same standard of covenants not to compete.

The Supreme Court disagreed.

Why are Covenants Not to Compete Disfavored in South Carolina?

As we’ve discussed in previous blogs (here, here and here), South Carolina courts tend to side with the employee rather than the employer when it comes to covenants not to compete. The South Carolina Supreme Court has stated that “restrictive covenants not to compete are generally disfavored and will be strictly construed against the employer” and that they must also be reasonably limited in time and geographical scope. (See Rental Uniform Service of Florence, Inc. v. Dudley, 1983)

This is a high standard to hold all provisions to. However, it’s important to understand why these agreements are often found unenforceable by South Carolina courts. It’s because when they are overly broad and badly worded, they violate public policy by hampering an individual’s ability to make a living in their profession.

The same is not true about the provisions at hand, which do not hamper Morin’s ability to make a living within his profession. The Supreme Court found the inventions assignment agreement and the confidentiality agreement to be clear, reasonable, and enforceable. That’s why it upheld the Court of Appeals’ decision and decided against Morin.

What Employers Need to Know About Drafting These Provisions

While this South Carolina Supreme Court decision is good news for employers in this state, it’s important to understand that the Court upheld the enforceability of reasonable provisions. A reasonable provision is one that protects legitimate business interests yet does not violate public policy by hampering an individual from making a living in their profession.

In this particular case, the exact wording of the relevant parts of the employment agreement signed by Morin was important to the Court. Let’s look at the specific language used and upheld by the Court to understand what businesses can do when wording their own provisions in the future.

- Clear Definitions

For both the confidentiality clause and the invention assignment agreement, the Court’s opinion stressed that the definitions were extremely clear. Here they are, as presented in the opinion.

Milliken’s definition of confidential information contains five elements, all of which must be met for information to be considered confidential. The Court wrote “It does not take much elaboration to see that rather than covering general skills and knowledge, it encompasses only important information […]” As defined by Milliken in the agreement, confidential information is:

- Competitively sensitive information

- Of importance to and

- Kept in confidence by Milliken,

- Which becomes known to the employee through his employment with Milliken, and

- Which is not a trade secret.

Regarding the invention assignment agreement, the Court notes that at first Milliken defines inventions broadly, then provides the following broad exception to that definition:

“for which no equipment, supplies, facility or proprietary information of Milliken was used and

Which was developed entirely on your own time, and

- Which does not relate

- Directly to the business of Milliken or

- To Milliken’s actual or demonstrably anticipated research or development, or

- Which does not result from any work performed by you for Milliken.”

Both of these provisions had clear definitions that protected Milliken’s interests without limiting Morin’s ability to find employment.

- Reasonable Time Limitations

The Court stated that the confidentiality agreement was “reasonably limited” to “only” three years and it called the one-year restriction attached to this provision “eminently reasonable.”

Businesses should be conservative, not greedy, when attaching time limitations to any and all provisions.

- Reasonable Geography Limitations

Although not discussed in this decision, geographical limitations on such provisions are also important. The Court of Appeals decision in this case cited a previous South Carolina Supreme Court decision which found “geographic restriction is generally reasonable if the area covered by the restraint is limited to the territory in which the employee was able, during the term of his employment, to establish contact with his employer’s customers.”

For companies that do business with customers across the country and across the globe, this means that a provision unlimited in territory may not be considered unreasonable if the company actually does do business all over. For companies that do business solely in South Carolina, it would be unreasonable to have a provision unlimited in territory.

Employers should err on the side of being conservative when it comes to limitations in geography.

Get Help with Business Contracts, Employment Agreements, and More

As you can see, the wording in an employment agreement or provision can make the difference between being enforceable and unenforceable here in South Carolina’s courts. If you have business interests to protect, you should be working with an experienced attorney.

Gem McDowell is a business attorney with over 25 years of experience solving legal problems and helping businesses protect their interests. For advice and help with your business legal matter, contact Gem McDowell Law Group in Mt. Pleasant, SC today at 843-284-1021.

Protect Your Business Interests with Anti-Raid and Anti-Disparagement Provisions

We’ve talked before about how South Carolina courts tend to favor employees over employers in regards to covenants not to compete. This means that employers must be very careful in wording covenants not to compete to ensure they’re not overly broad or too restrictive.

But this bias against employers doesn’t extend to all covenants employers use. South Carolina courts are more likely to enforce covenants that don’t have clauses and provisions limiting an employee or former employee from earning a living in their profession.

Two other provisions that can help protect an employer’s business interests and should be considered when drafting a covenant not to compete are anti-raid provisions and non-disparagement provisions. As with covenants not to compete, the purpose of these provisions is to protect the employer’s interests after an employee leaves the company. Let’s look at them in turn.

Anti-Raid Provisions

The anti-raid provision typically states that for a period of time after the employee is no longer with the company (and possibly during employment as well), they may not approach or attempt to solicit anyone working for the company to leave in order to compete with the company. This is intended to prevent an employee from leaving the company and taking along other employees, which is clearly detrimental to the company’s interests.

Like covenants not to compete, these provisions must be reasonable. In practice, that means limiting the provision to a restricted period of time, often a year after leaving employment. South Carolina courts are likely to interpret these more favorably for the employer rather than the employee, as they don’t harm the employee’s ability to make a living in their profession after leaving their employer.

Non-Disparagement Clauses

This clause prohibits an employee from disparaging, or making negative comments, about the company, its officers, and its employees, whether orally or in writing. This provision can be found in both employment agreements (often as a clause within the covenant not to compete) and in severance or settlement agreements at the end of the employee’s tenure. The purpose is to protect the company’s reputation. Again, South Carolina courts may be favorable towards these clauses because they don’t have anything to do with restricting the employee’s right to work. Employers should consider using this clause as a matter of course upon either hiring or dismissing employees.

Still, employers need to use caution with this clause. The agreement must be clear to both parties, as a lack of clarity can lead to unintended consequences. Great care is warranted with these clauses, in part because they are greatly disfavored by state and federal agencies.

Work with an Experienced Business Attorney in Mt. Pleasant, SC

As always, remember that issues like this depend very much on the state where business is being done and arbitrated.

If you need legal advice on business contracts, employment or severance agreements, business real estate transactions, corporate taxes, or other business matters in South Carolina, contact Gem McDowell Law Group in Mt. Pleasant, SC. Gem and his associatess help businesses of all sizes protect their interests so they can continue to grow. Call today to schedule an initial consultation at 843-284-1021.

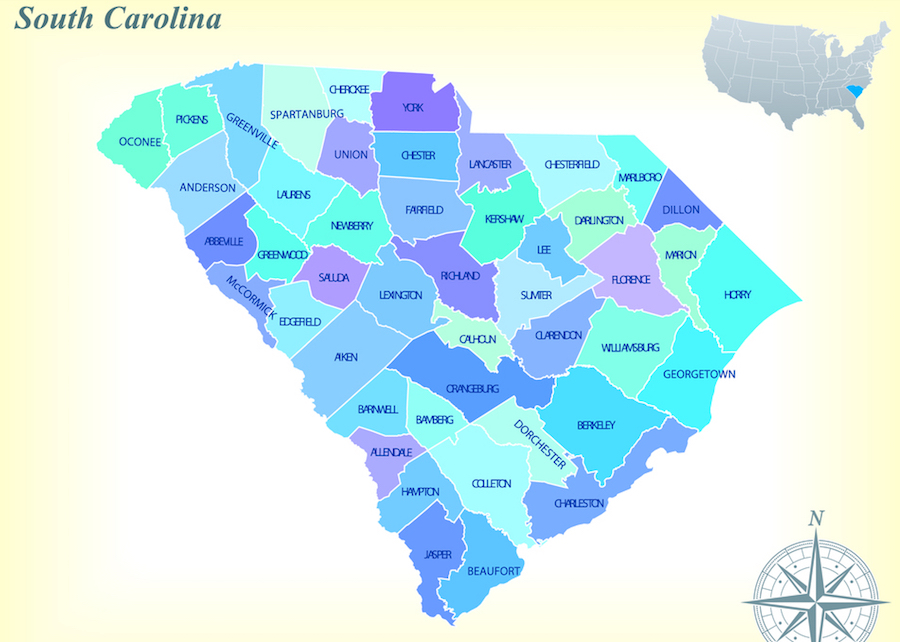

Where Should I Open My Business In South Carolina?

Note: this blog was updated in October 2019 to reflect the most recent data available

In recent years, South Carolina has attracted numerous companies to the state that want to take advantage of various business incentives. Two such headline-making companies include Boeing, which opened its Charleston facility in 2011, and Volvo, which officially opened its Ridgeville plant in 2018.

Business owners looking to open a store, plant, office, or other business here first need to consider where they’re most likely to encounter success. While available facilities, infrastructure, and local incentives may play a factor, undoubtedly the largest factor that will affect success is population.

South Carolina is Growing in Population

Companies opening a new factory or branch look for available work force to hire from. To forecast their success, they need to look not only at current population but at population trends, too.

South Carolina has been growing in population for years and was #9 on the U.S. Census Bureau’s list of Top 10 States in Numeric Growth (with 62,908 people) and #9 on the Top 10 States in Percentage Growth (at 1.3%) for 2017-2018. It’s a safe bet that this trend will continue for many more years and that South Carolina will remain an attractive destination for businesses.

But where are all the newcomers moving to? Is the influx evenly distributed through the state? The Charleston tri-county area sees 28 people move into the area every day, and the Charleston metro area alone is growing at three times the U.S. average. Meanwhile, several cities and counties lose people every day to other areas of the state and the country.

What’s going on?

A Quick Lesson on South Carolina Demographics

At the end of the Civil War, South Carolina had 31 counties. By 1919, we had 46. Fifteen new counties were added in between, many to honor prominent men in South Carolina’s history.

For years, the state ran everything and counties had very limited power. Adding counties essentially meant drawing new lines on the map. New counties were carved out of existing counties: Marion became Marion and Dillon; Charleston became Charleston, Berkeley, and Dorchester; Barnwell became Barnwell, Allendale, and Bamberg; and so on. County populations were slashed as more counties were added, but again, that had no real practical consequences, as the state was mostly in charge.

When counties gained more power after the Home Rule Act was passed in 1975, however, the number of counties – and their smaller sizes – began to matter. Where the state had previously been in charge, suddenly counties were responsible. Many counties found themselves without the ability to raise adequate funds from their low populations to provide the police and emergency services, public schools, infrastructure, parks, libraries, and other services and amenities they were now responsible for. That issue persists for some counties to this day.

Which S.C. Counties Are Growing and Which Are Shrinking?

It appears to be a vicious cycle. As counties are able to provide less to their residents, residents leave for greener pastures, leaving the county with even fewer people to tax and even less money to provide for their remaining residents.

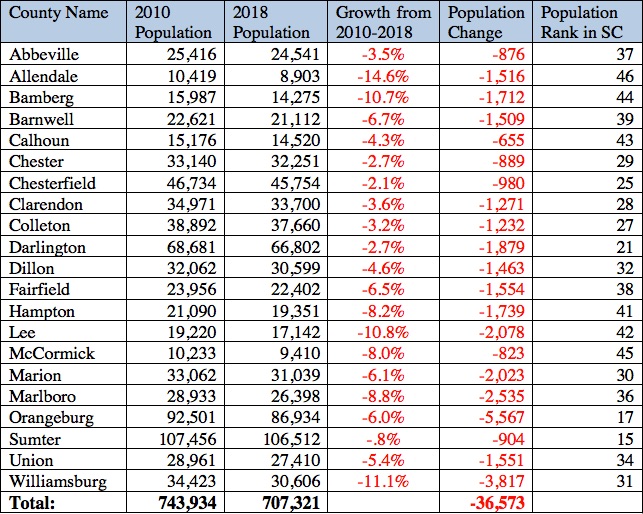

You can see this happening in census numbers. Between 2010 and 2018, 21 of South Carolina’s 46 counties have declined in population: Abbeville, Allendale, Bamberg, Barnwell, Calhoun, Chester, Chesterfield, Clarendon, Colleton, Darlington, Dillon, Fairfield, Hampton, Lee, Marion, Marlboro, McCormick, Orangeburg, Sumter, Union, and Williamsburg.

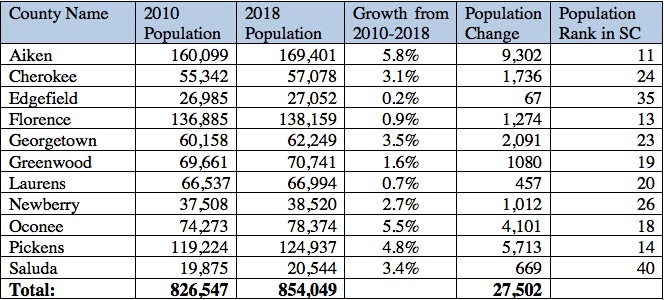

A further 11 grew more slowly than the U.S. growth rate of 6.0%: Aiken, Cherokee, Edgefield, Florence, Georgetown, Greenwood, Laurens, Newberry, Oconee, Pickens, and Saluda.

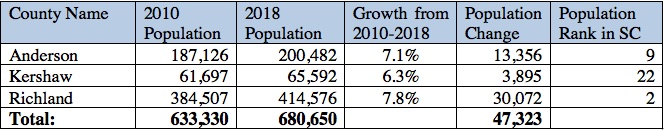

Three counties grew faster than the U.S. growth rate of 6.0% but slower than the South Carolina growth rate of 9.9%: Anderson, Kershaw, and Richland.

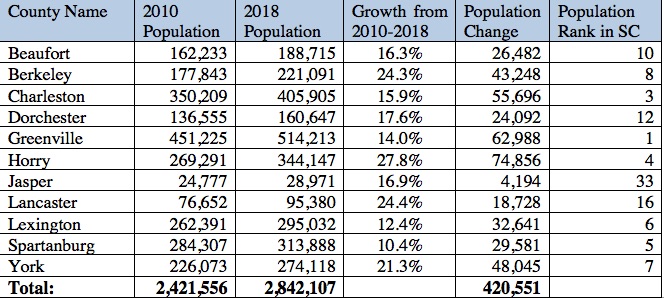

The remaining 11 counties grew faster than the South Carolina growth rate of 9.9%: Beaufort, Berkeley, Charleston, Dorchester, Greenville, Horry, Jasper, Lancaster, Lexington, Spartanburg, and York.

See the charts at the end of this post for all the numbers.

What This Means for Businesses Moving To South Carolina

Be strategic before selecting a place to open your business.

South Carolina as a whole is a great place to run a business, but some counties are more attractive than others due to available workforce and infrastructure. Counties with a growing population will be more likely to support your business for years to come.

In general, counties on the coast (with the exception of Georgetown) and in the northwest part of the state (which include fast-growing cities Spartanburg, Greenville, and Rock Hill) have been trending upwards in terms of population over the past decade.

Get strategic advice from Mt. Pleasant corporate attorney Gem McDowell

Population is just one factor when it comes to deciding where to open your business in South Carolina. To discuss legal aspects of your business, contact business attorney Gem McDowell of the Gem McDowell Law Group.

Business owners need more than corporate legal services to make their businesses thrive – they need strategic advice. Gem McDowell has over 20 years of experience helping businesses grow in South Carolina. He can advise on a number of topics including complex real estate transactions, where to open a new factory or office, what to do about corporate taxes, and much more.

Contact Gem and his associates at the Mount Pleasant office today by calling (843) 284-1021 or filling out this contact form online.

South Carolina counties that grew at a rate of less than the U.S. growth rate of 6.0%. Click to enlarge.

South Carolina counties that grew faster than U.S. growth rate of 6.0% but slower than S.C. rate of 9.9%. Click to enlarge.